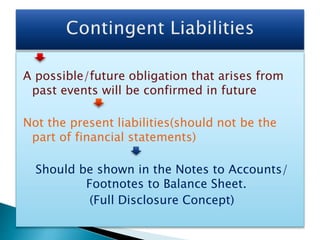

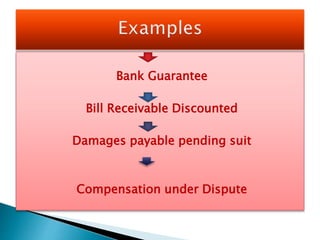

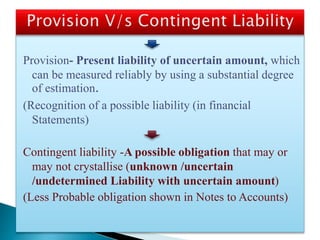

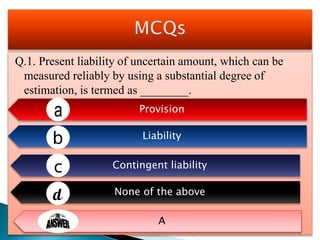

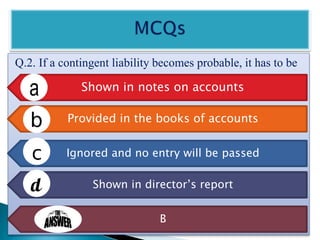

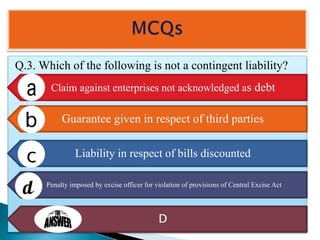

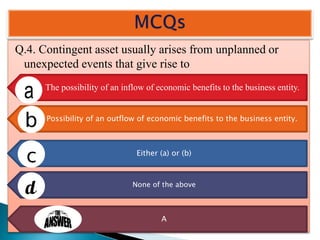

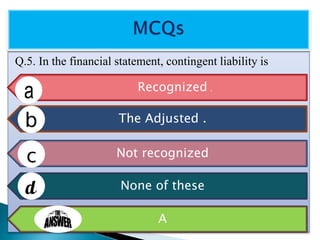

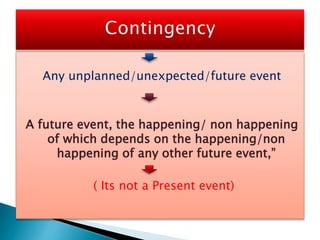

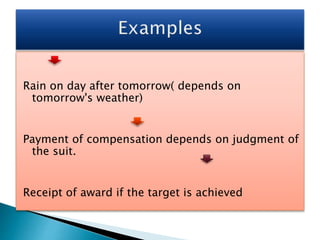

The document discusses contingent assets and liabilities, explaining that they pertain to future events that are uncertain and depend on the occurrence or non-occurrence of other events. Contingent assets should not be recognized in financial statements but rather disclosed in notes, while contingent liabilities are possible obligations arising from past events that are also not recognized directly in financial documents. It includes examples of provisions, liabilities, and relevant questions regarding their treatment in financial reporting.

![A possible(future) asset that arises from past events

Confirmed only by the occurrence or non- occurrence of one

or more uncertain future events

Should not be recognized in financial statements

(uncertain/not a present asset)- [Prudence Concept]

Should be shown in “Notes to Accounts/Footnote to

balance sheet”](https://image.slidesharecdn.com/contingentassetsliabilities-160523074440/85/Contingent-Assets-Liabilities-5-320.jpg)