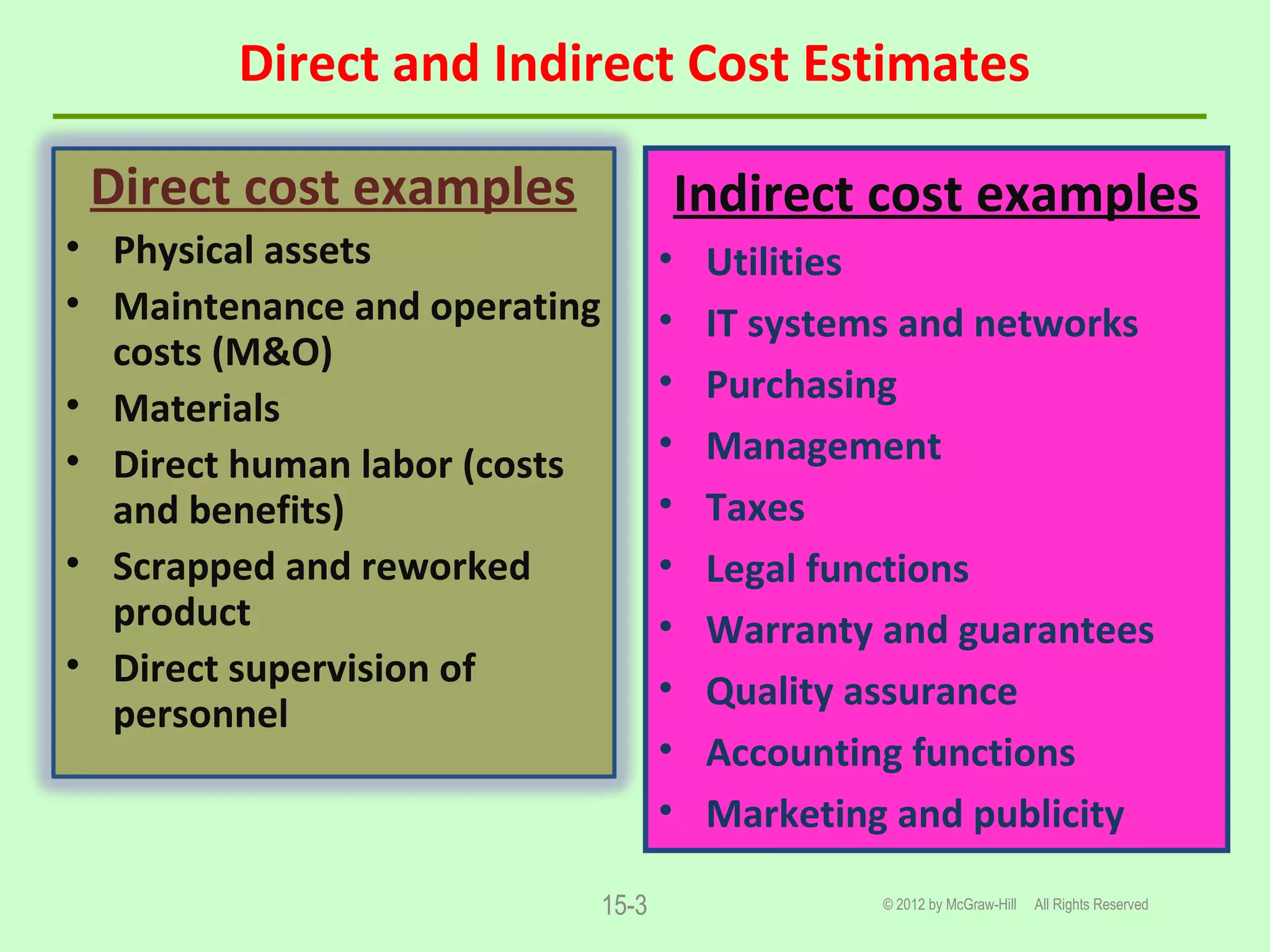

