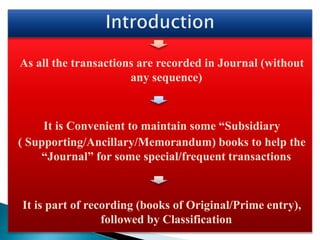

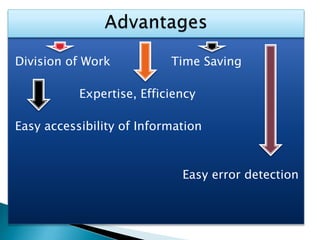

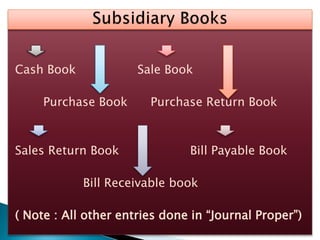

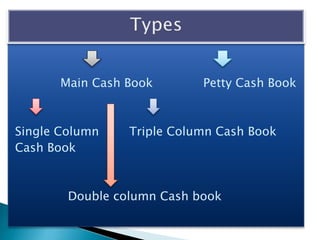

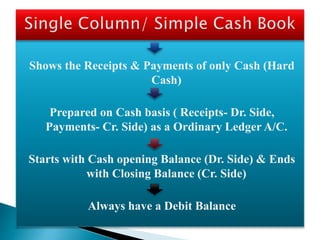

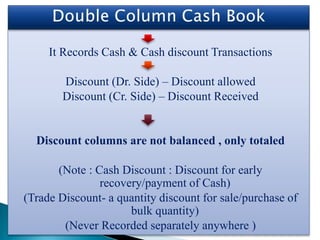

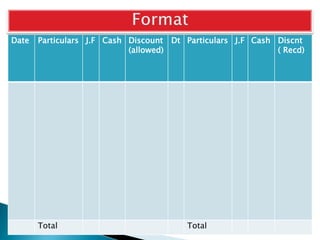

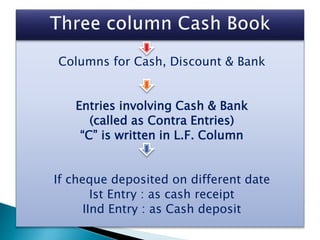

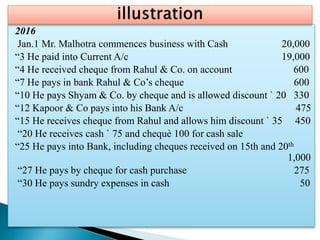

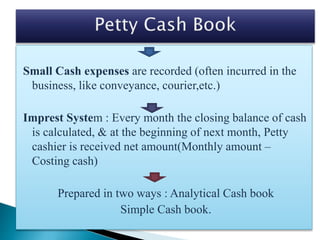

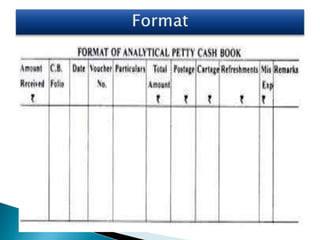

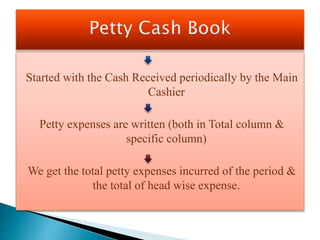

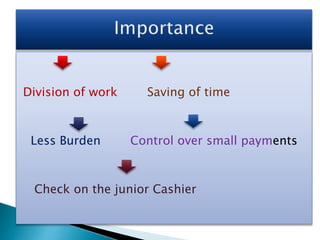

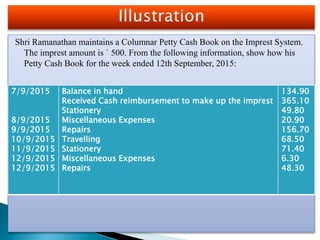

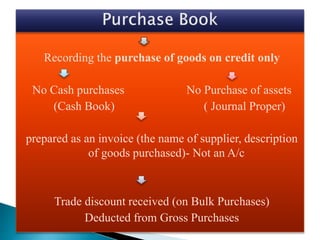

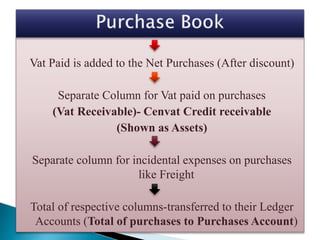

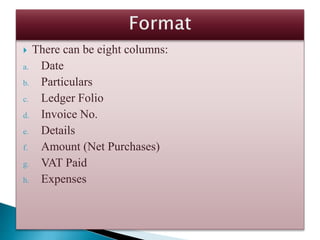

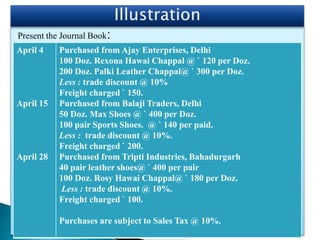

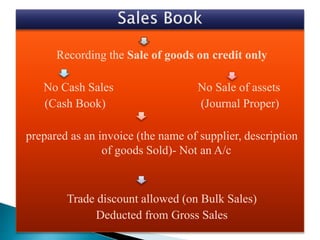

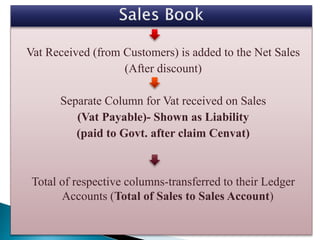

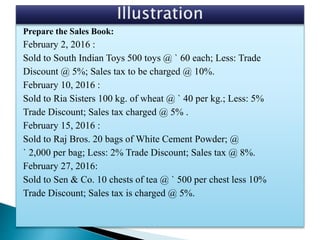

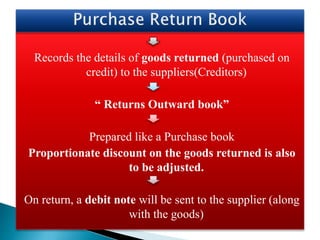

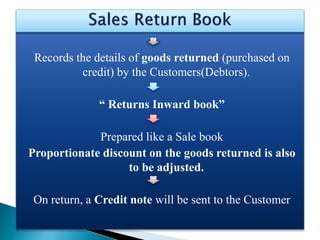

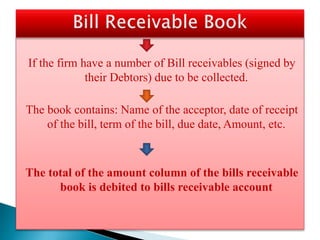

