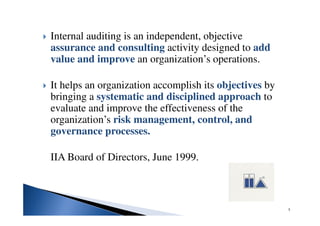

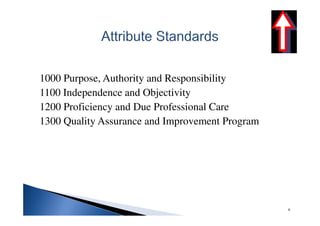

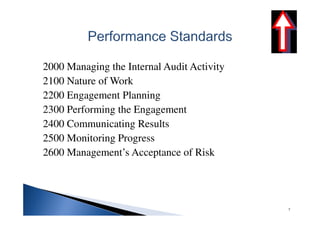

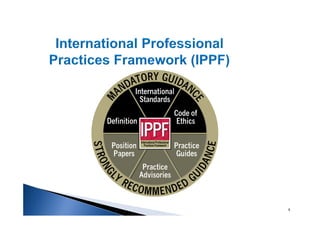

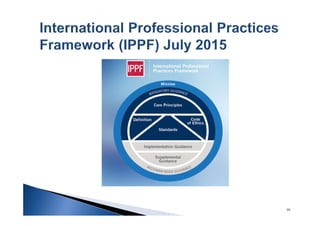

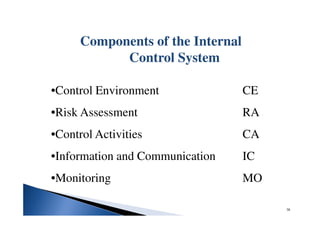

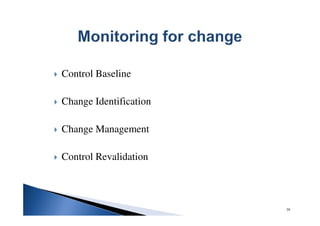

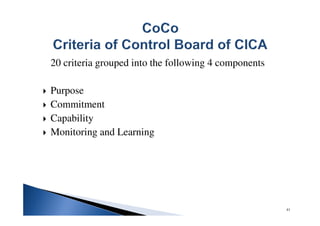

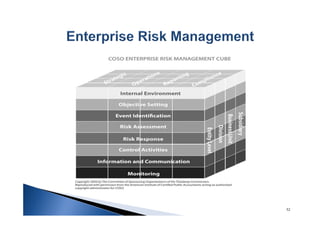

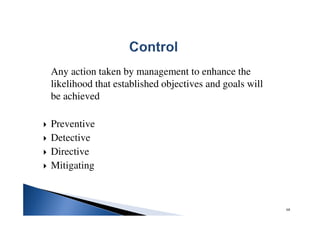

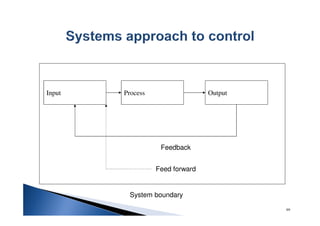

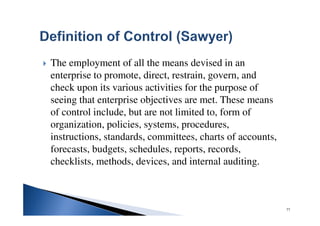

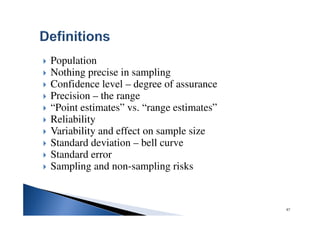

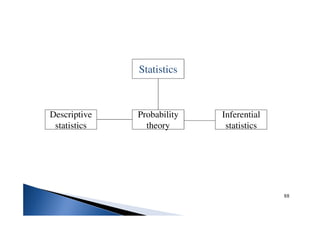

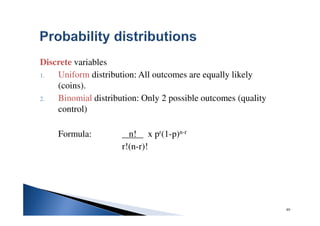

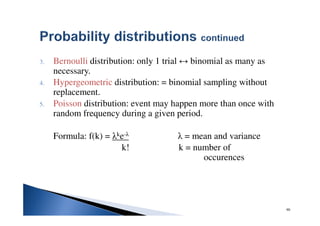

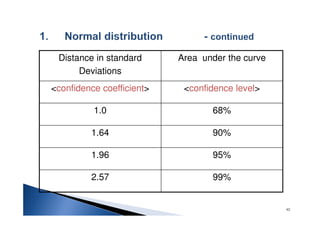

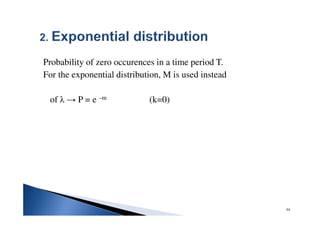

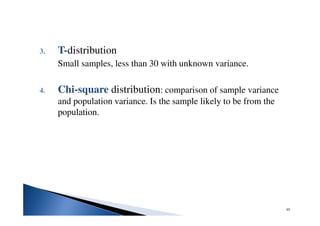

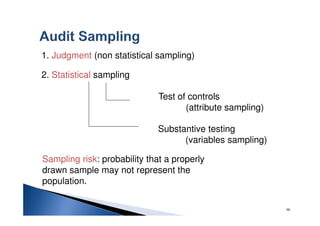

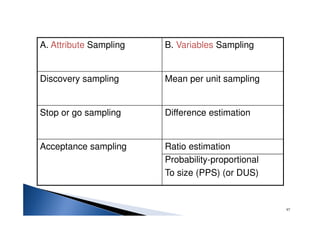