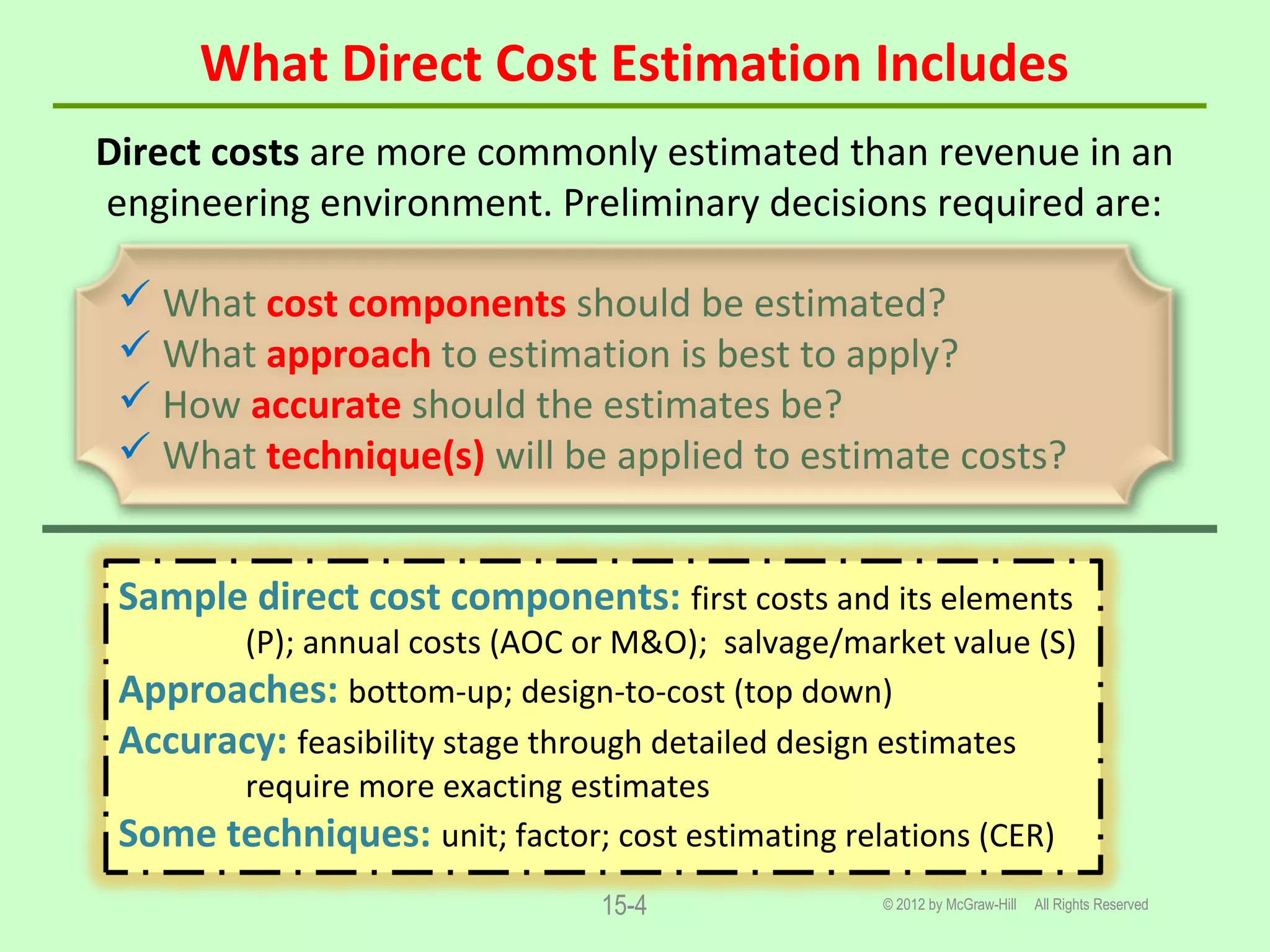

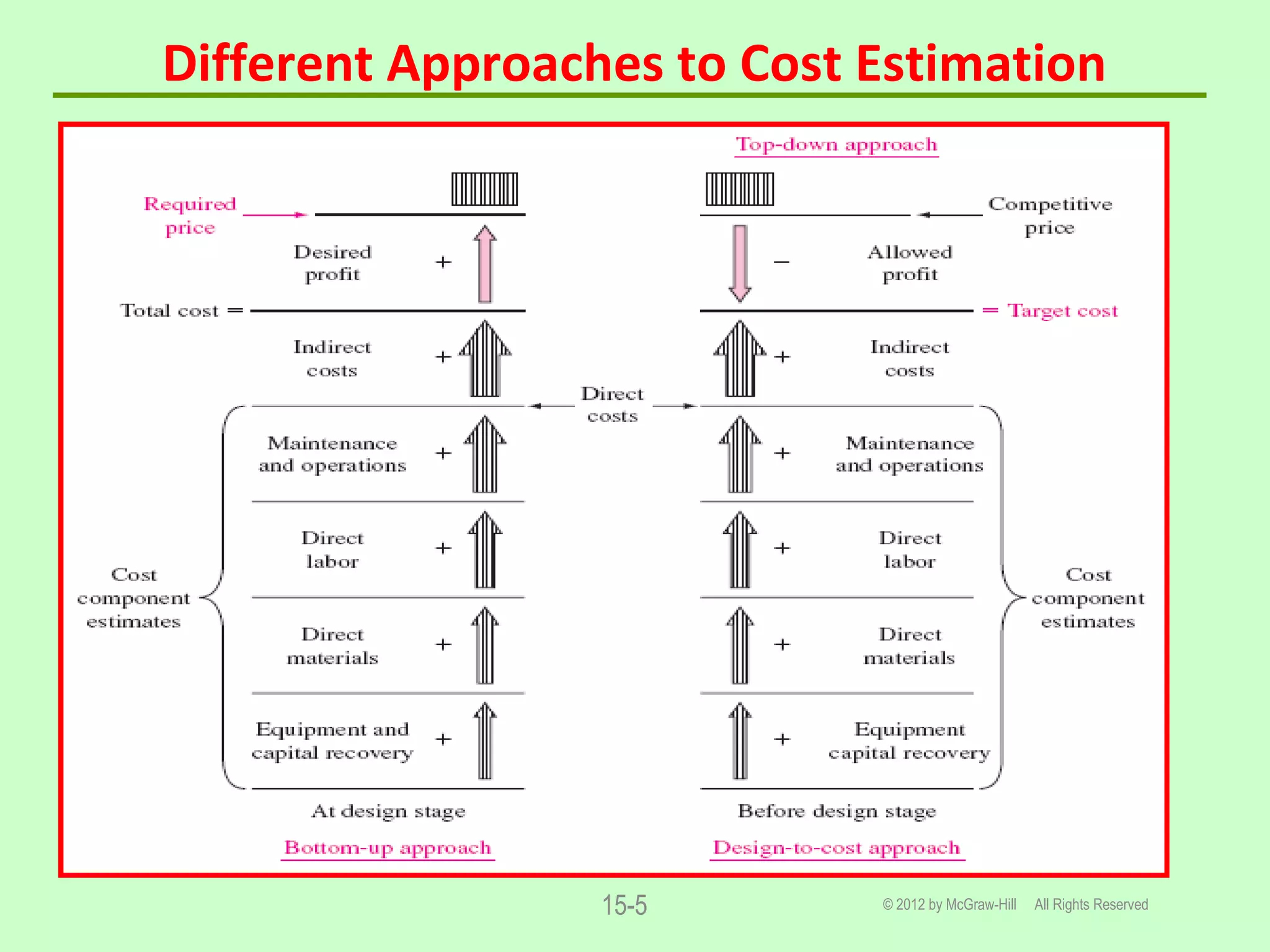

