Embed presentation

Download as PDF, PPTX

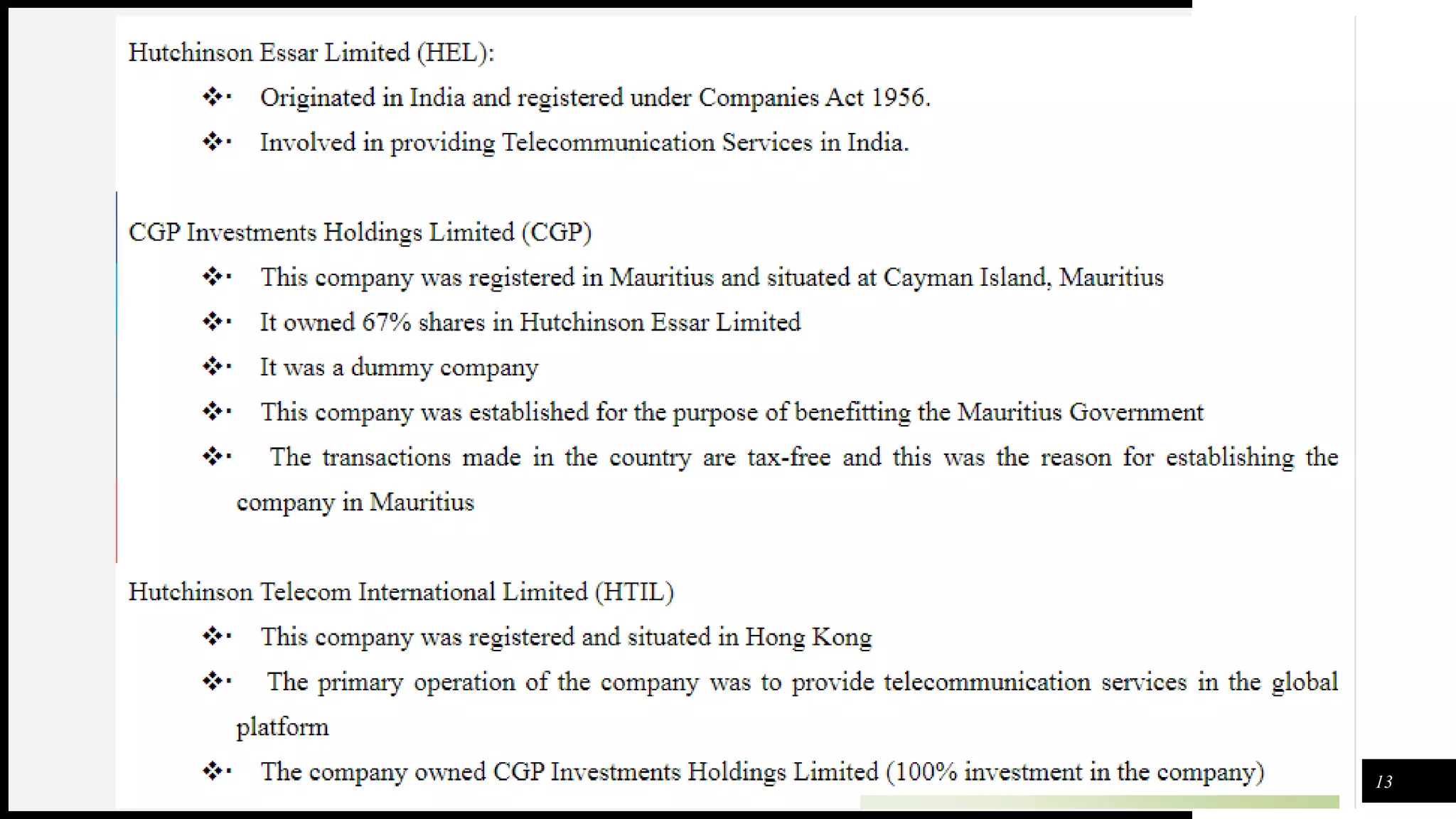

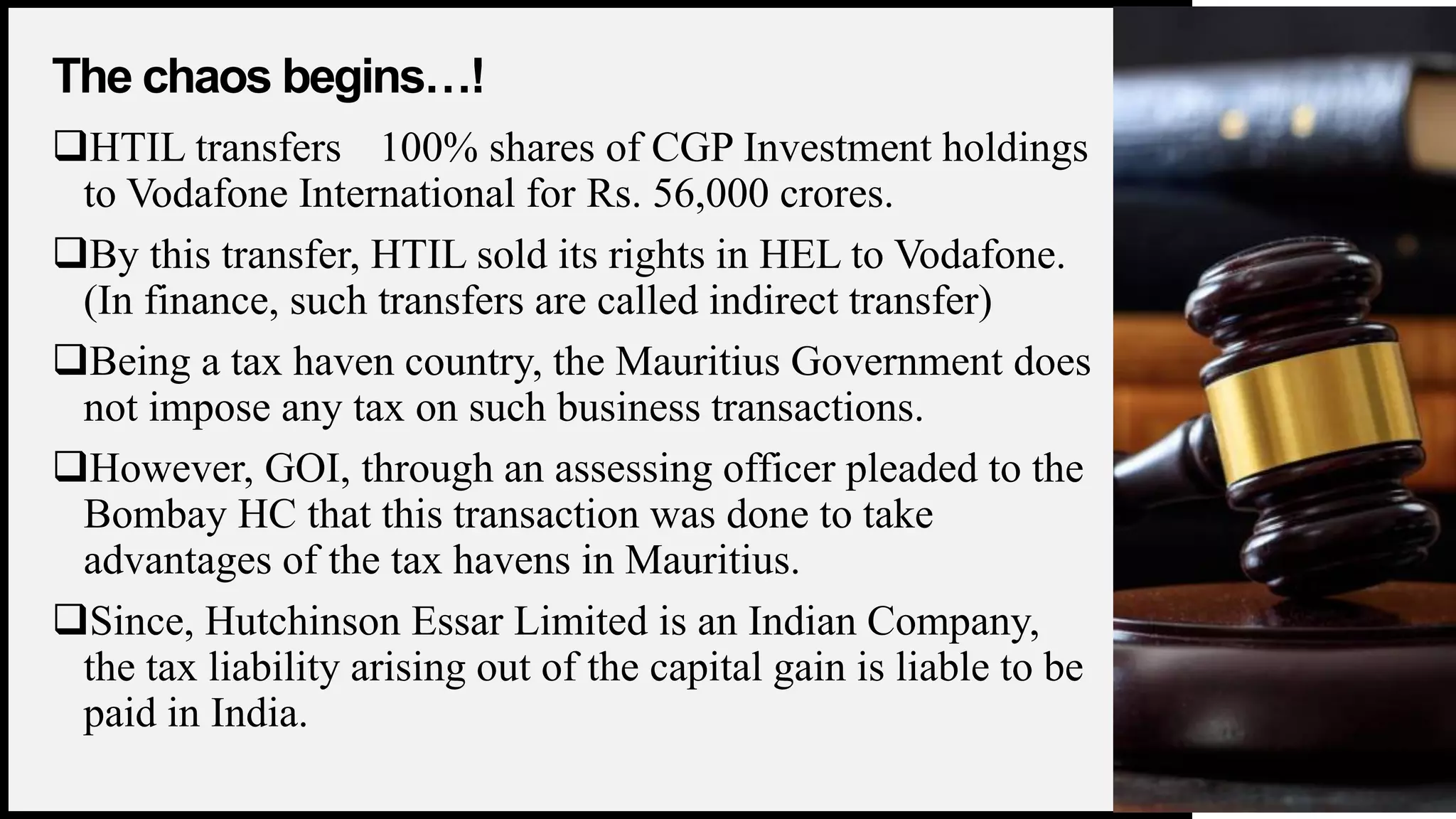

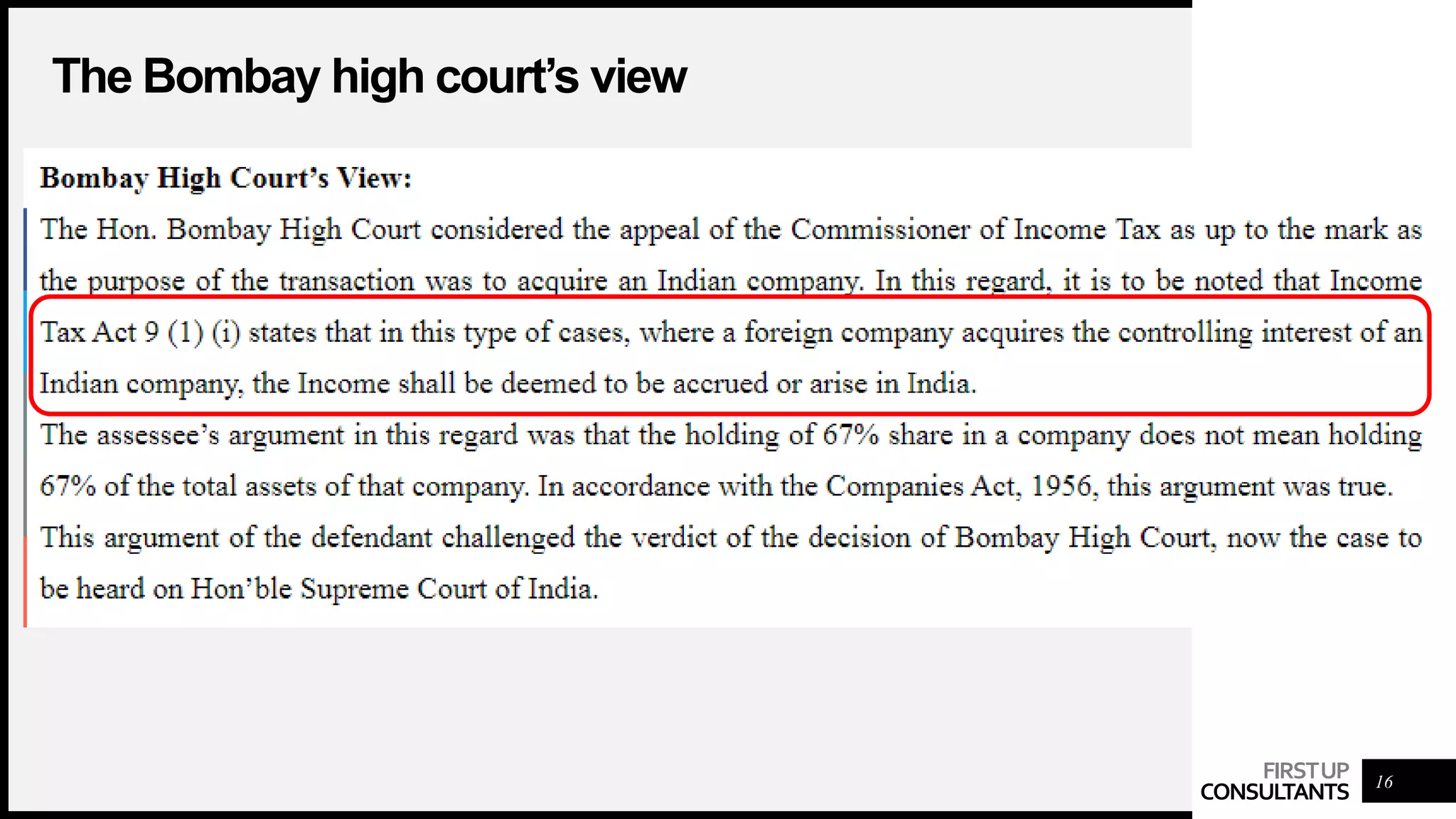

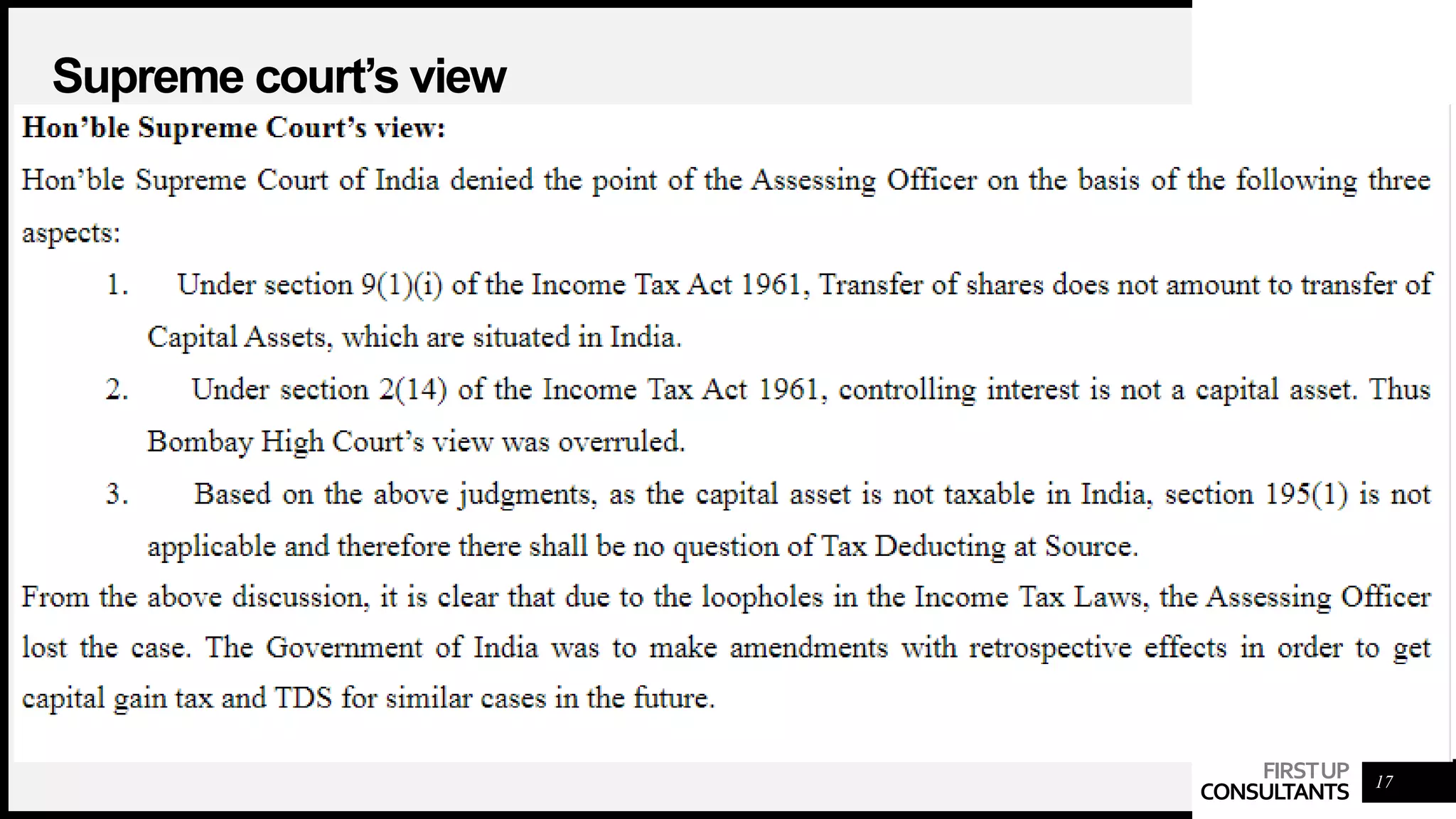

