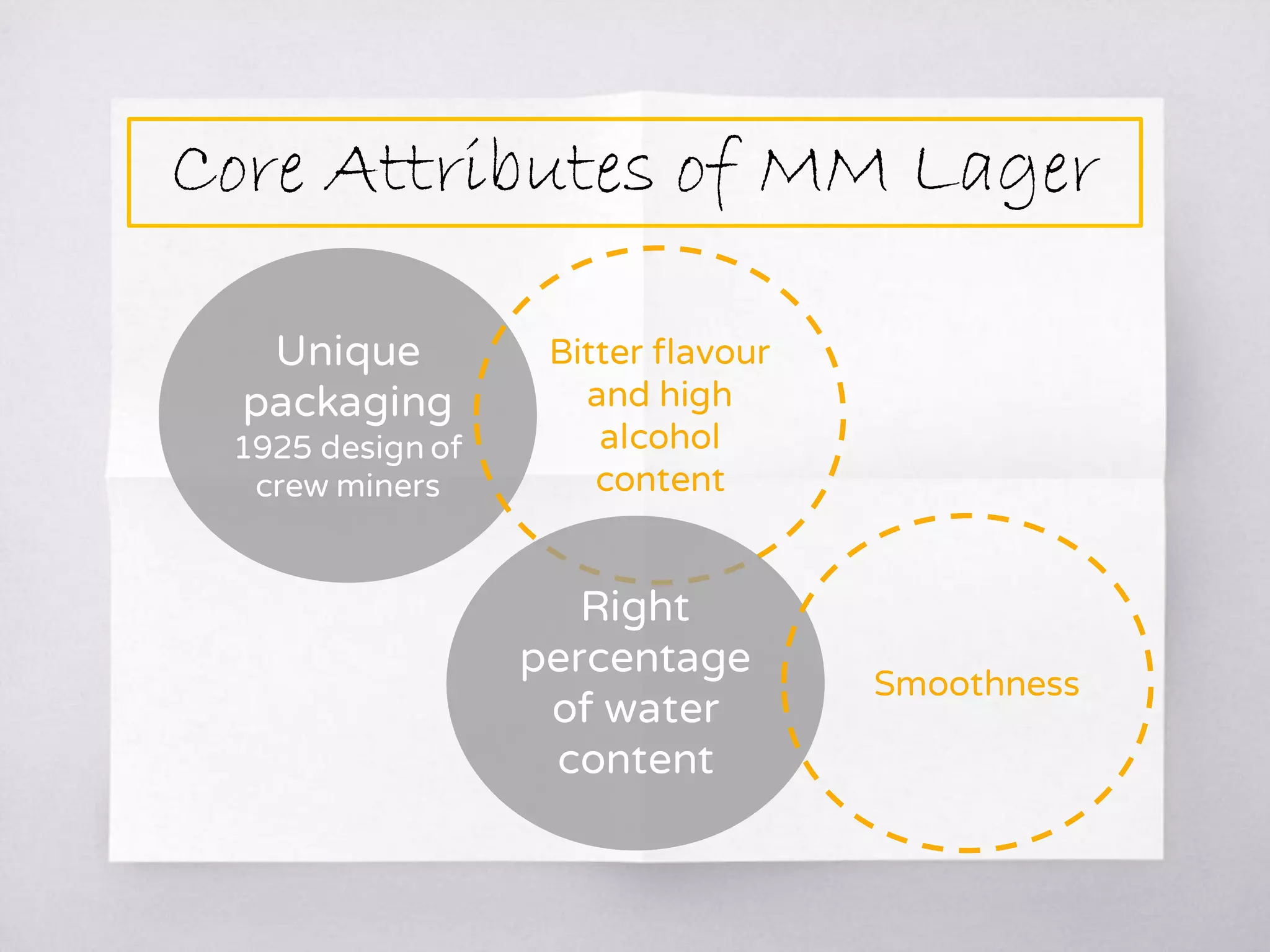

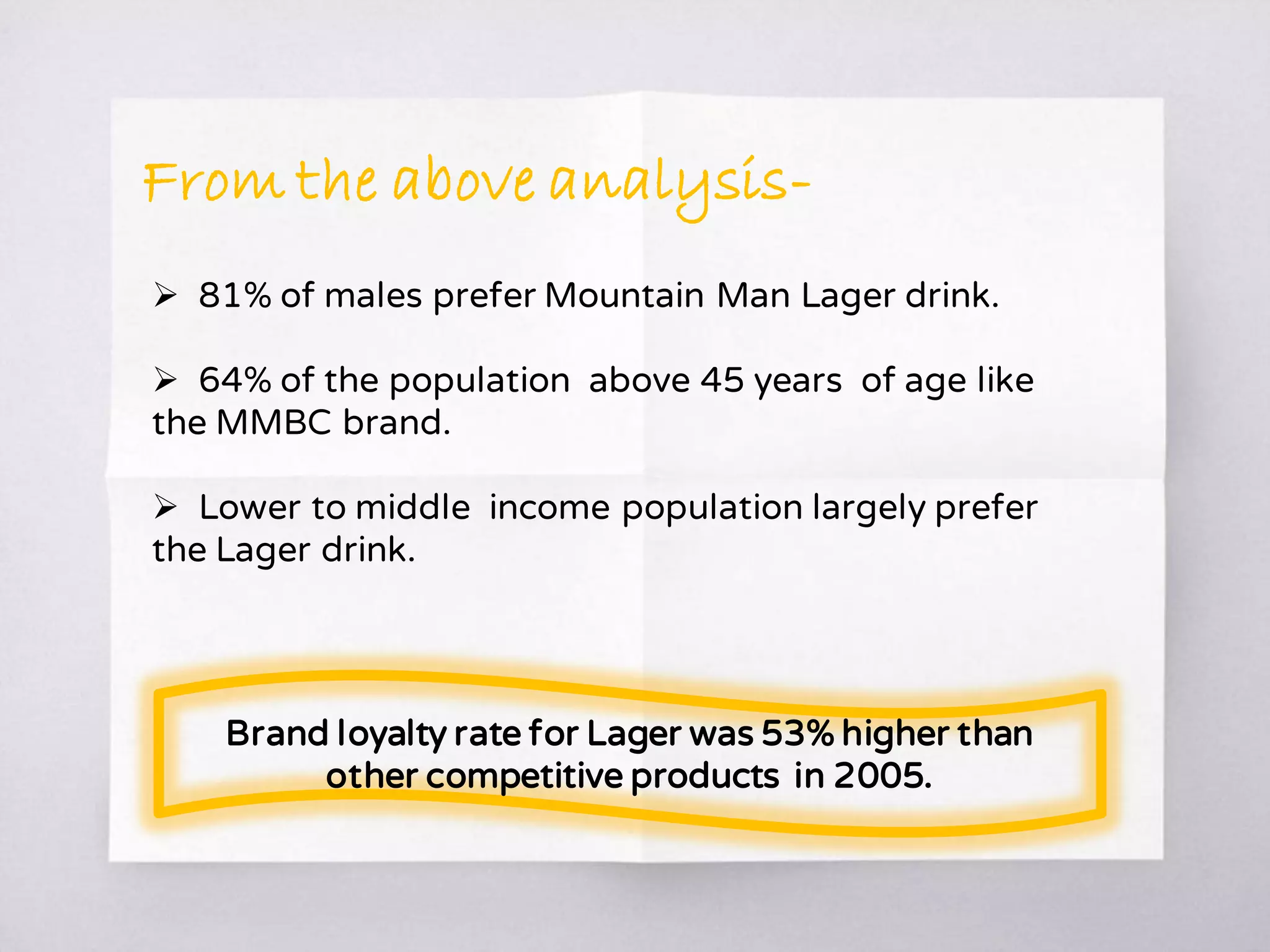

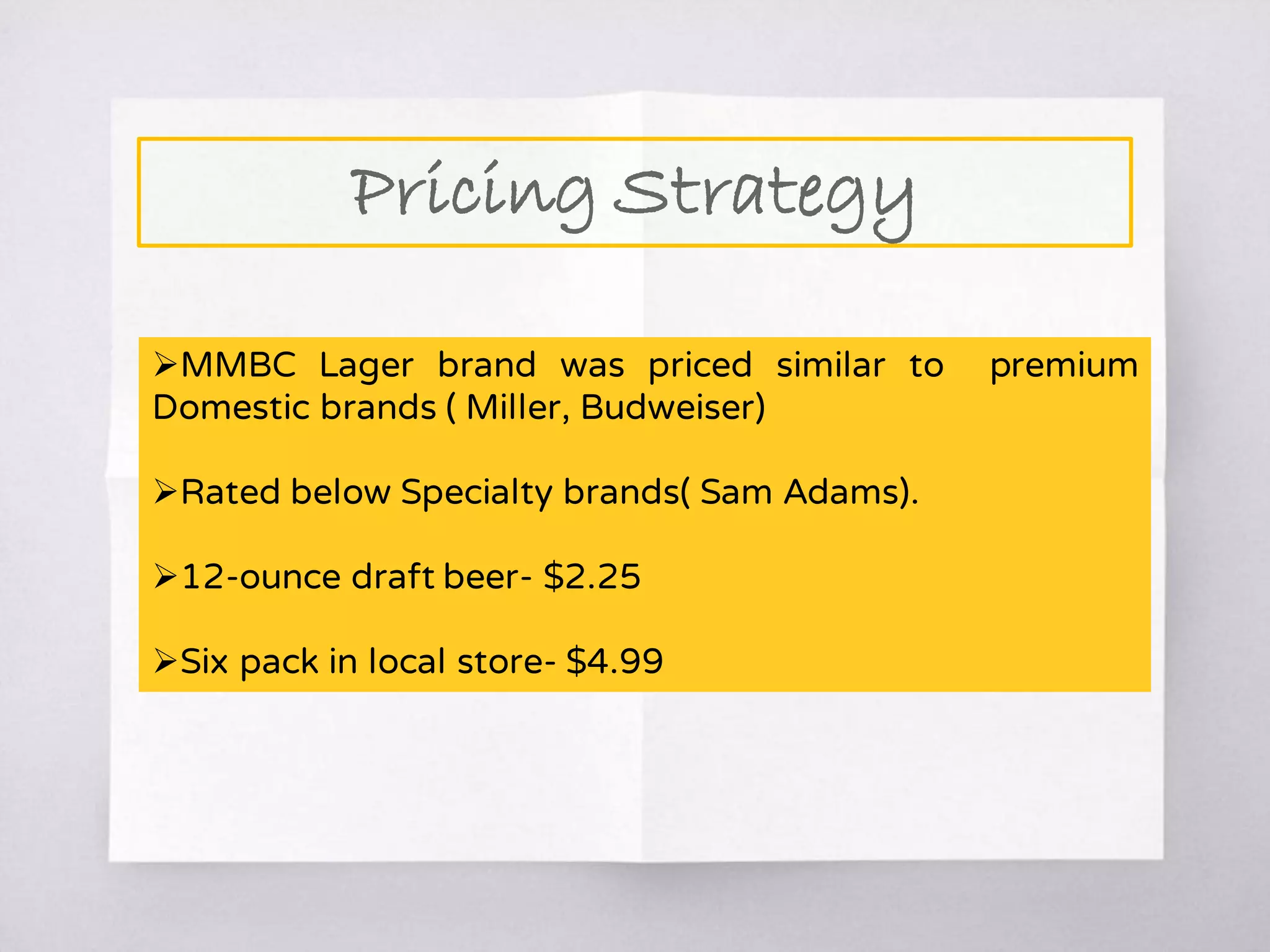

