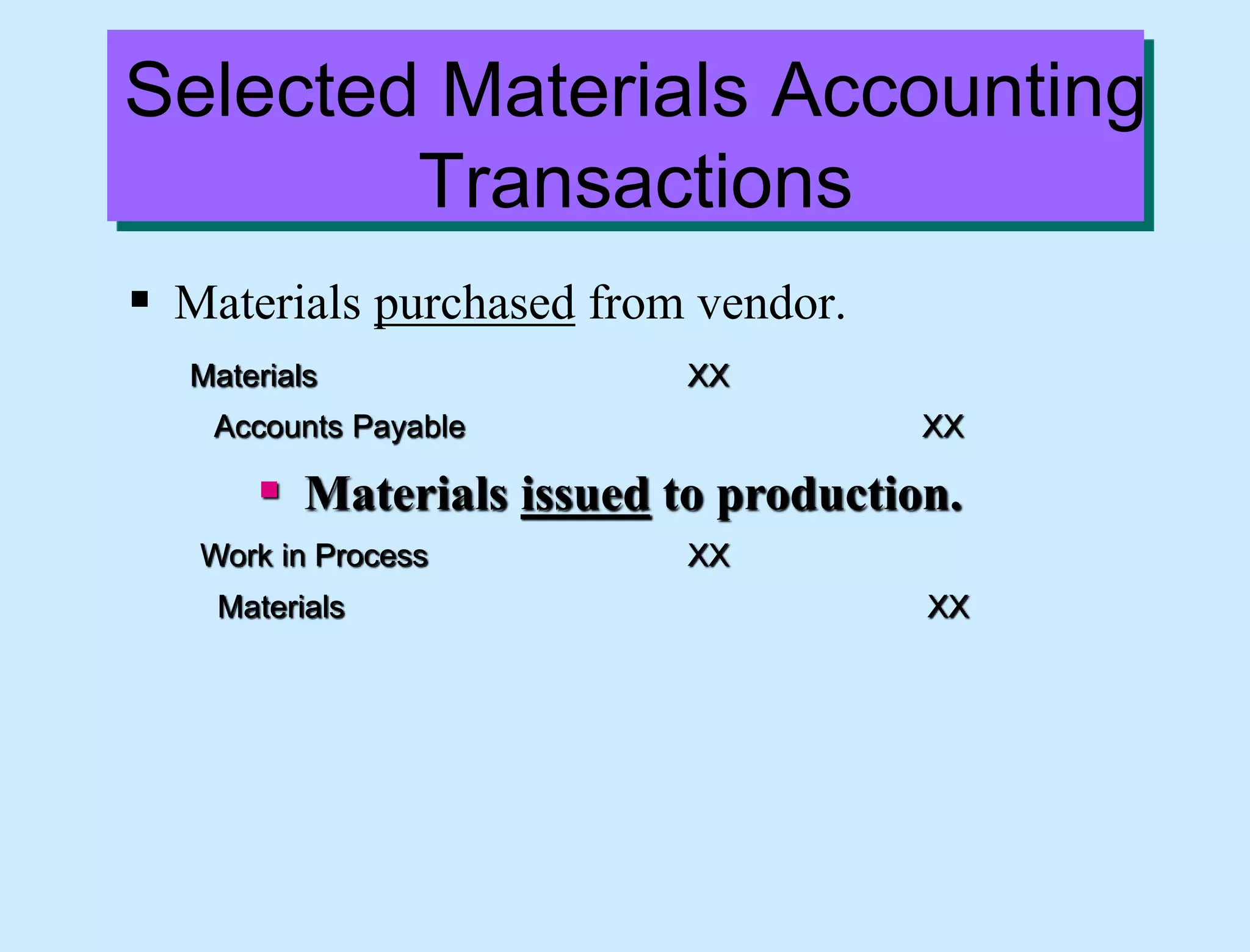

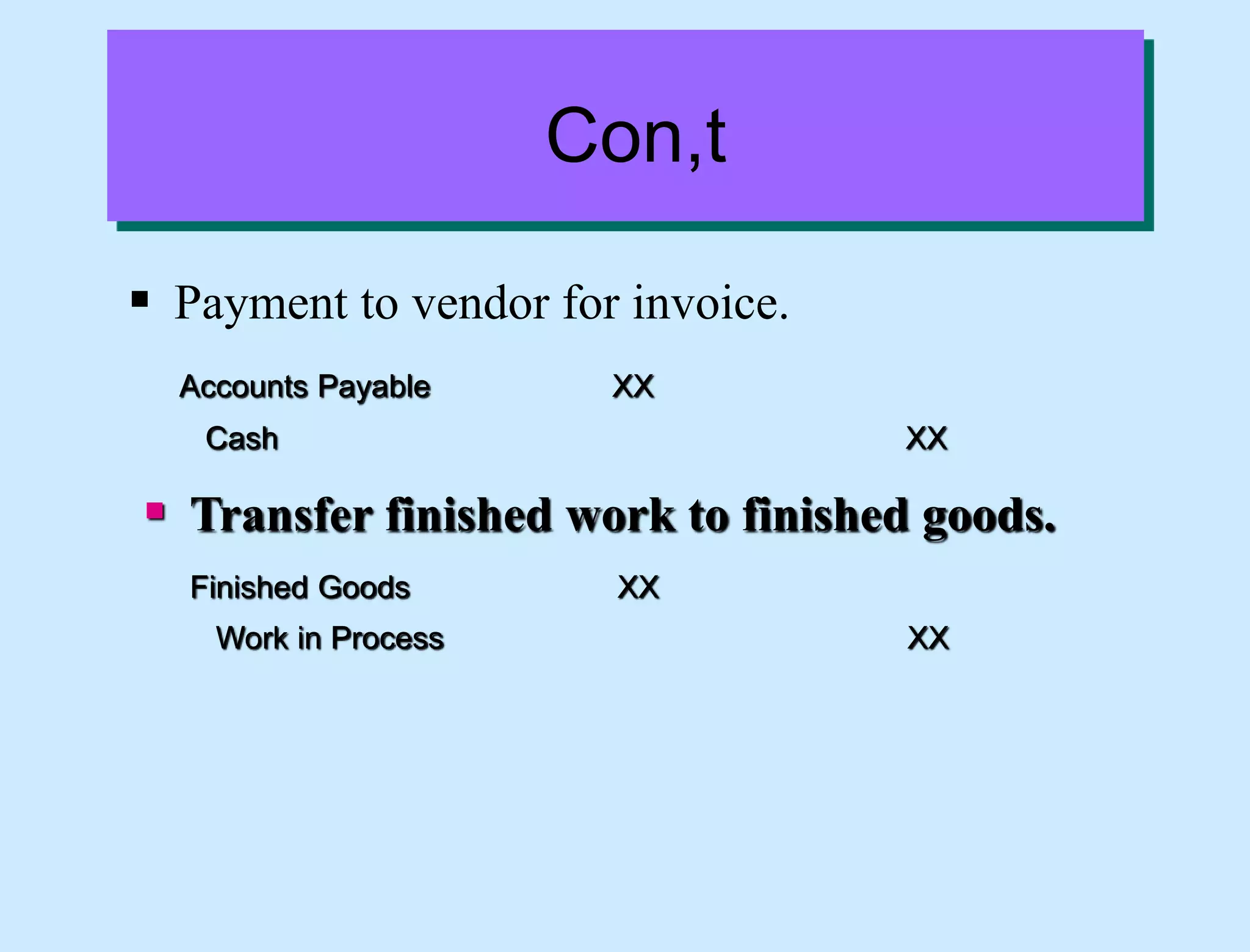

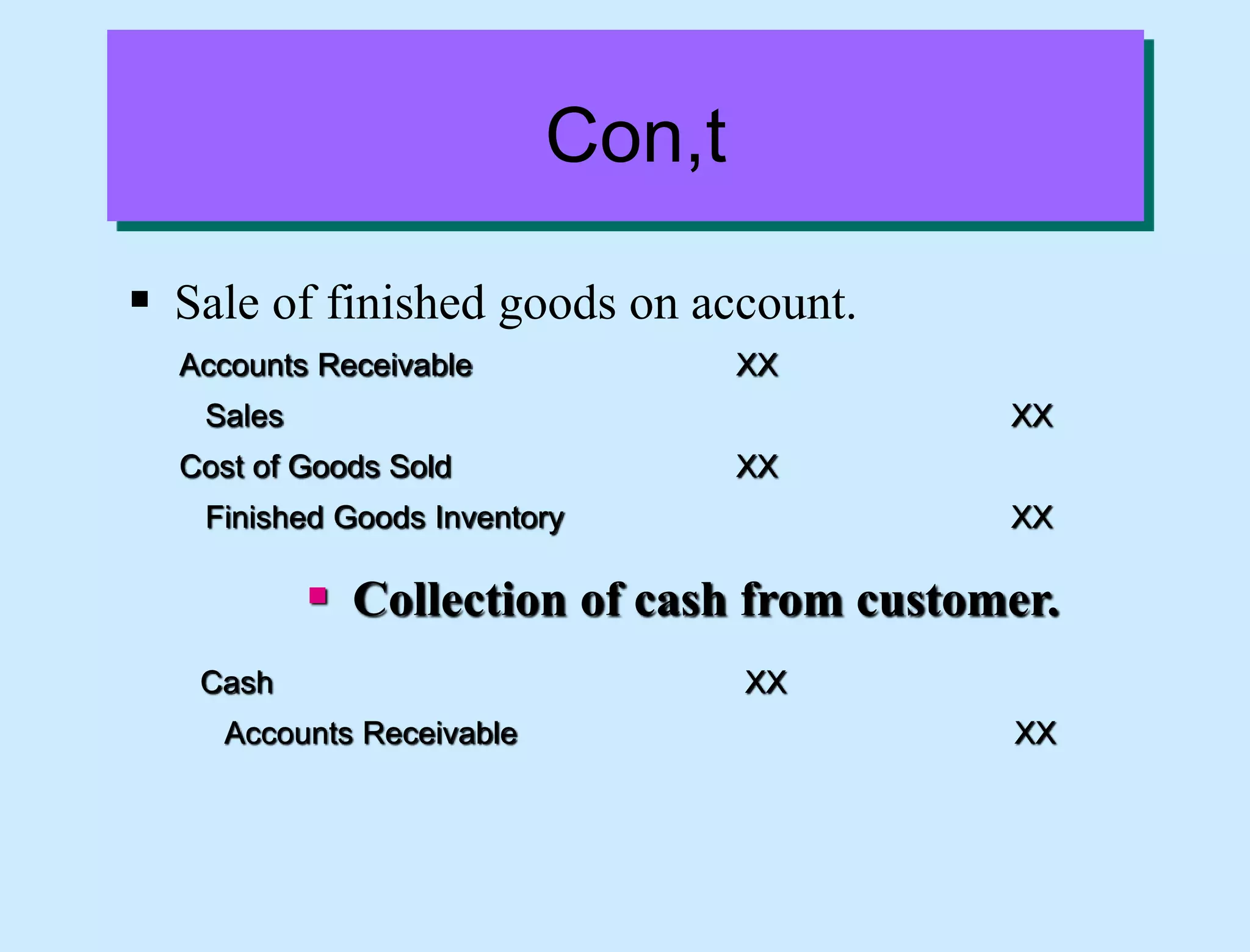

