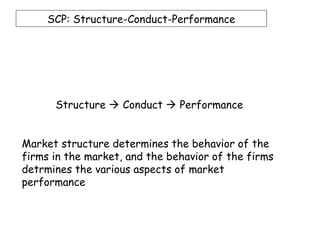

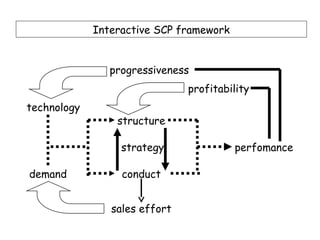

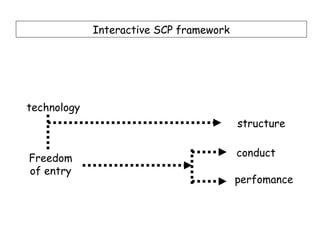

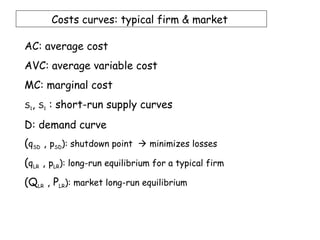

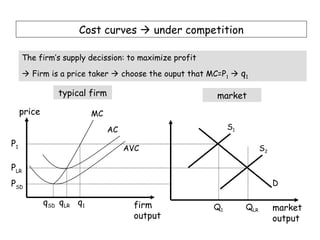

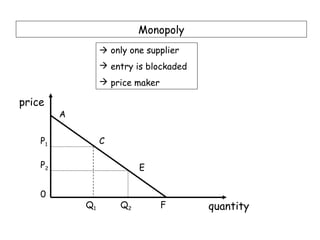

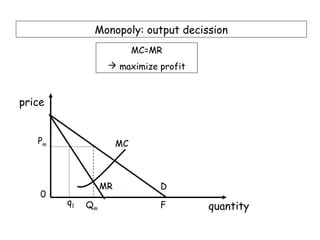

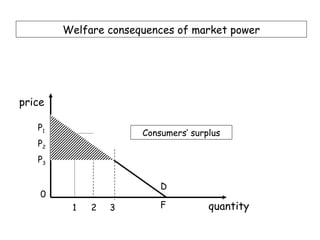

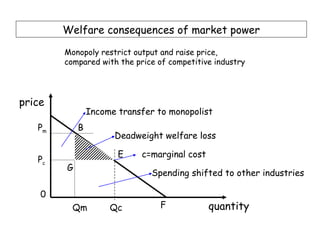

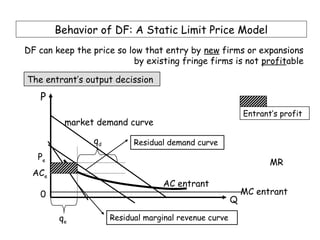

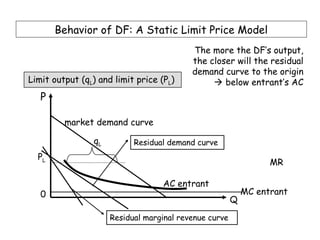

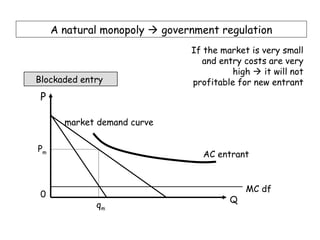

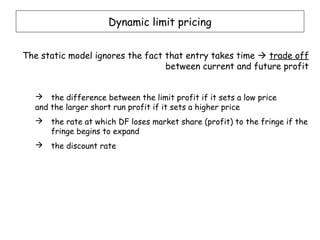

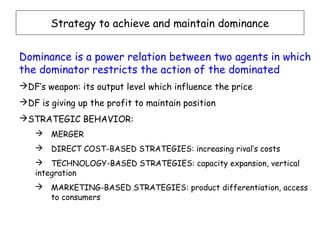

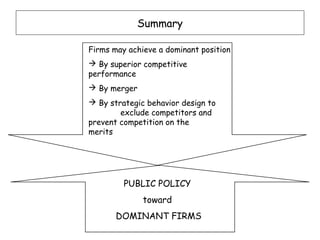

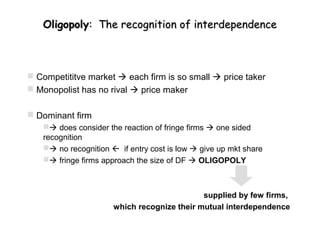

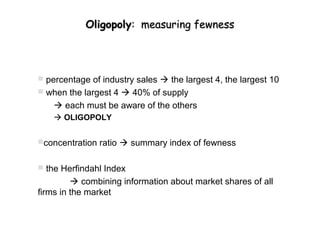

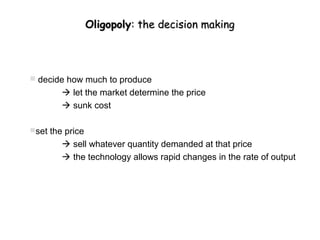

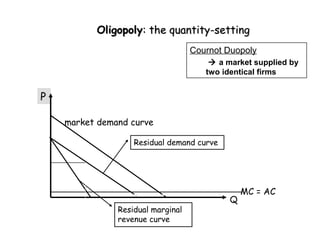

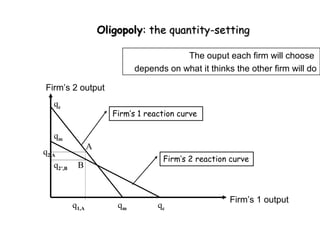