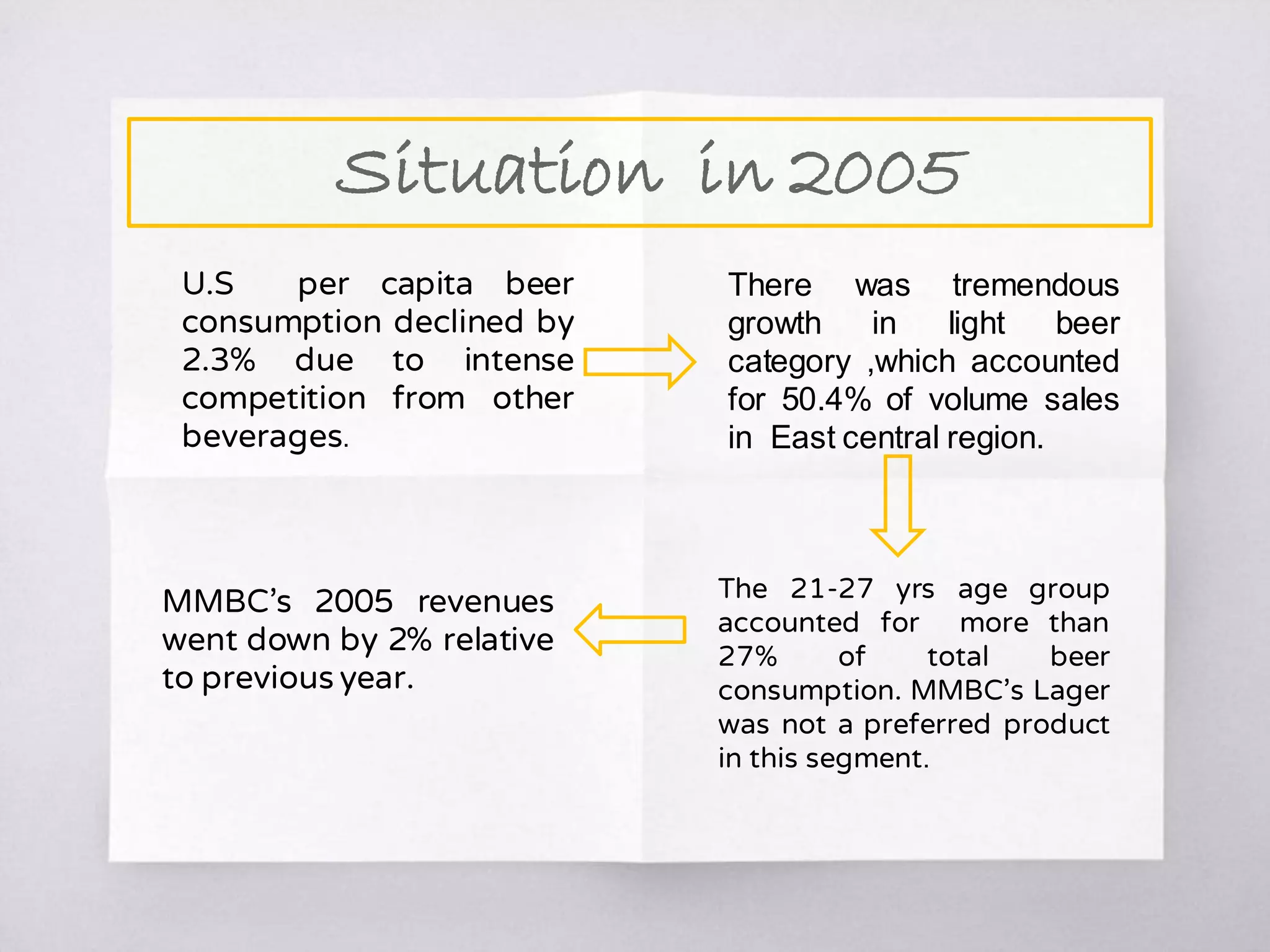

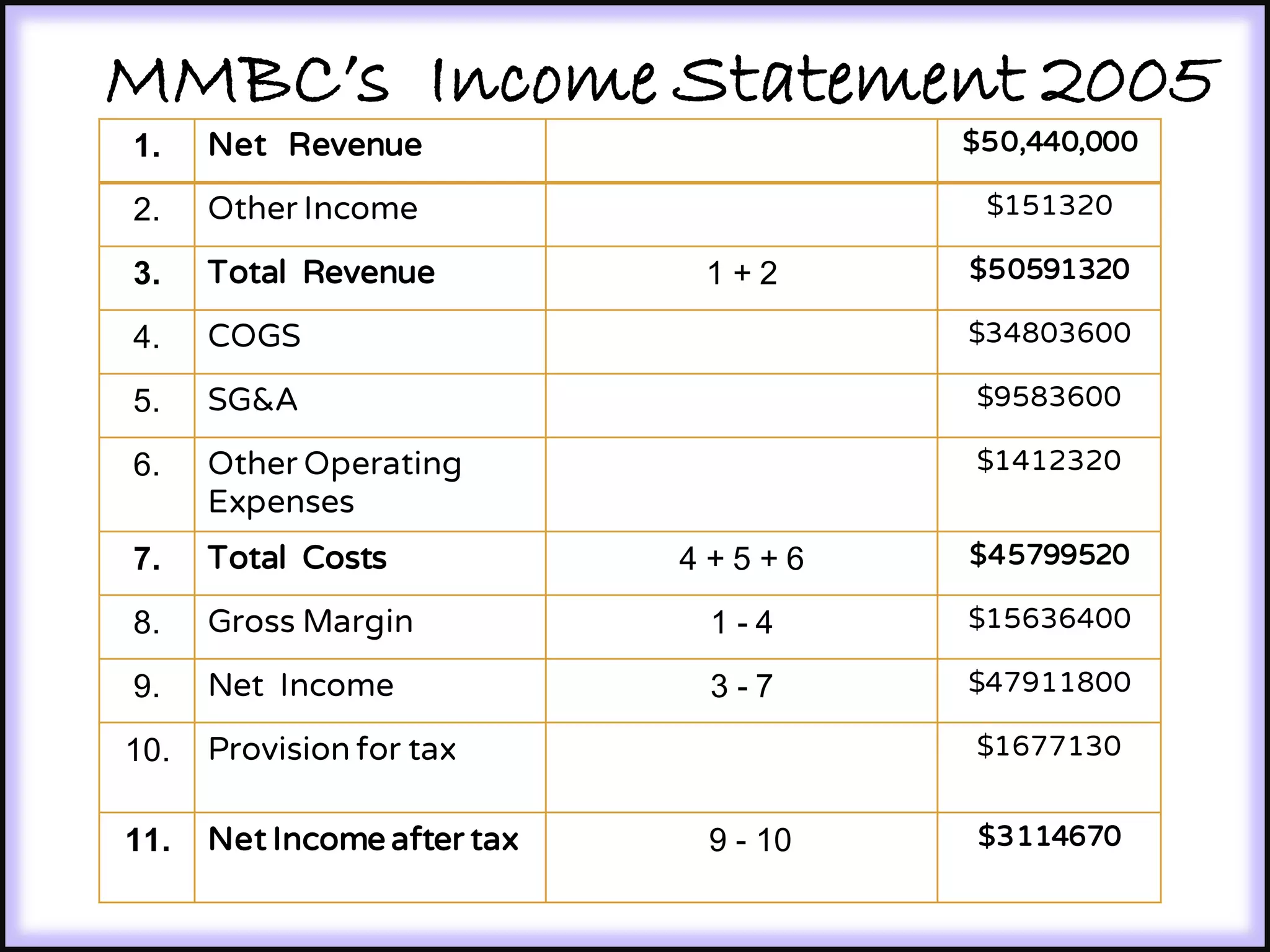

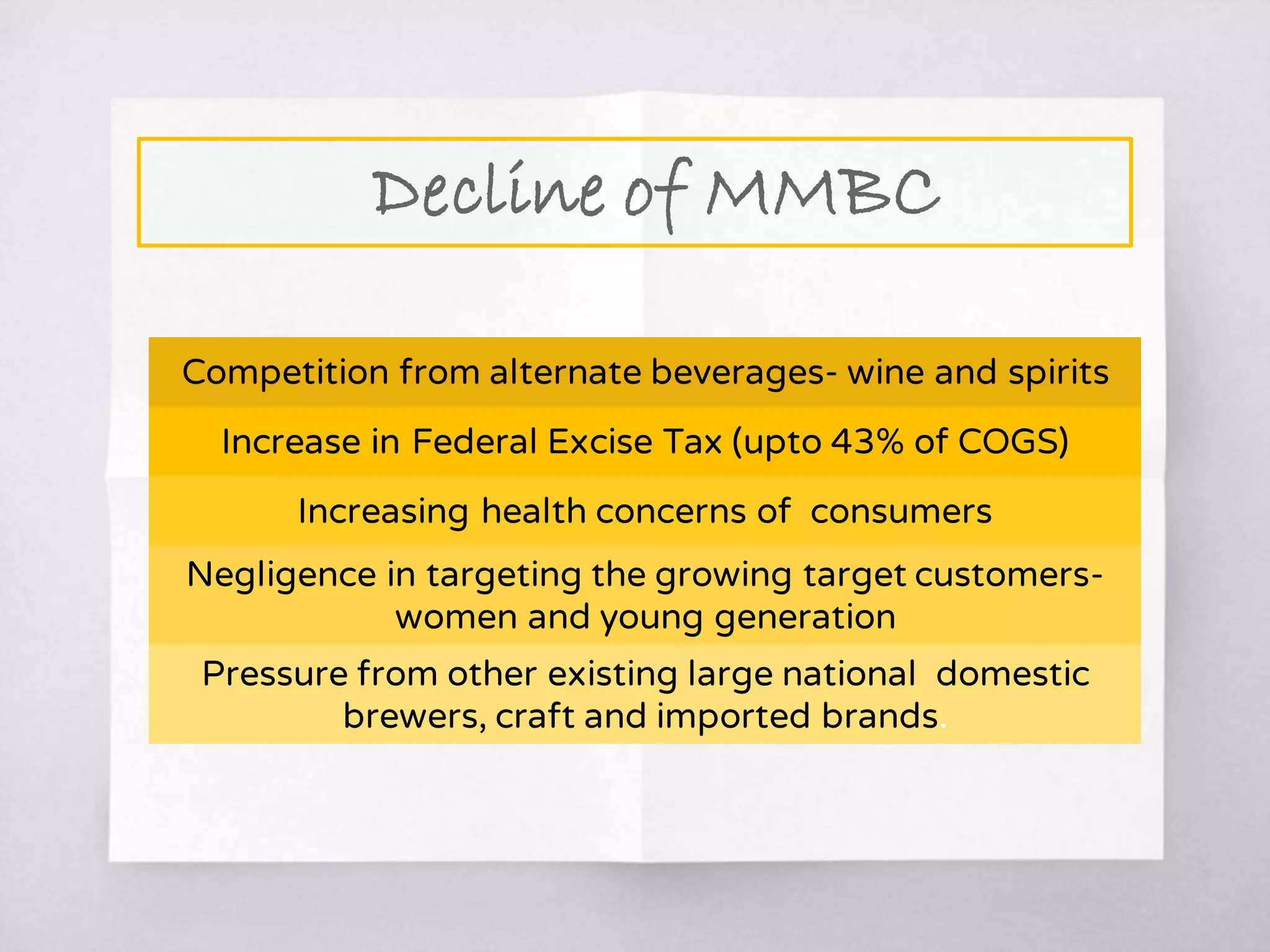