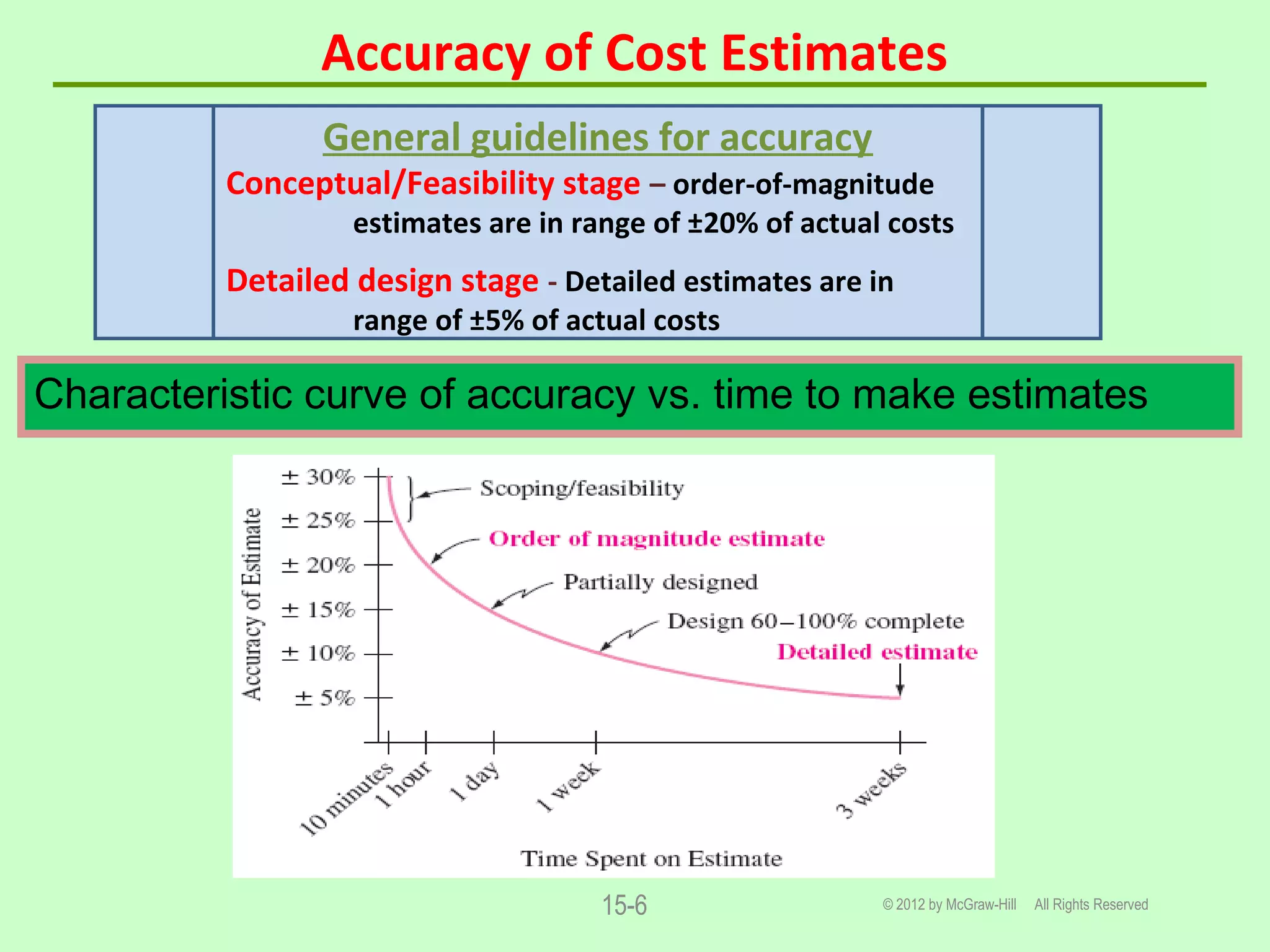

