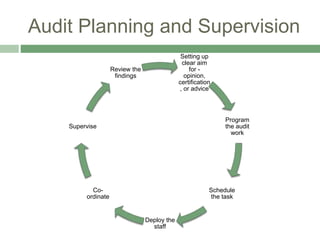

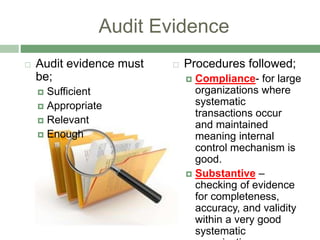

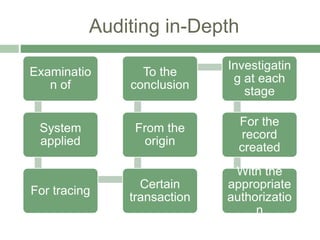

This chapter provides an overview of auditing. It covers topics like generally accepted auditing standards, competence and independence of auditors, audit planning and supervision, audit evidence, gathering evidence through inspection, observation, inquiry and other procedures. It discusses auditing in depth by examining the system and tracing transactions. It also covers test checks, related precautions, factors determining sample size, and compliance with accounting standards and enactments. Finally, it lists various accounting and auditing statements, guidance and standards.