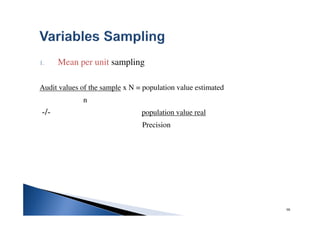

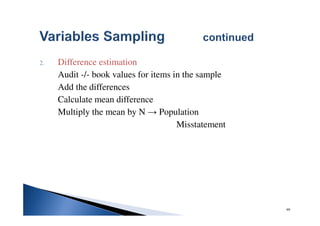

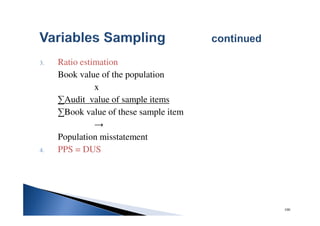

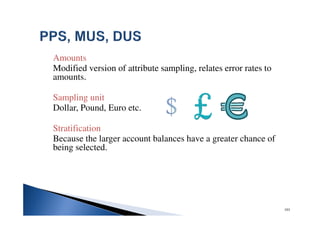

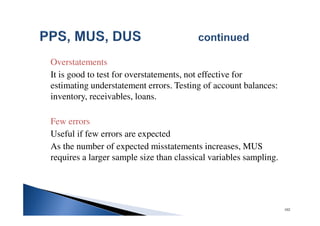

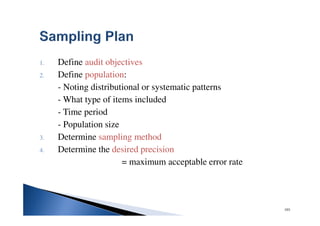

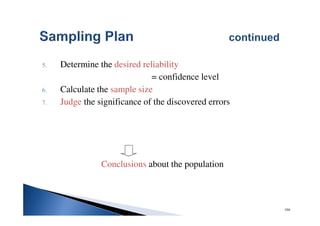

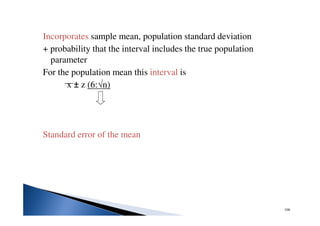

The document outlines a CIA exam review course covering internal auditing principles, including mandatory guidance, independence, and control frameworks, as well as procedures for conducting audits. It emphasizes the importance of risk management, internal control systems, ethical conduct, and the role of internal auditors in ensuring organizational effectiveness and compliance. Additionally, it touches on evidence gathering, sampling methods, and various statistical approaches relevant to internal auditing.