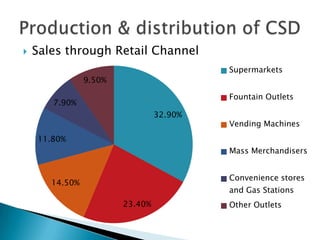

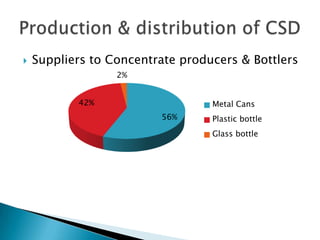

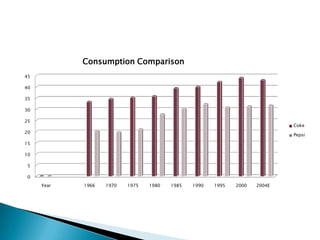

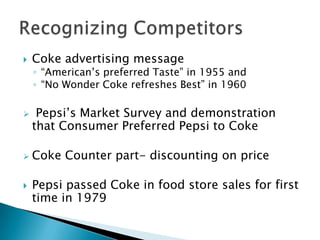

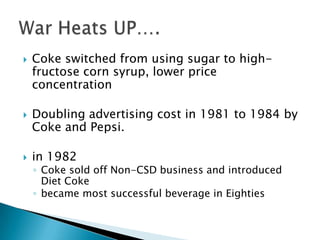

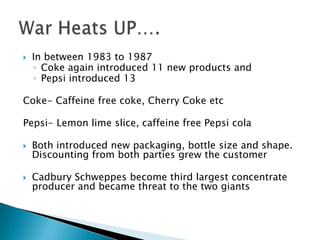

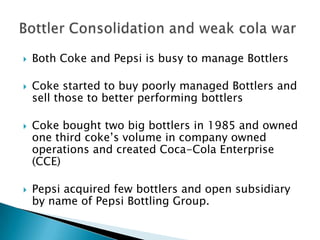

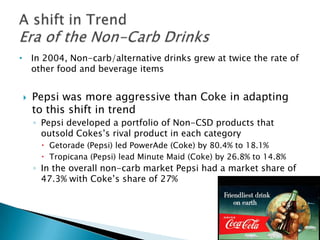

The document provides a history and overview of Coke and Pepsi in 2006. It discusses the origins of each company in the late 1800s and their growth throughout the 20th century. It also analyzes their strategies, marketing, relationships with bottlers, and challenges faced in the 2000s from declining soda consumption and rising alternatives. Both companies diversified their portfolios and pursued international growth to address the changing landscape.