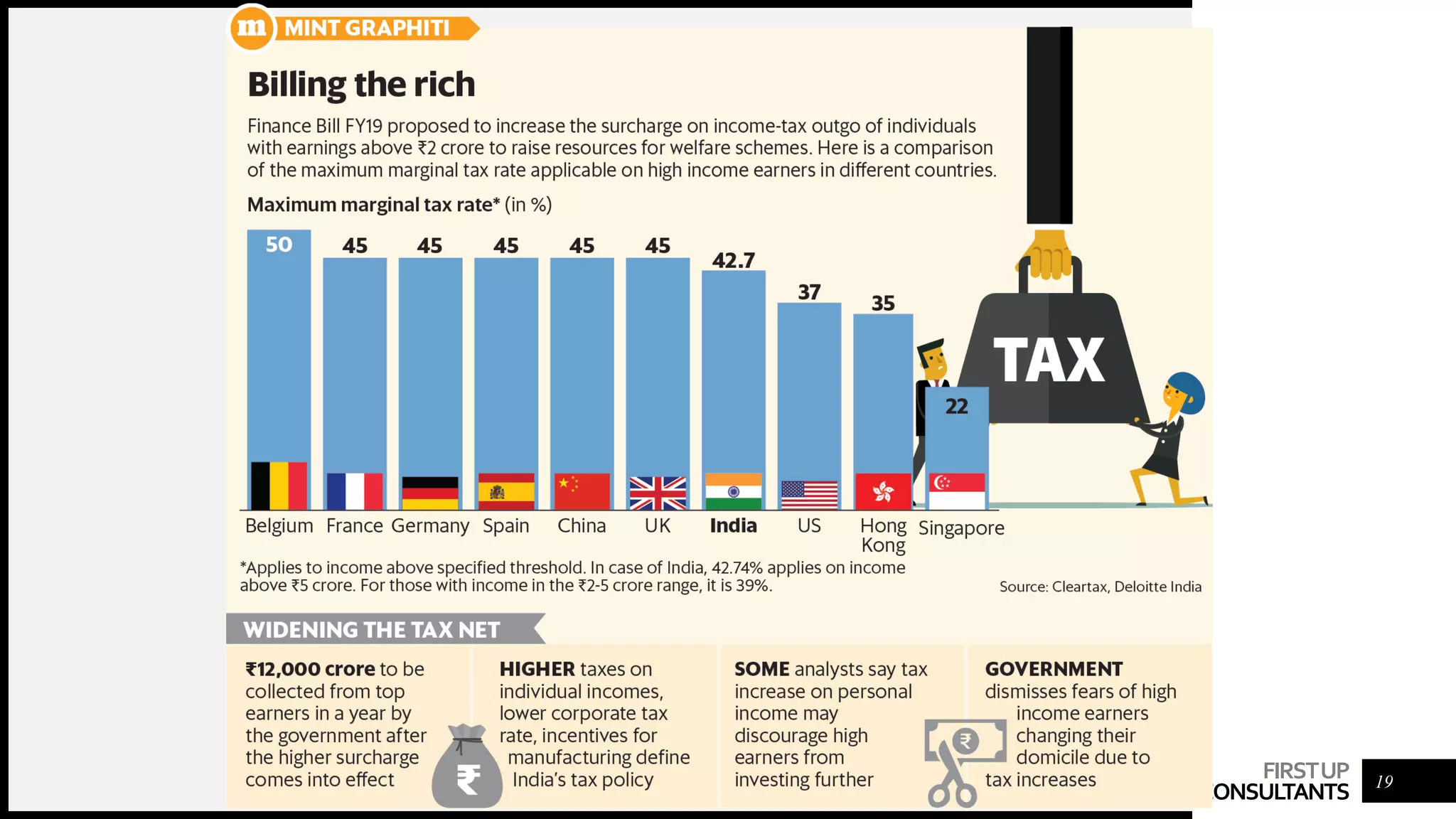

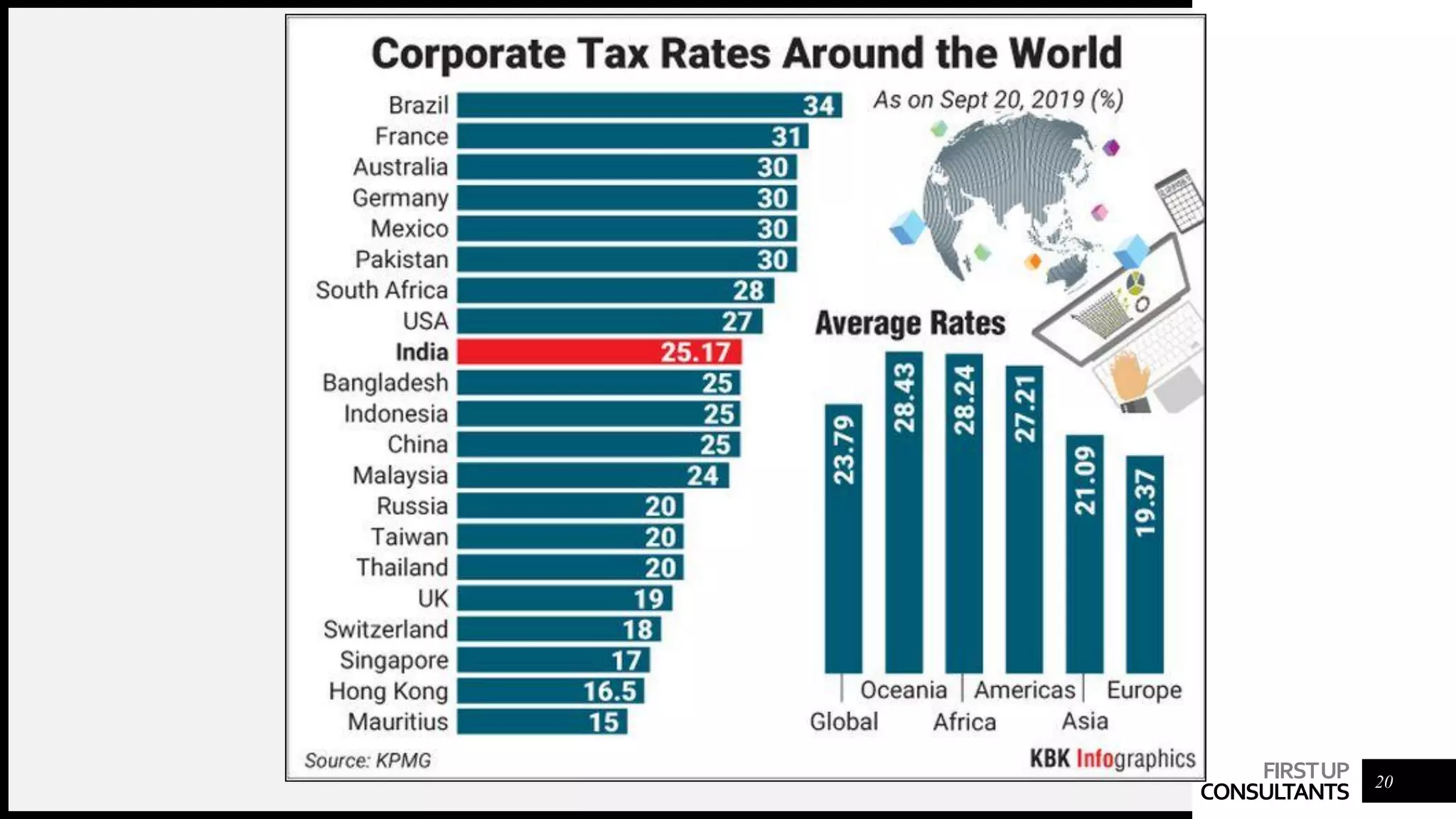

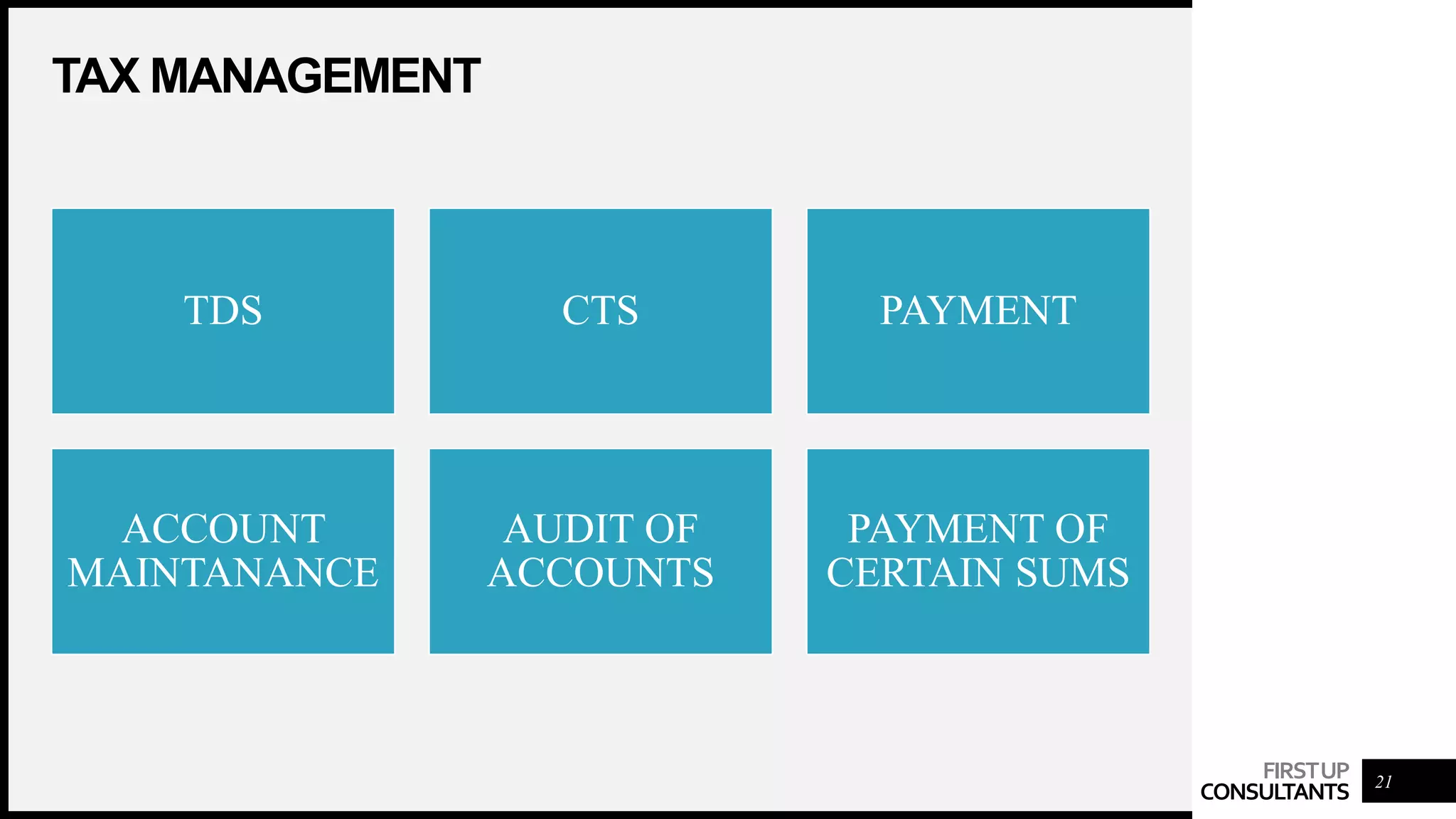

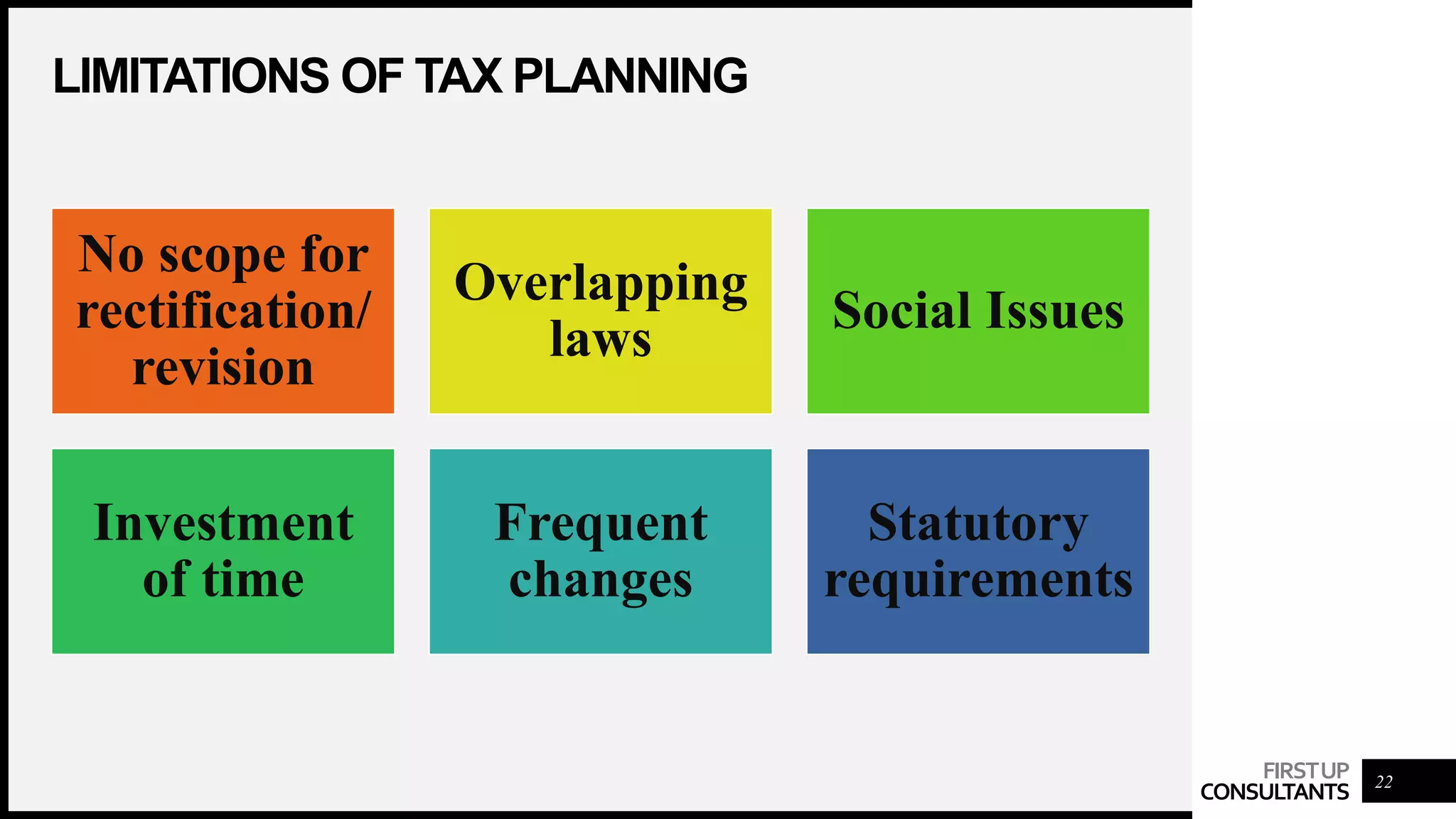