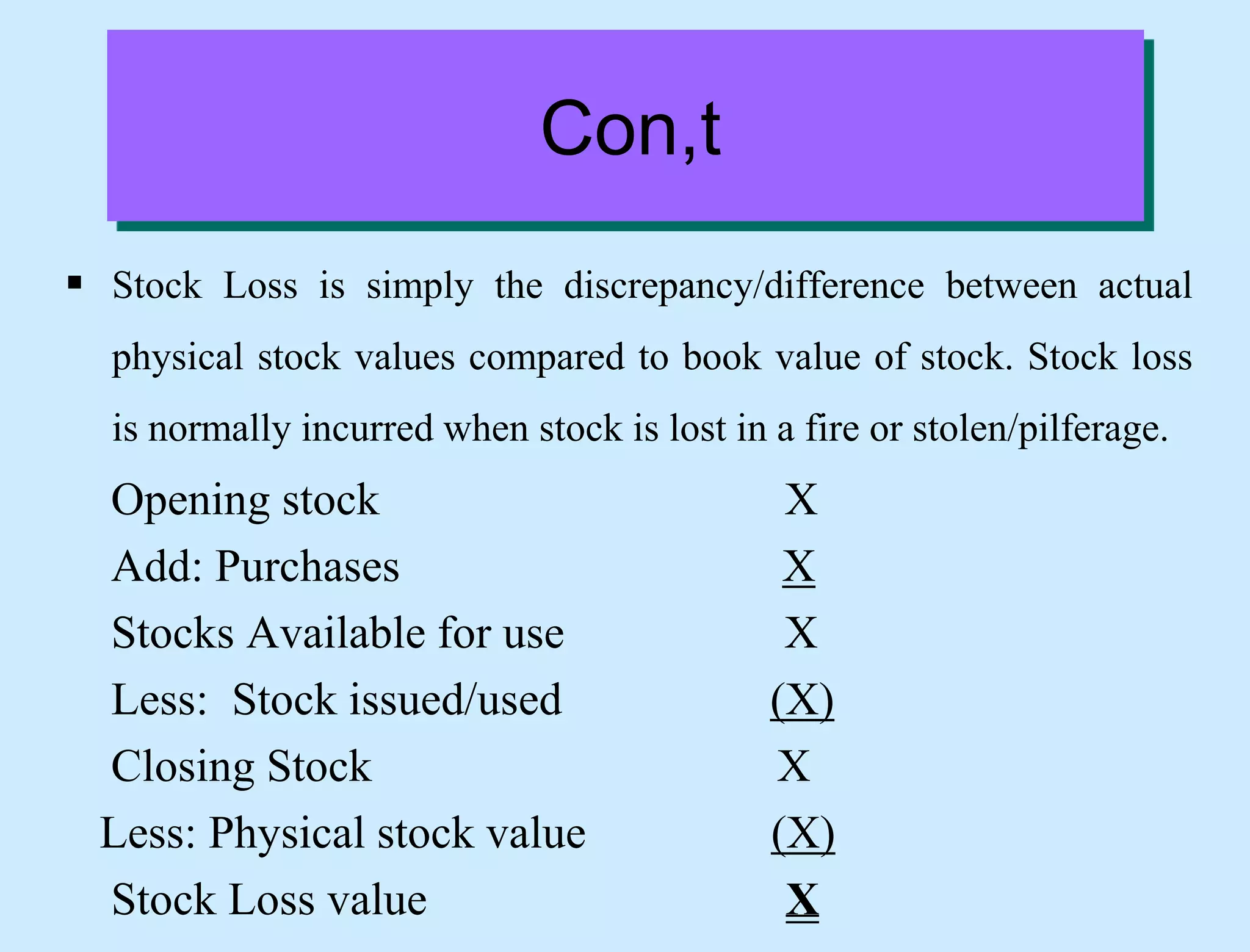

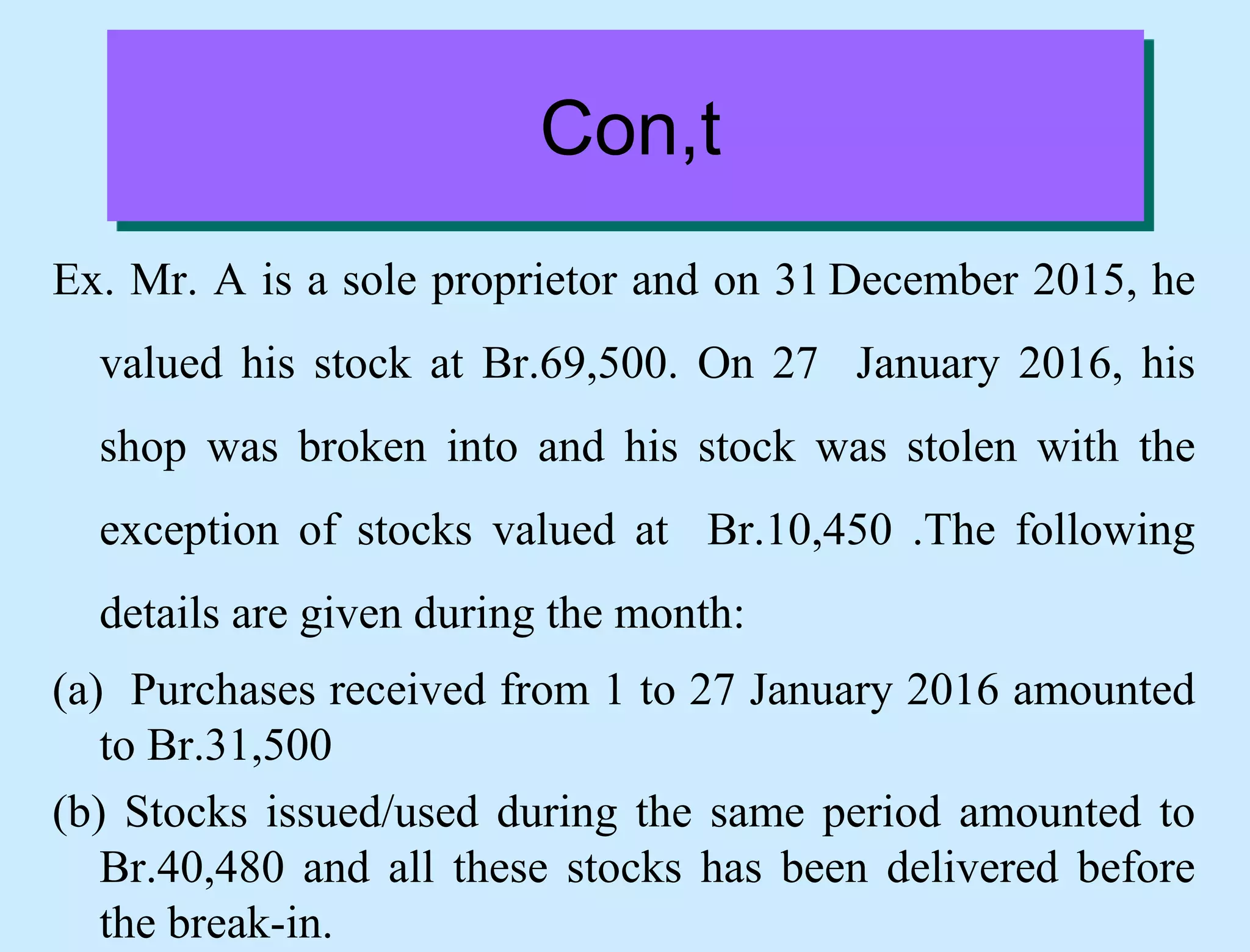

The document discusses materials costing and control. It defines direct and indirect materials and explains how materials are accounted for as they move through the production process. It also covers determining the optimal purchase quantity to minimize total inventory costs, identifying stock losses through periodic stocktaking, and accounting for discrepancies between physical and book stock values.