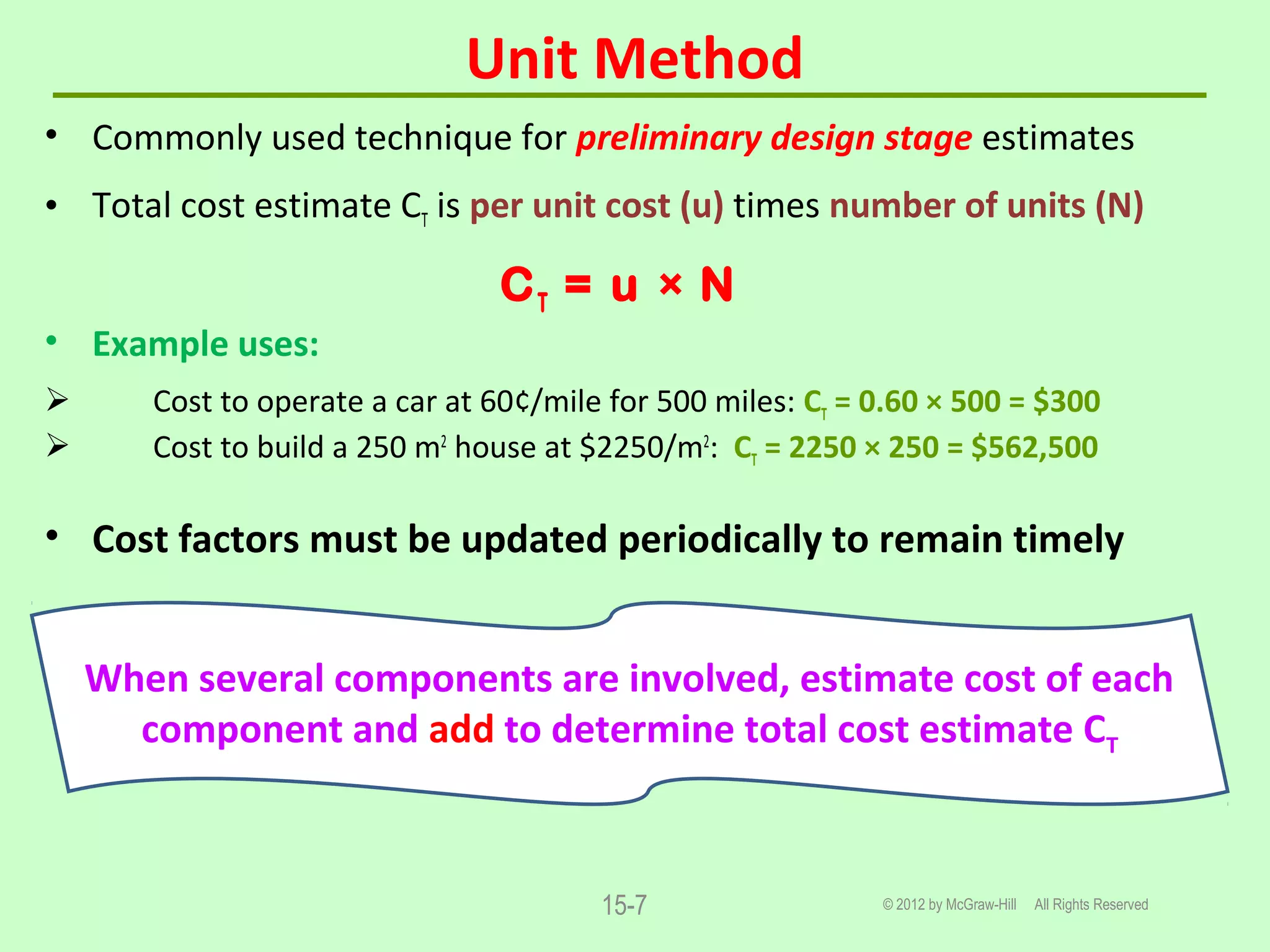