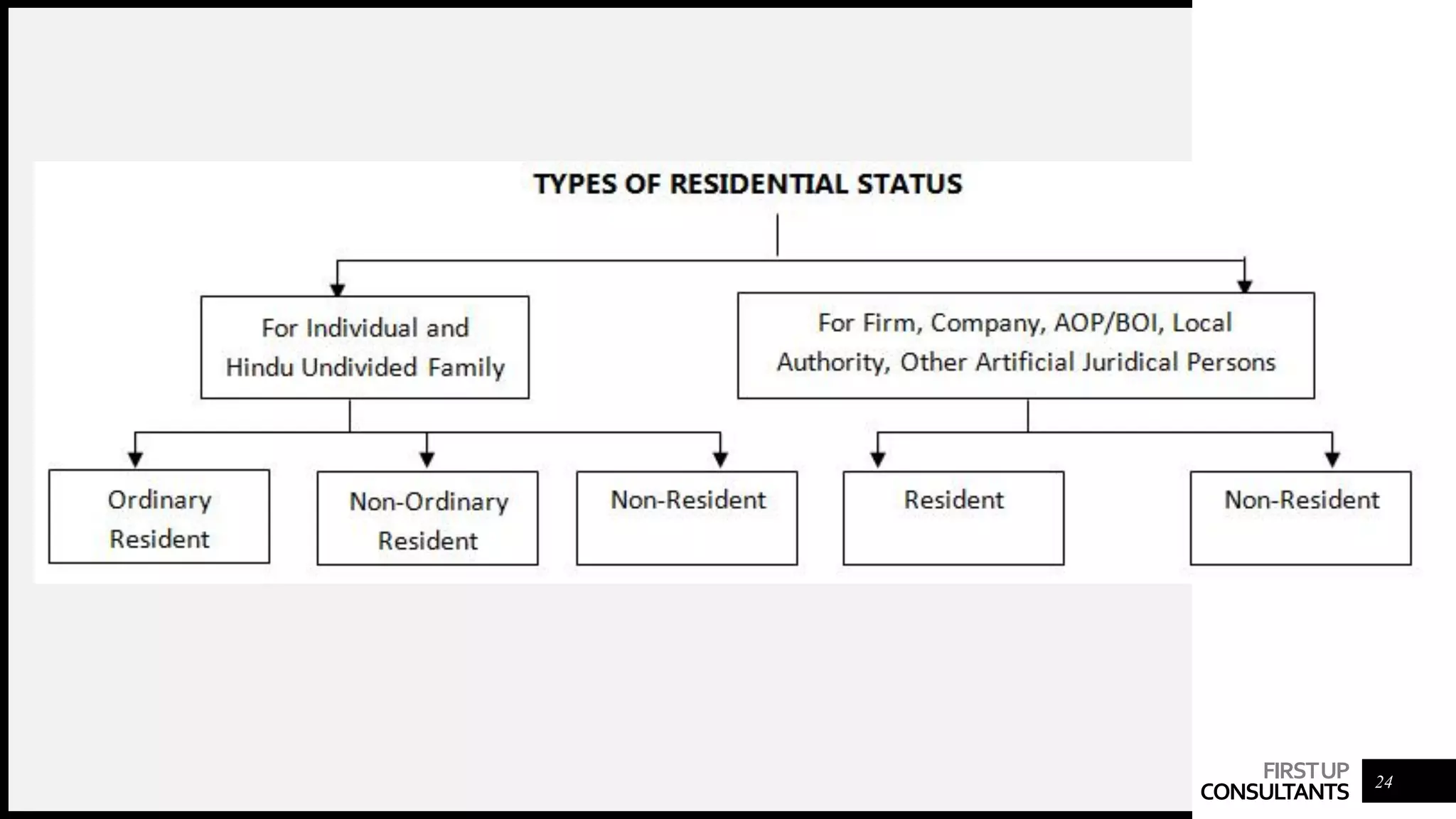

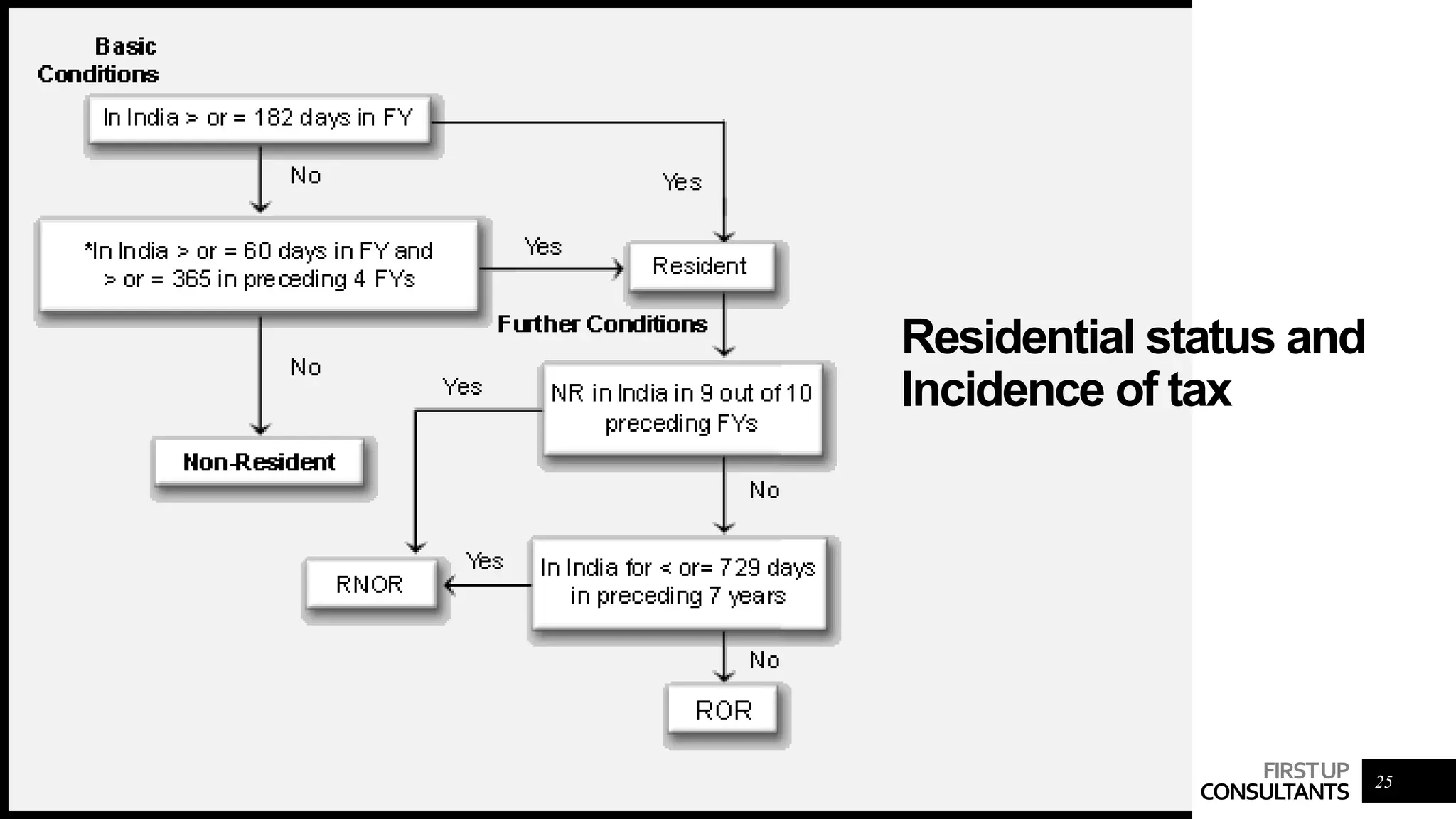

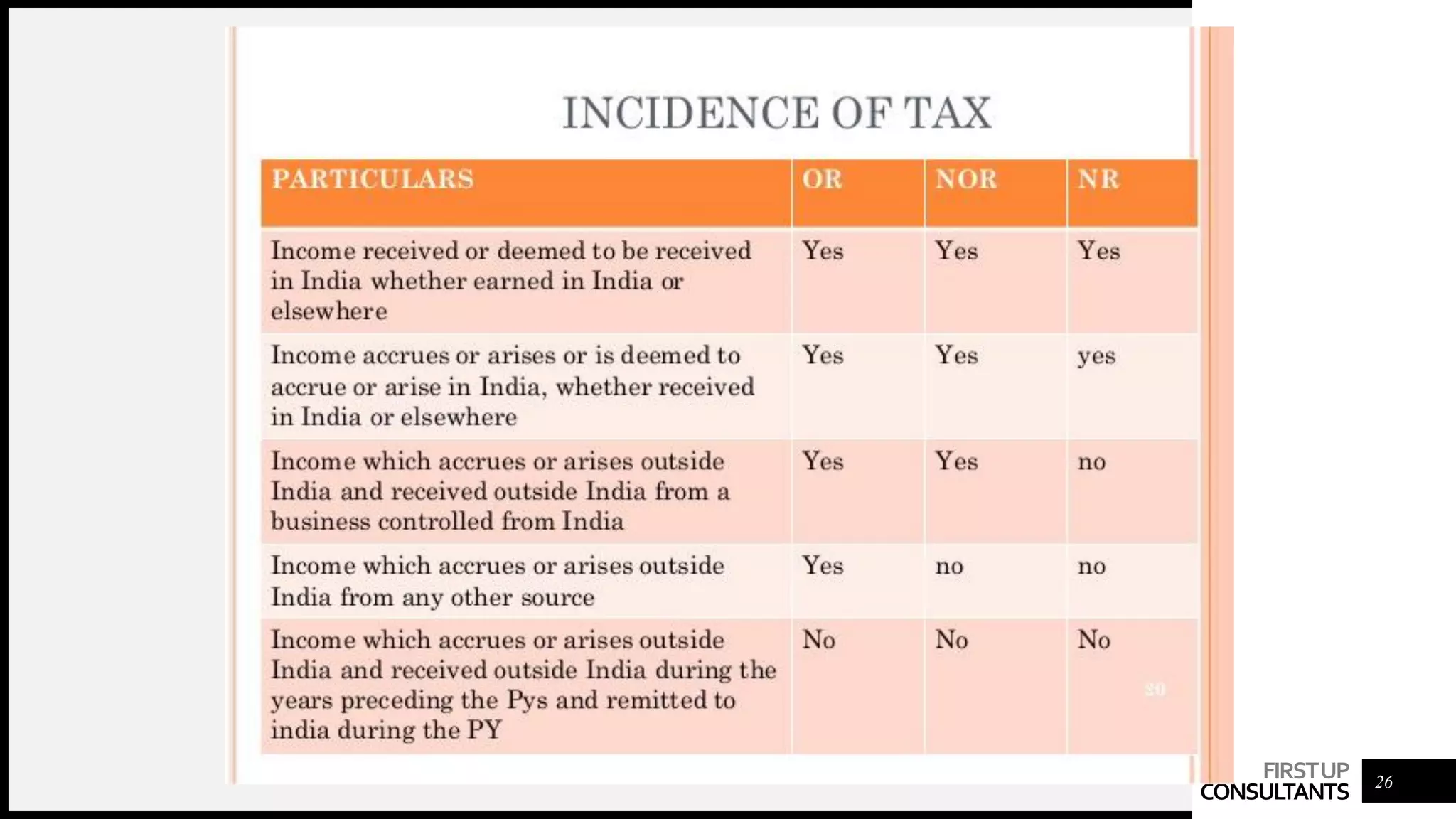

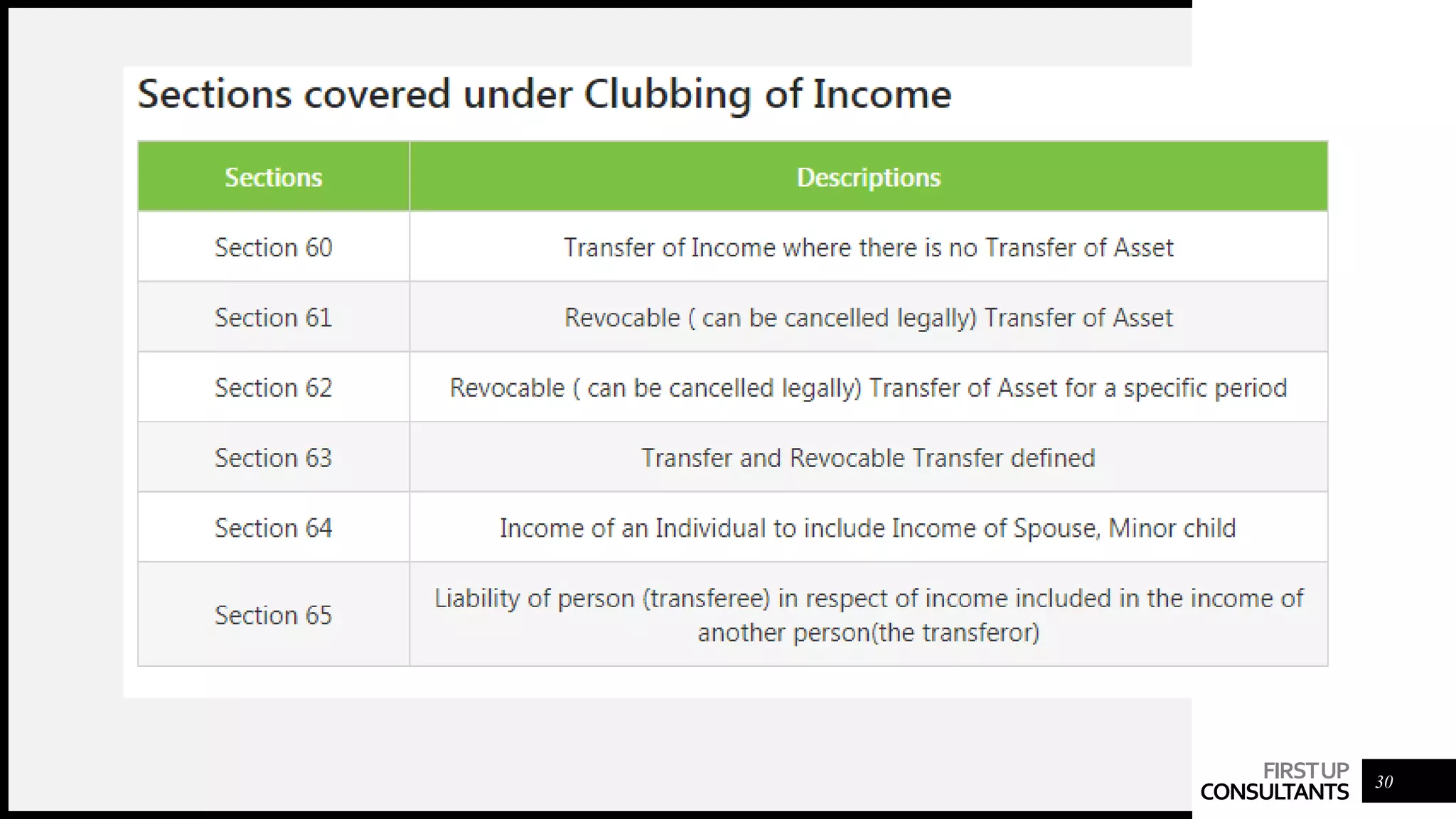

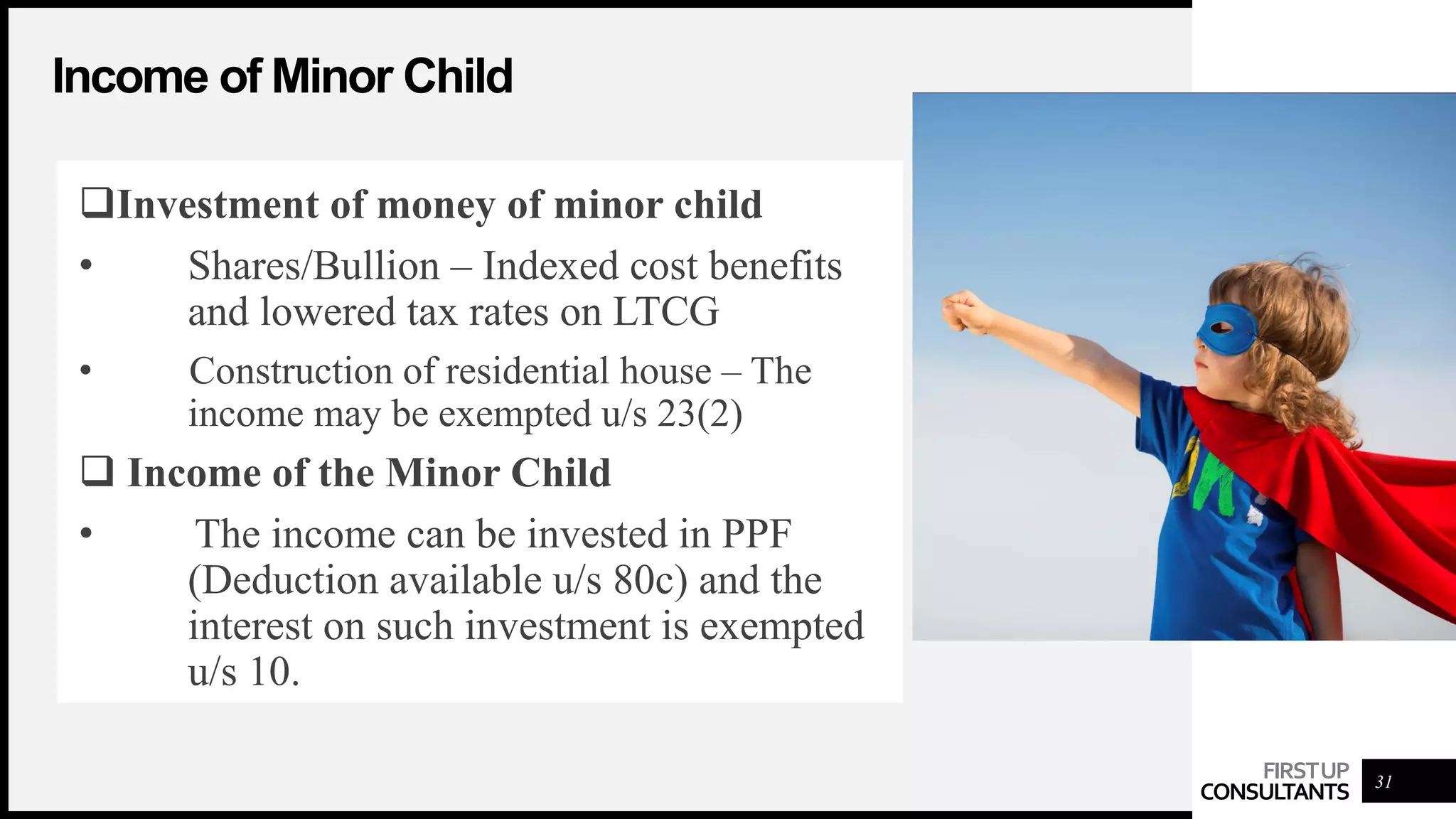

