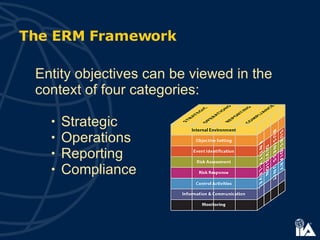

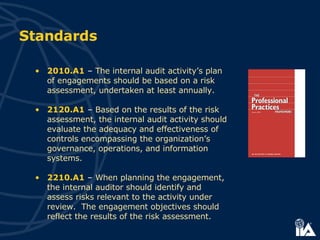

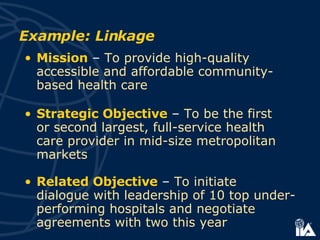

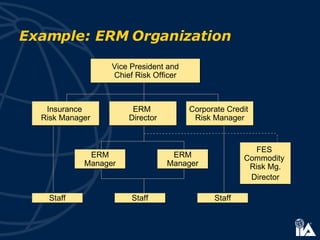

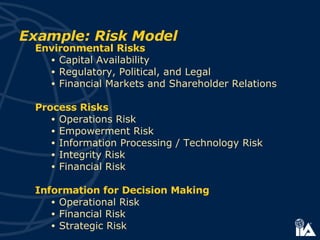

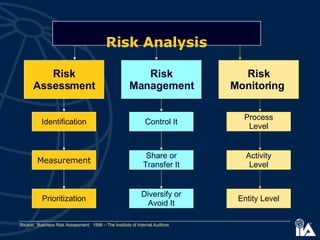

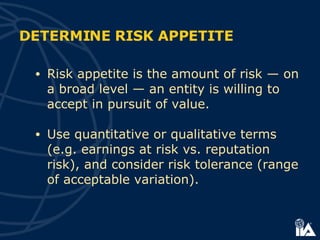

The document discusses COSO's Enterprise Risk Management framework. It defines ERM and explains why it is important for managing risks and uncertainties to achieve organizational objectives. The framework establishes eight components of ERM - internal environment, objective setting, event identification, risk assessment, risk response, control activities, information & communication, and monitoring. It provides guidance on implementing ERM.