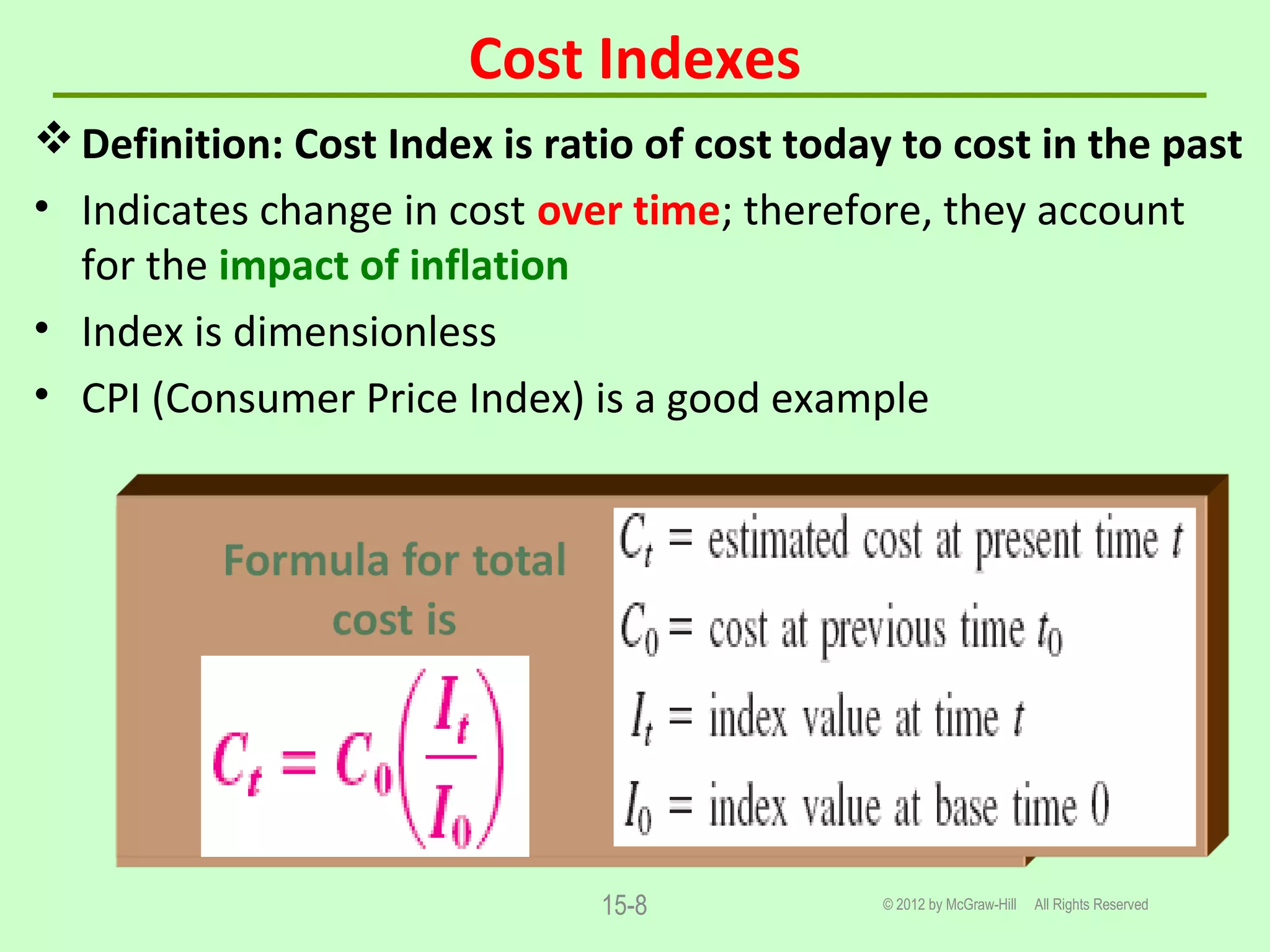