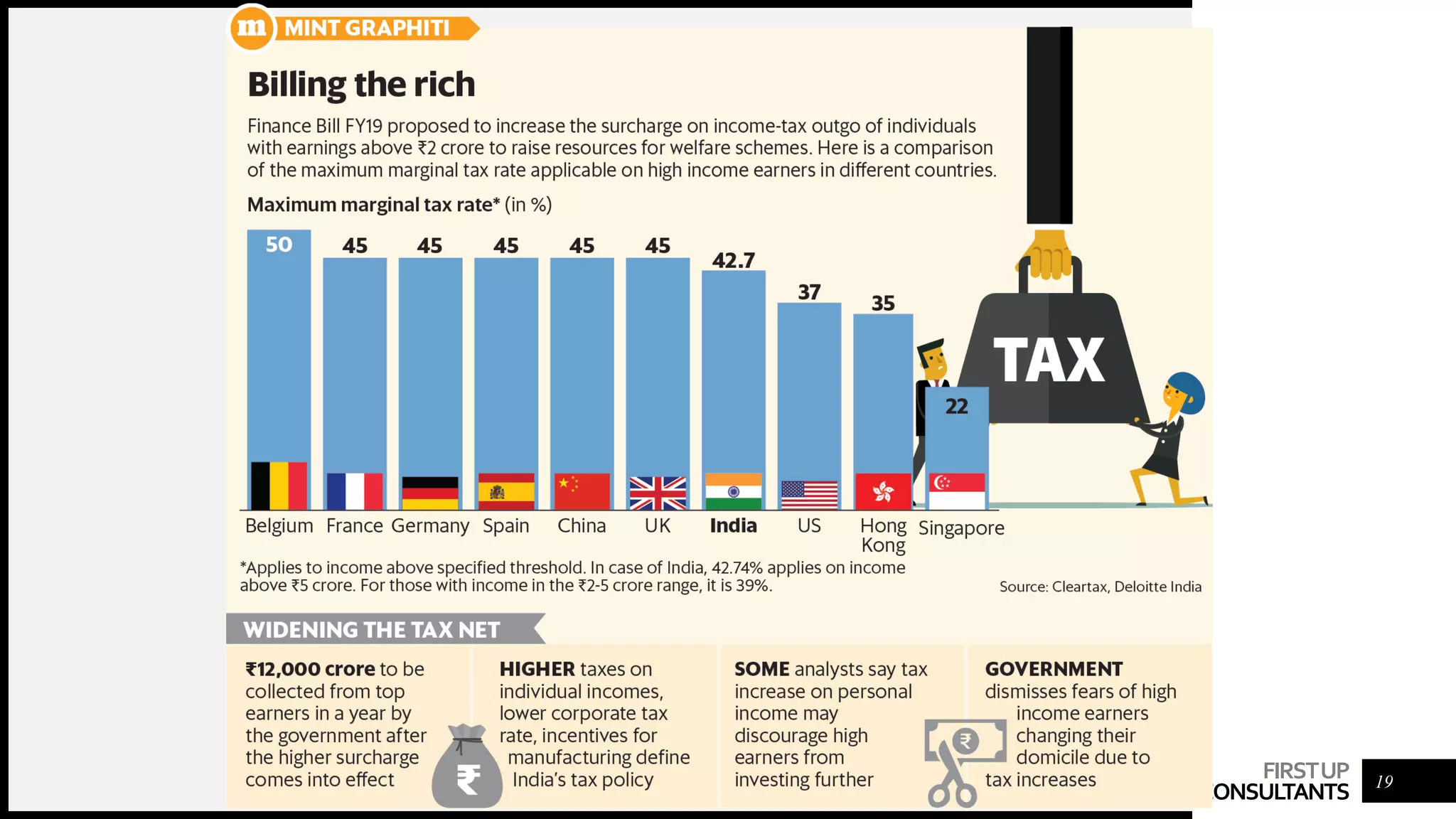

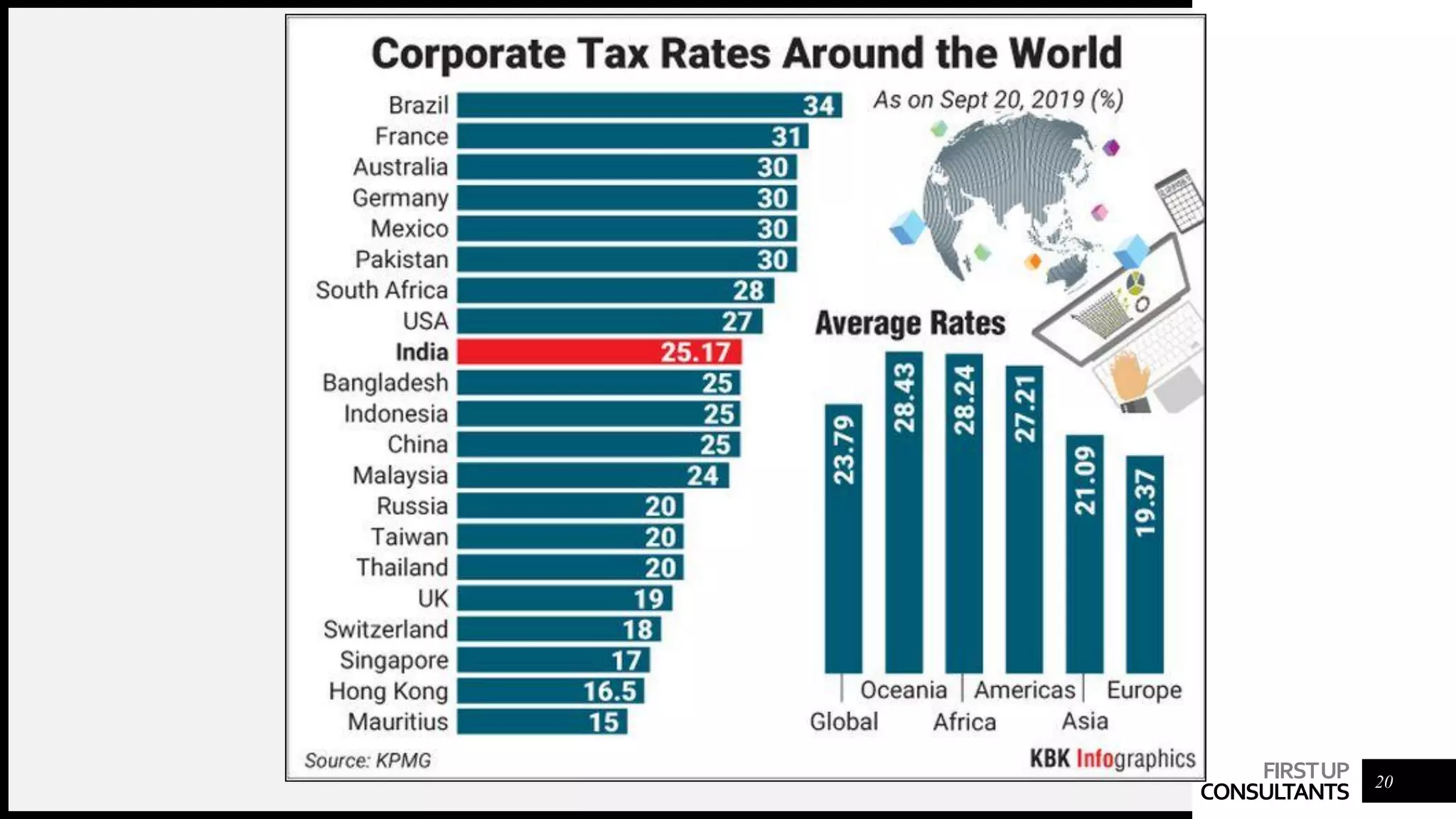

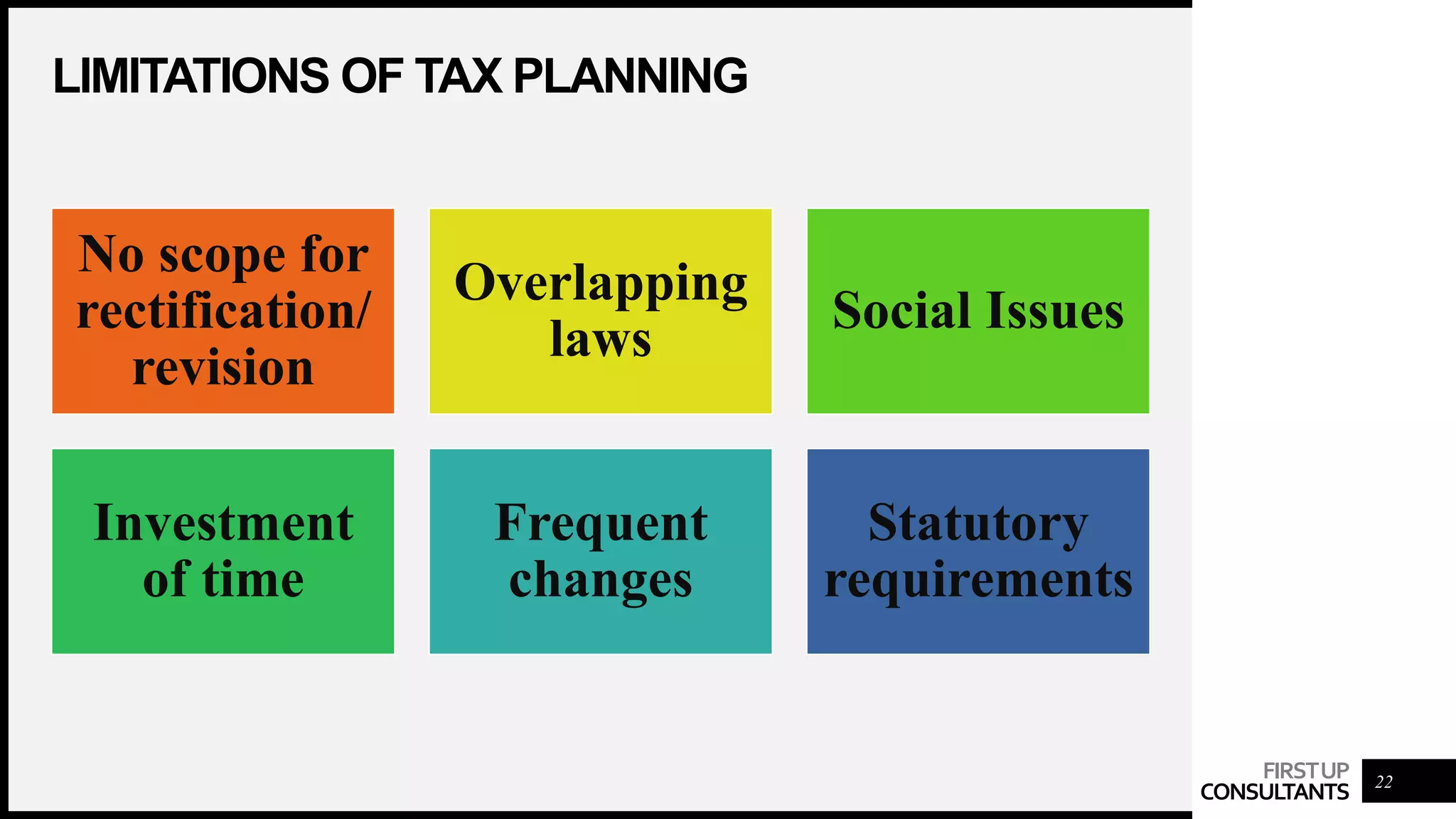

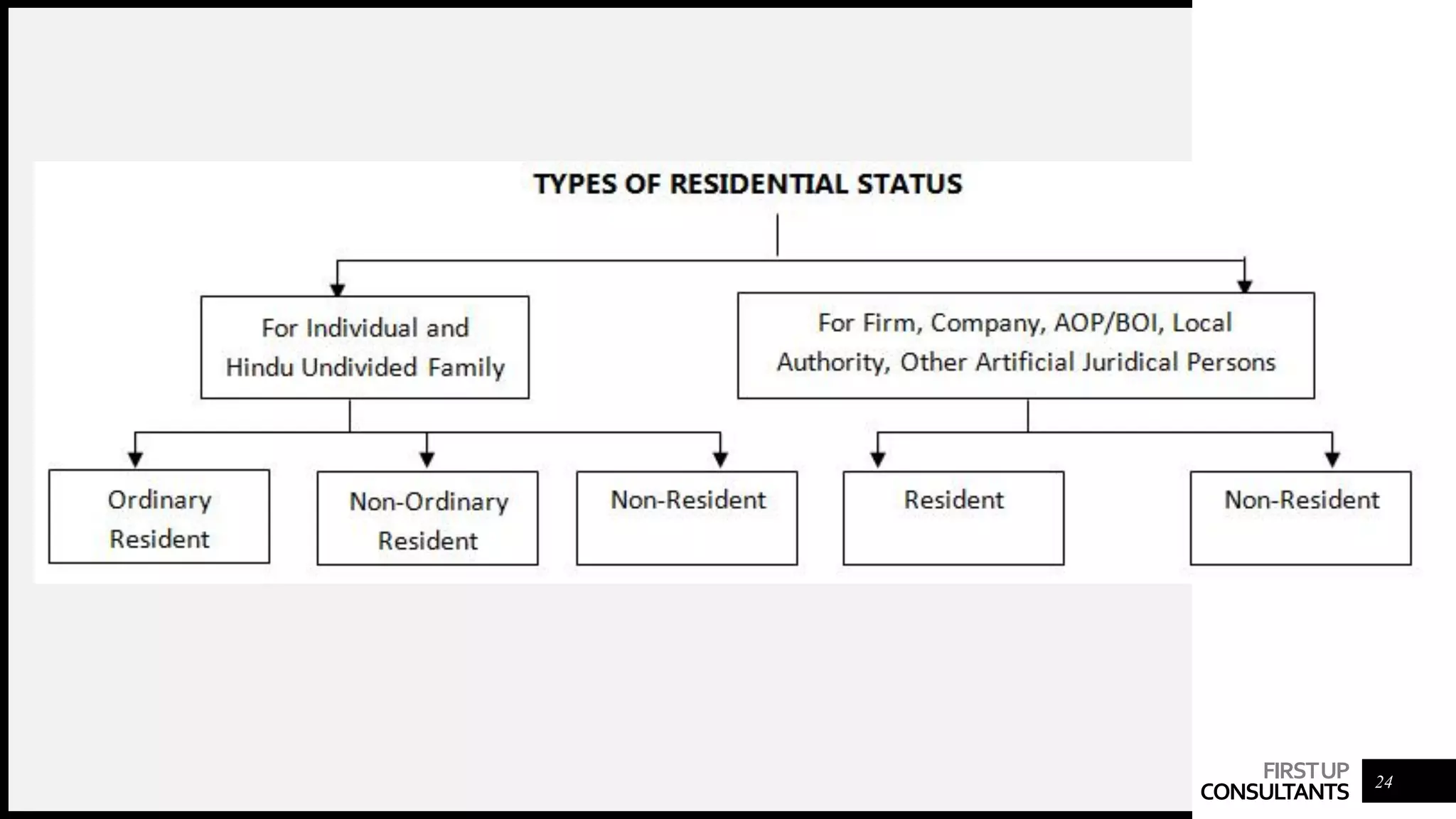

