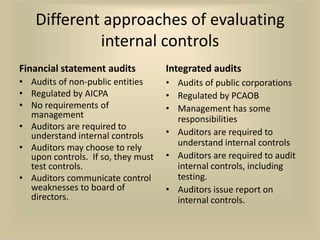

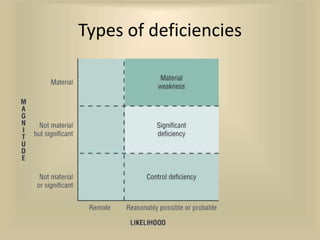

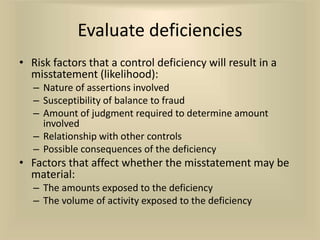

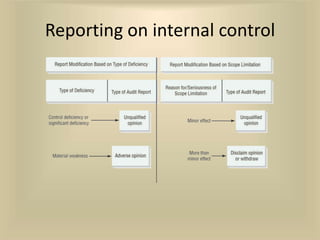

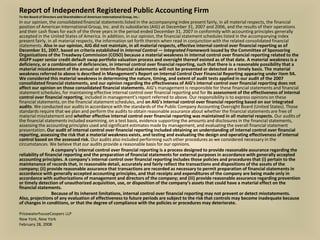

Yes, it is possible to give an adverse opinion on internal controls and an unqualified opinion on the financial statements.

The key factors that allow for this are:

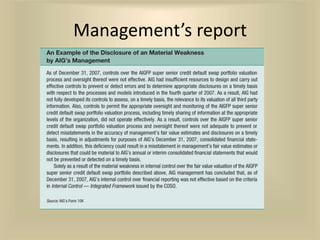

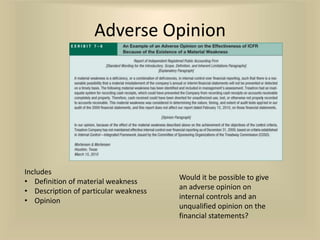

1. The material weakness in internal controls relates specifically to the valuation process and oversight of a particular portfolio, not broader internal controls.

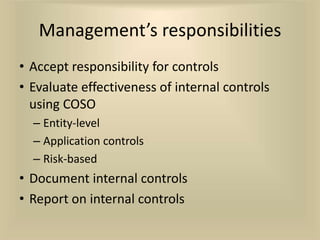

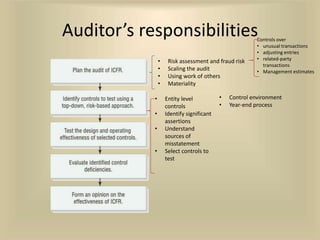

2. The auditors considered the material weakness in determining their audit approach but still obtained sufficient appropriate audit evidence to issue an unqualified opinion on the financial statements.

3. Management is responsible for the financial statements and internal controls, and the adverse internal controls opinion does not affect the auditors' opinion on the financial statements.

So in summary, while a material weakness in internal controls was identified, it did not per