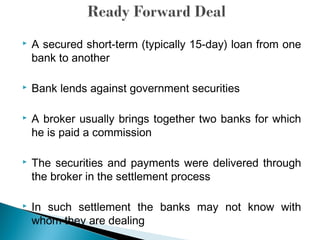

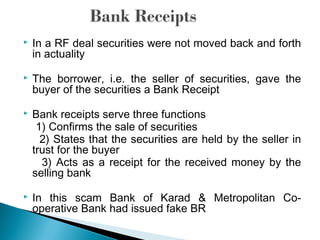

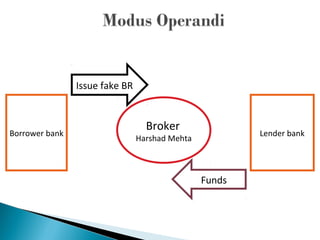

Harshad Mehta used loopholes in the banking system in the early 1990s to divert funds of Rs. 4,000 crore from various banks and trigger a spike in the SENSEX. As a stockbroker, he exploited the ready forward system and issued fake bank receipts to borrow funds without proper collateral. His scam was exposed by journalist Sucheta Dalal in 1992 and resulted in reforms to tighten regulation of the stock market and banking system in India. Mehta was later arrested and banned from the stock market for over 70 criminal offenses related to misappropriation of funds.