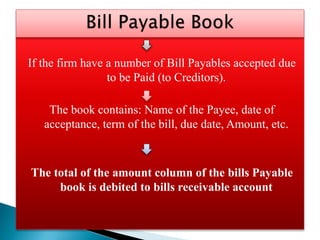

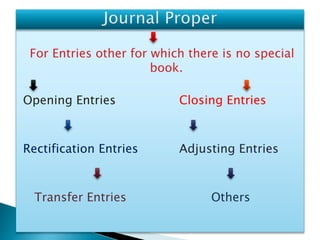

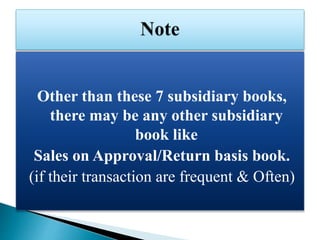

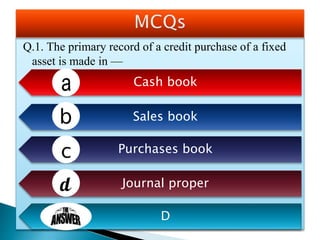

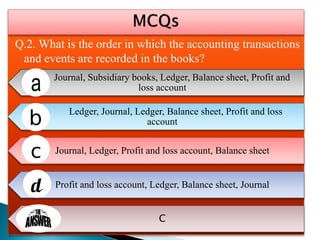

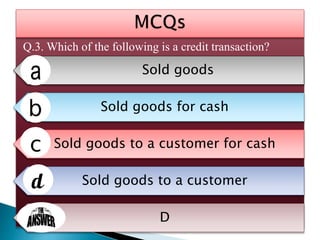

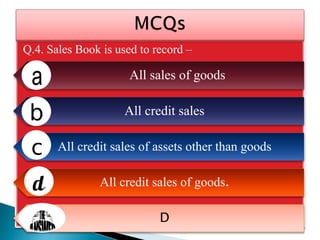

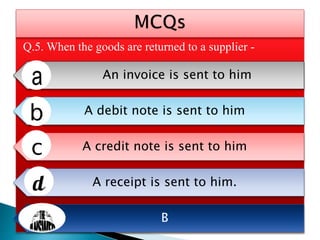

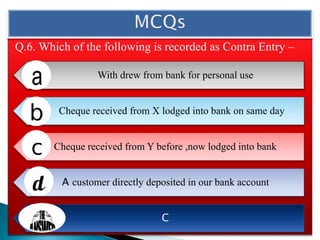

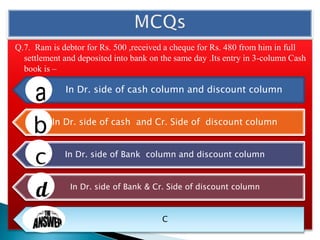

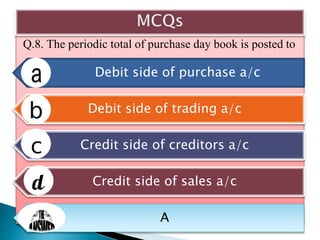

The document outlines the purpose and functioning of subsidiary books in accounting, detailing various types such as cash books, sales books, and purchase returns books. It explains the recording of transactions, including cash and bank transactions, credit purchases, and sales, along with examples of invoices and journal entries. Additionally, it covers the process of maintaining records like petty cash books and bills receivable/payable, emphasizing the importance of organization and classification for efficient accounting.