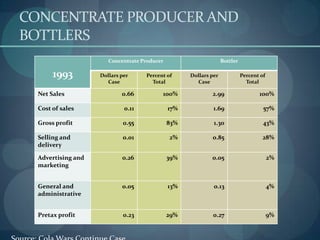

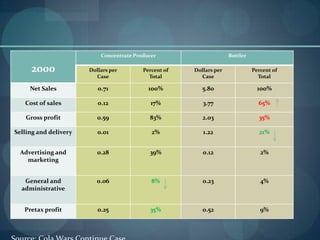

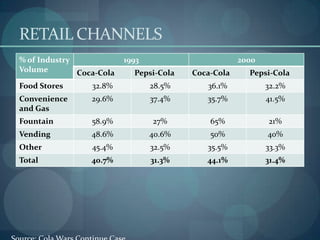

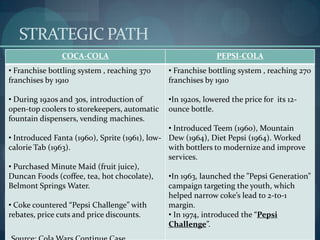

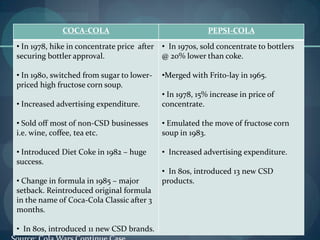

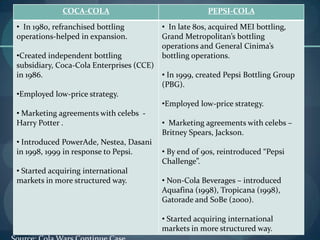

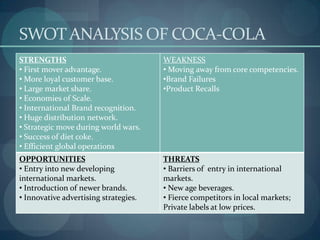

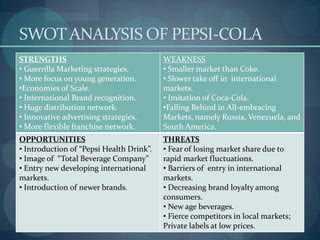

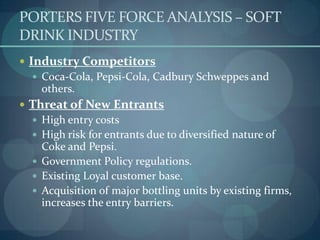

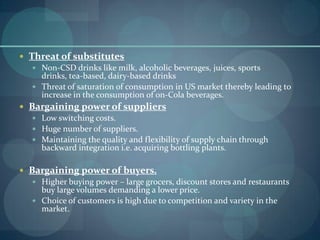

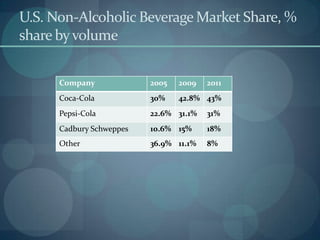

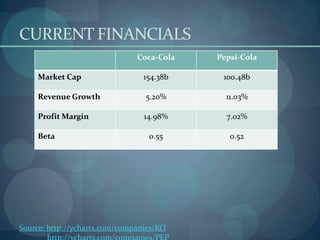

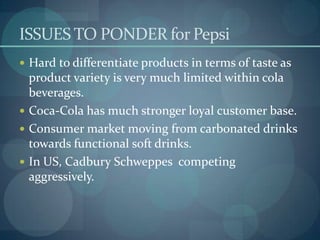

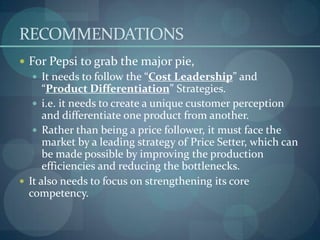

This document discusses the cola wars between Coca-Cola and Pepsi in the late 20th century. It provides financial data showing Coca-Cola had higher market share and profits than Pepsi in 1993 and 2000. Both companies used franchise bottling systems and pursued strategies like advertising, new products, and acquisitions to gain market share. By 2000, Coca-Cola's market share was 44.1% compared to Pepsi's 31.4%. The document performs SWOT and Porter's Five Forces analyses of both companies and the soft drink industry. It recommends strategies for Pepsi to better compete, such as differentiation, cost leadership, and strengthening its core competencies.