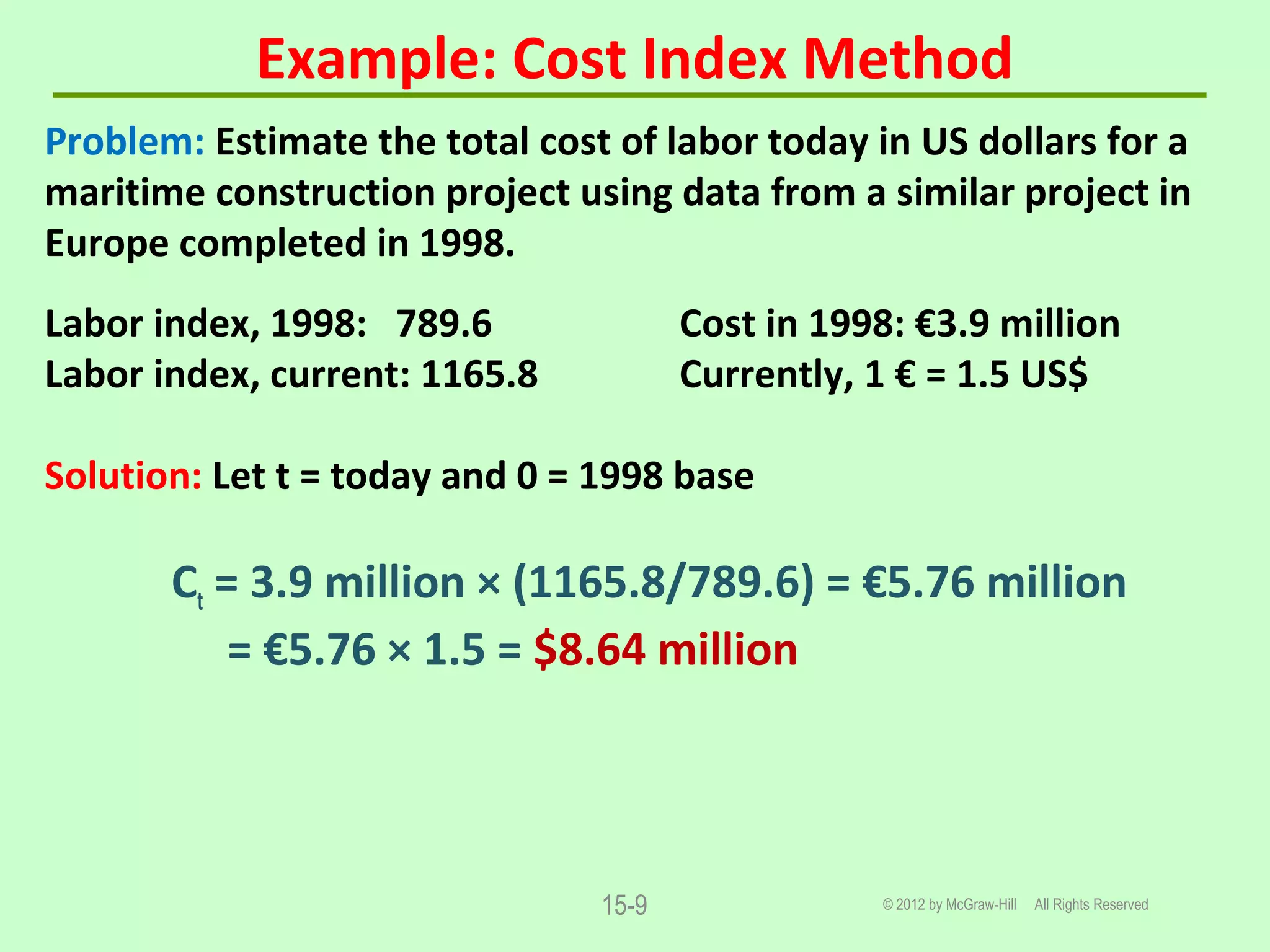

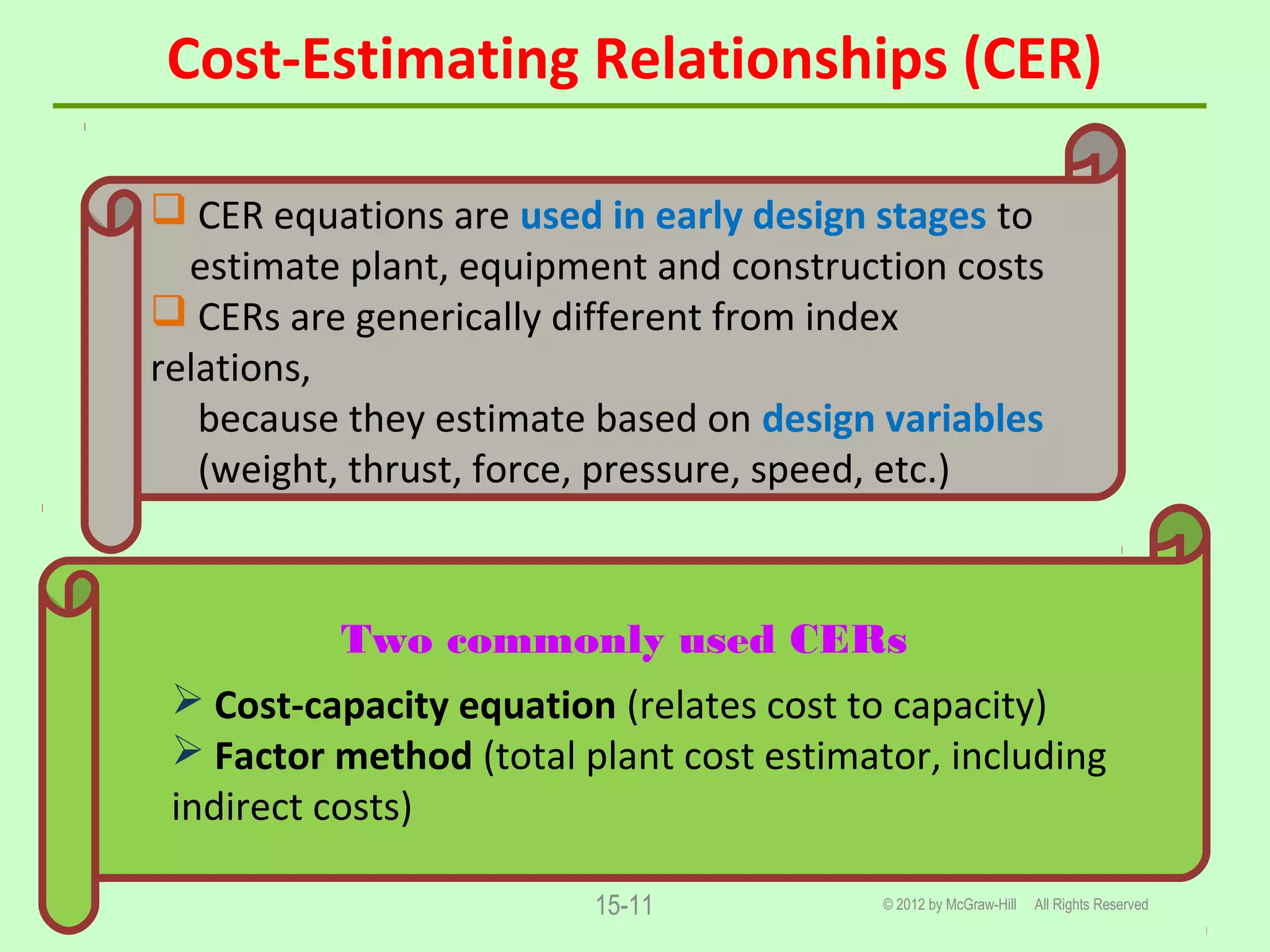

