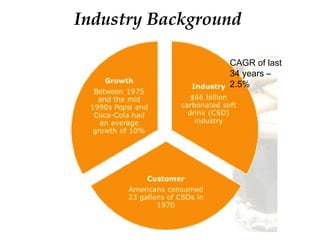

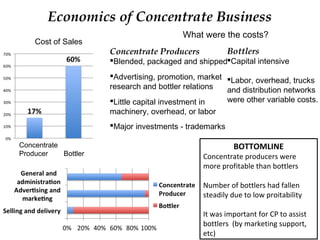

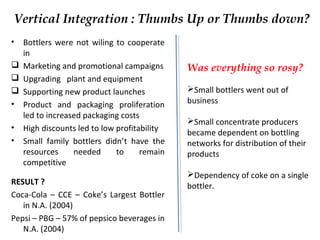

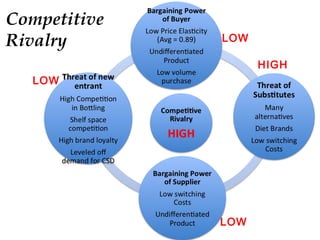

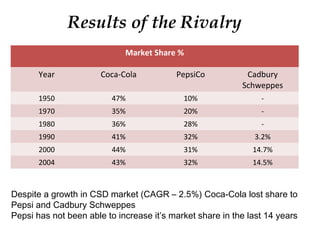

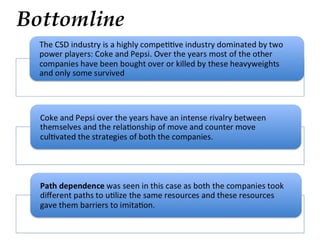

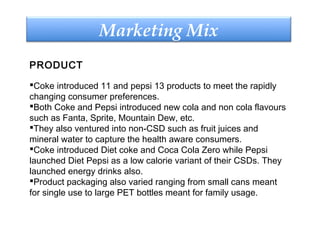

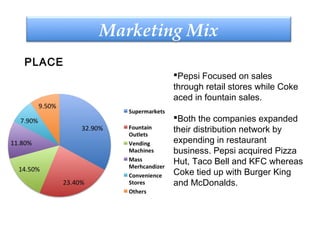

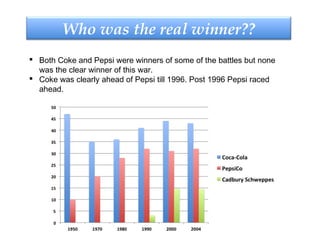

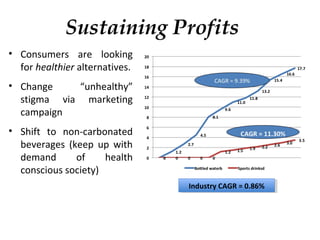

The document discusses the competitive dynamics of the cola industry in 2006, highlighting the profitability differences between concentrate producers and bottlers, and the challenges faced by smaller bottlers. It outlines the marketing strategies employed by Coca-Cola and Pepsi, including product diversification and pricing tactics in response to changing consumer preferences. The report concludes that while both companies have seen various successes, neither has emerged as a clear long-term winner due to shifting consumer attitudes towards health and carbonated soft drinks.