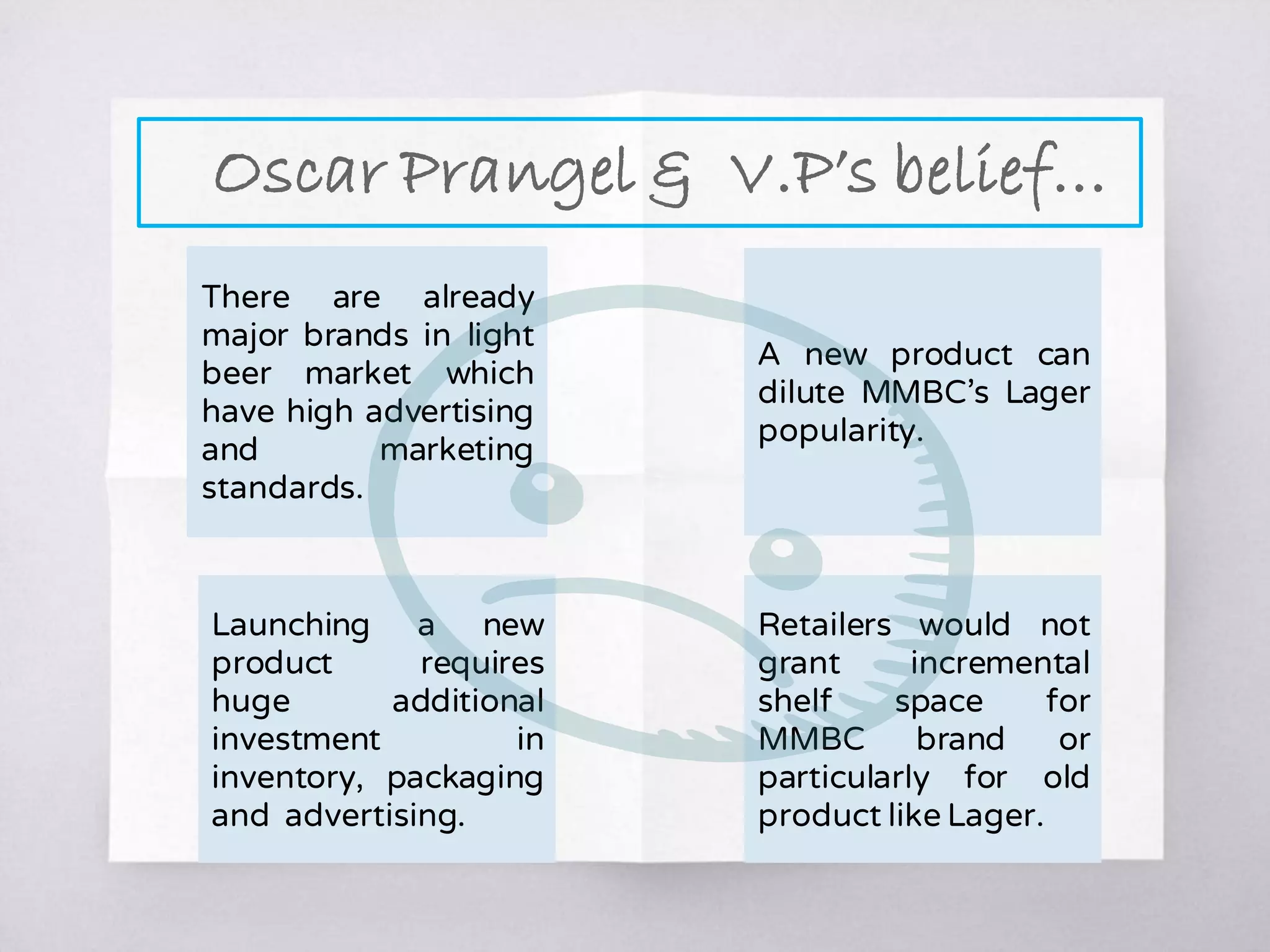

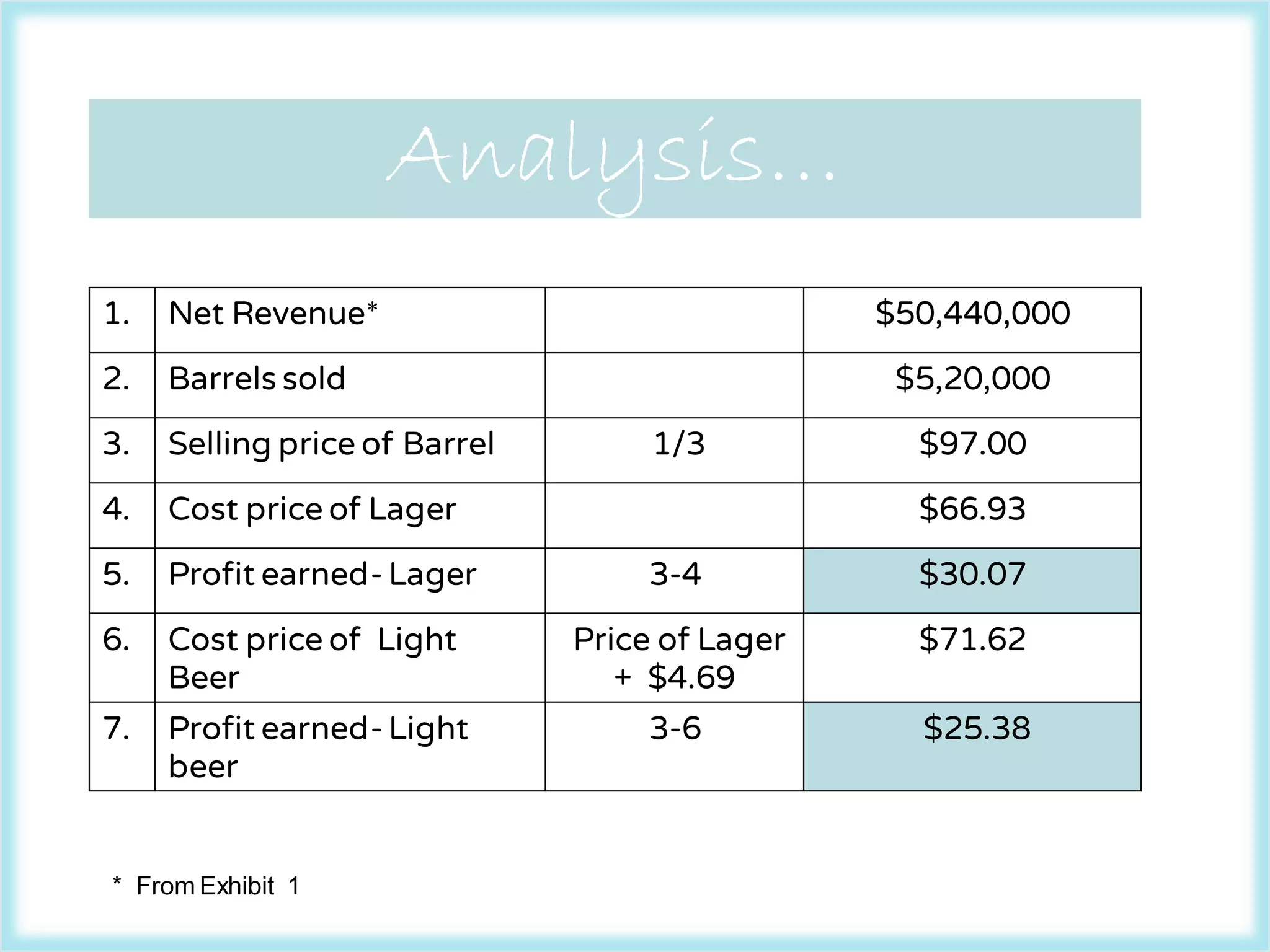

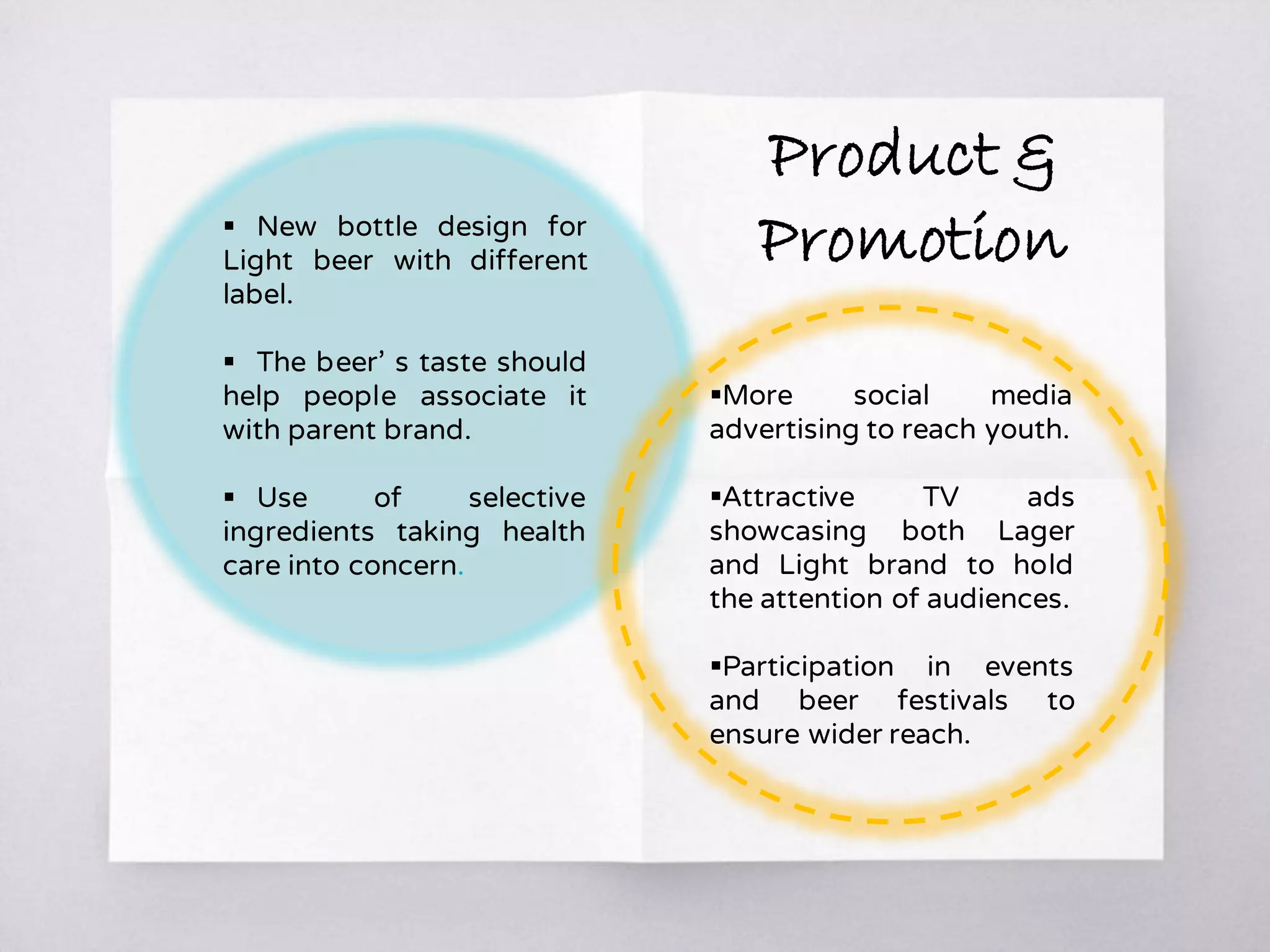