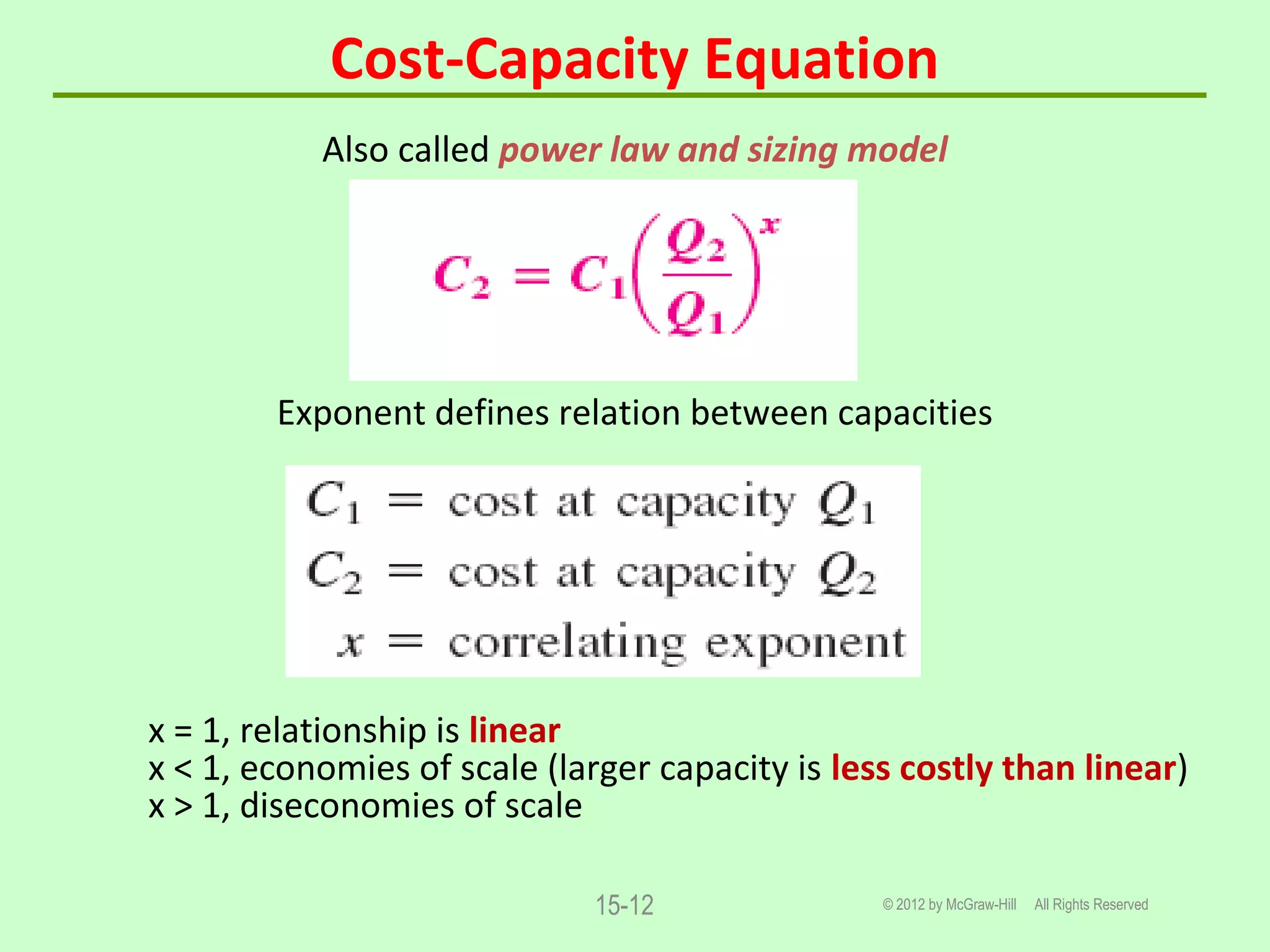

