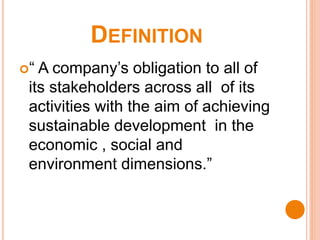

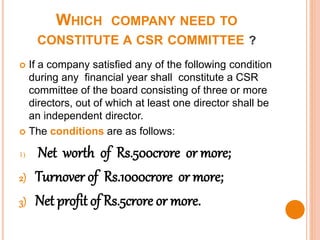

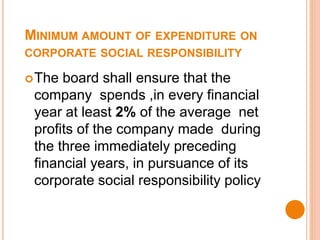

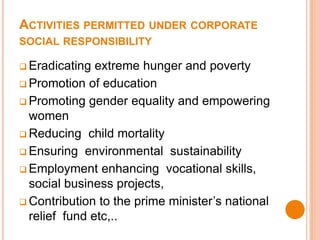

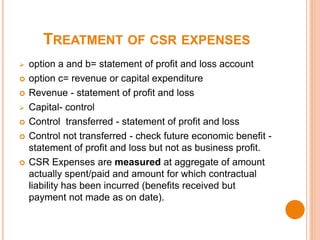

Corporate social responsibility (CSR) refers to a company's obligation to consider the interests of society in its business activities. Companies meeting certain financial criteria must constitute a CSR committee to oversee CSR activities. Companies must spend at least 2% of the average net profits of the previous three years on CSR activities like poverty alleviation, education, gender equality, and environmental sustainability. CSR expenses can be undertaken directly, through donations to approved funds, or via a registered trust or section 8 company. Unspent CSR amounts do not require provision but must be disclosed, while excess spending above the 2% threshold cannot be offset in future years.