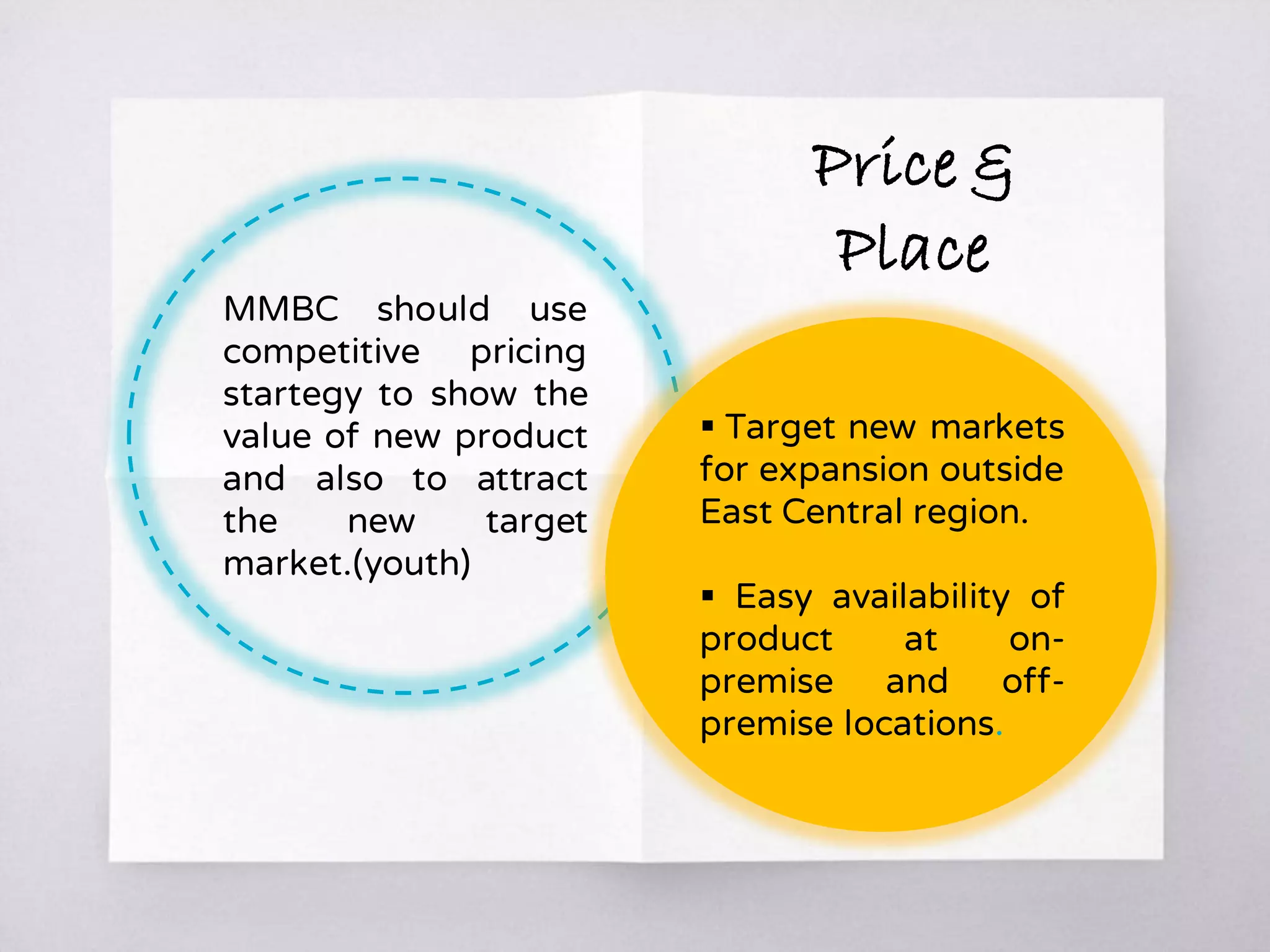

The case study examines Mountain Man Brewing Company (MMBC), founded in 1925, highlighting its flagship product, Mountain Man Lager, and the demographic trends affecting its market. It identifies challenges from increased competition, particularly against light beers, and outlines strategies for launching a new product to appeal to younger consumers while maintaining existing brand loyalty. The recommendation includes a focus on marketing renewal and diversifying the product range to ensure continued growth and relevance in the beer market.