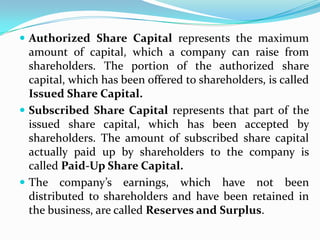

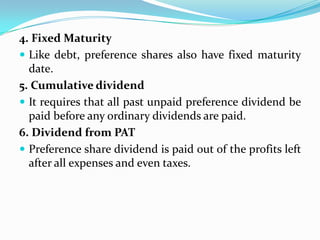

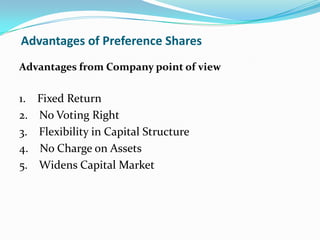

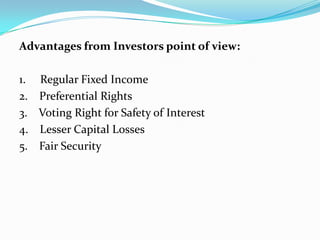

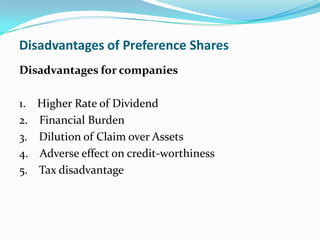

Equity shares represent ownership in a company and provide shareholders voting rights and claim to residual assets. They are a permanent capital source as they have no maturity date. Preference shares have fixed dividends and preference over equity shares but do not provide voting rights or claim to residual assets. Debentures are a type of loan that pays fixed interest and must be repaid by a specified maturity date. Term loans are long-term loans directly from banks or financial institutions, often secured by company assets.