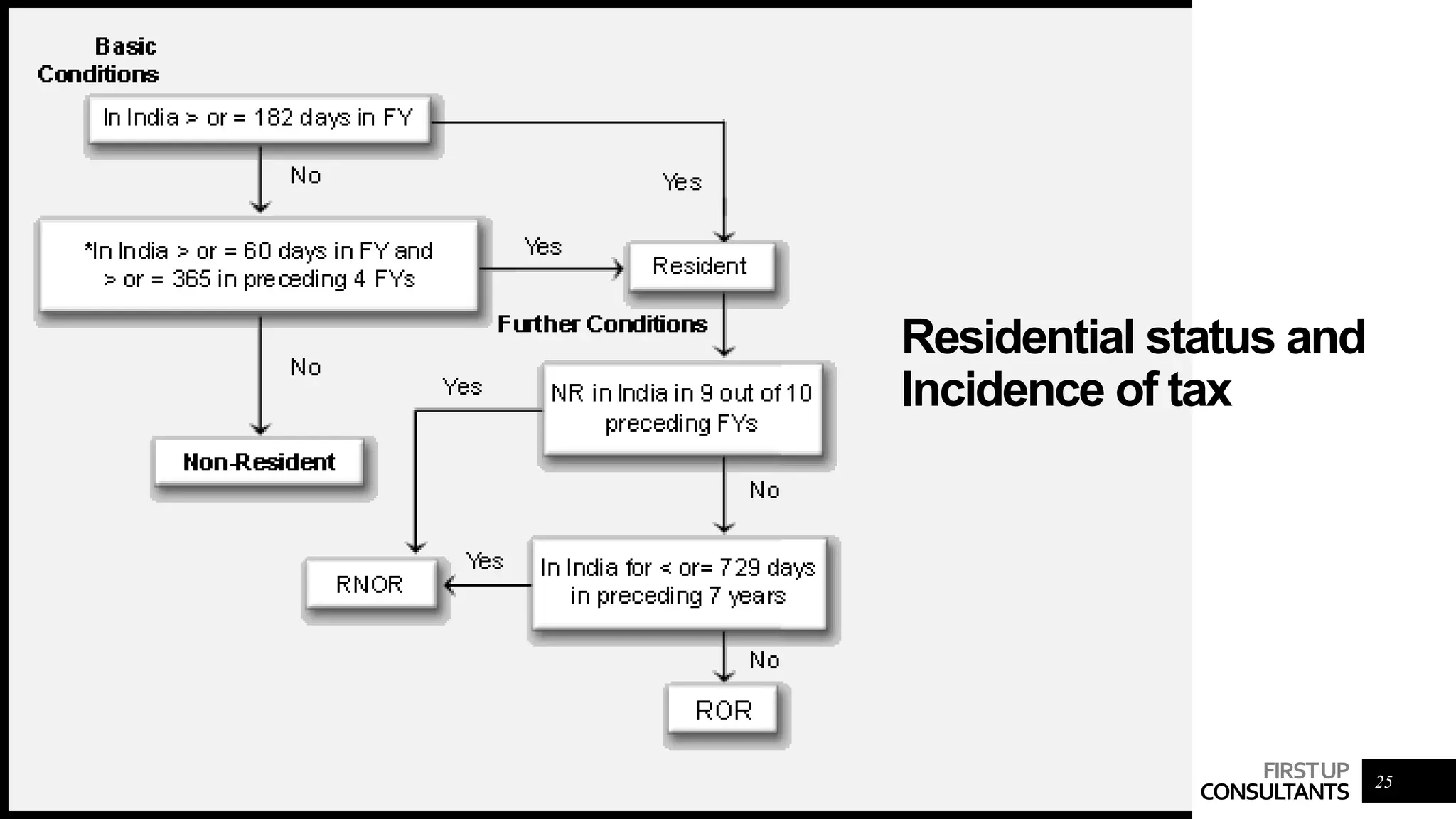

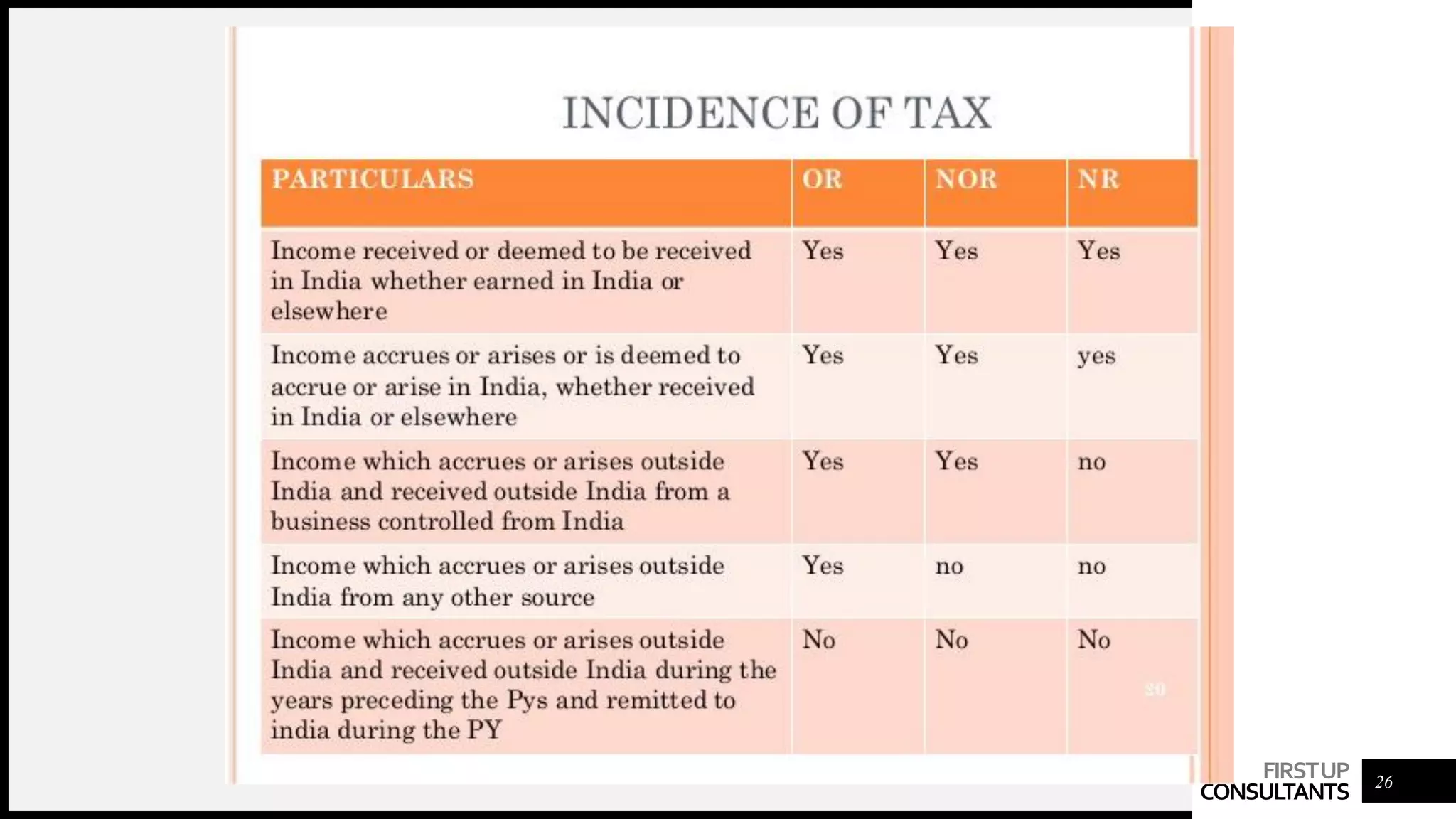

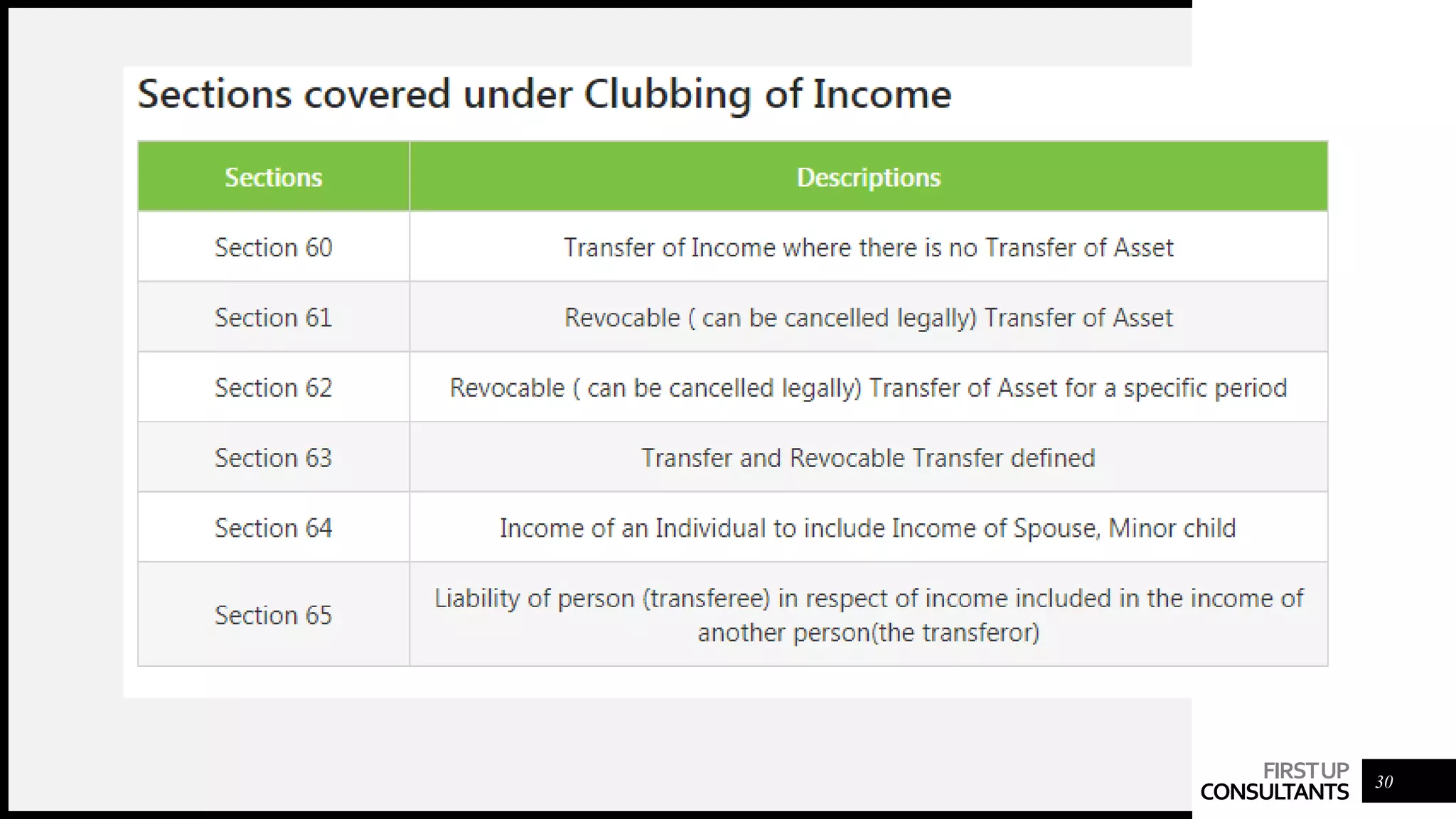

This document discusses tax planning and management by Firstup Consultants. It provides information on: - The differences between tax planning, which aims to minimize future tax liability, and tax management, which focuses on compliance. - The distinctions between tax avoidance, which uses legal methods to reduce taxes, and tax evasion, which involves illegal activities to avoid paying taxes. - Examples of tax planning for individuals, including investments in agriculture, HUFs, gifts, income of minor children and spouses. - The importance of having thorough knowledge of tax laws and not relying only on avoidance or past court decisions when planning taxes.