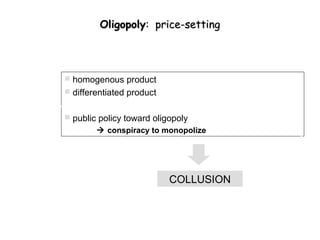

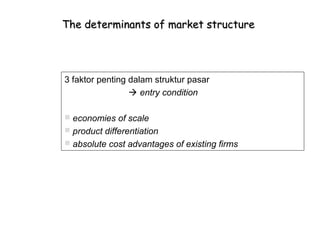

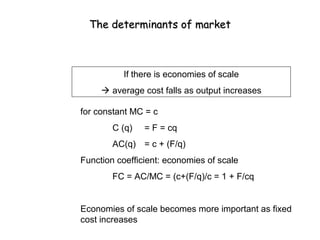

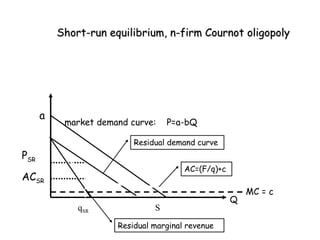

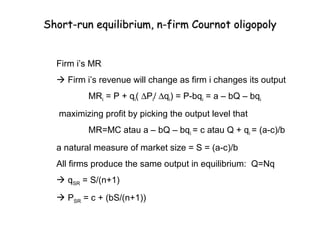

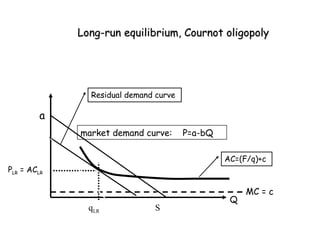

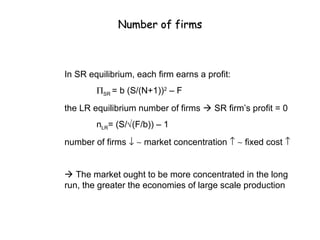

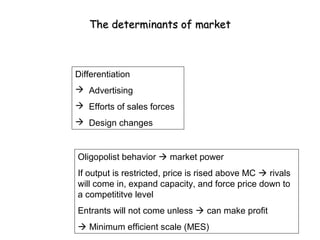

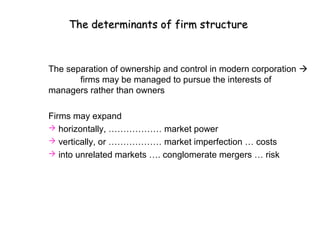

The document discusses industrial economics and focuses on the behavior of firms in imperfectly competitive markets. It covers various market structures like monopoly, oligopoly, and monopolistic competition. The main topics covered include the relationship between market structure, conduct, and performance; the welfare effects of market power; strategies used by dominant firms; and the determinants of market structure.