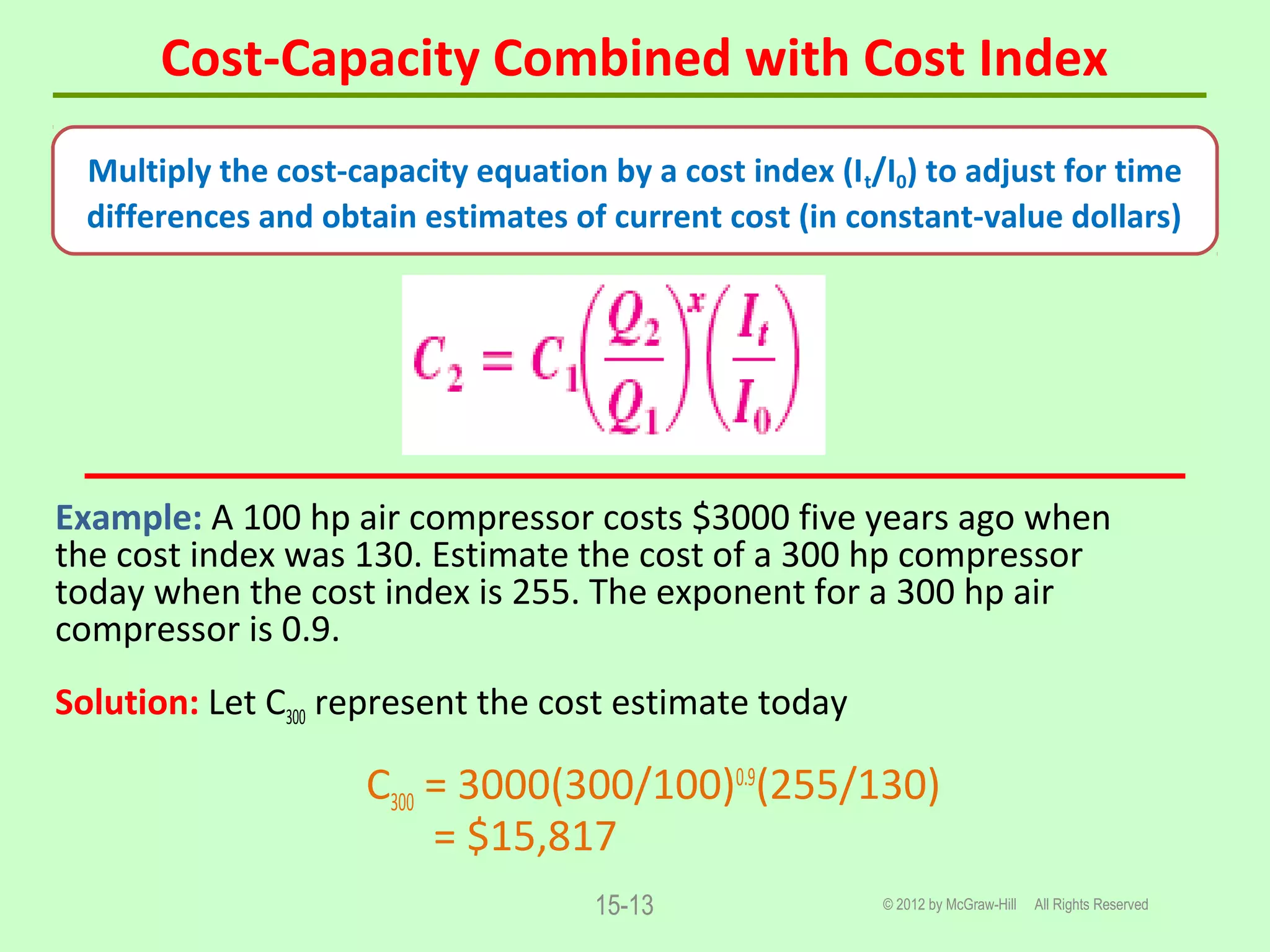

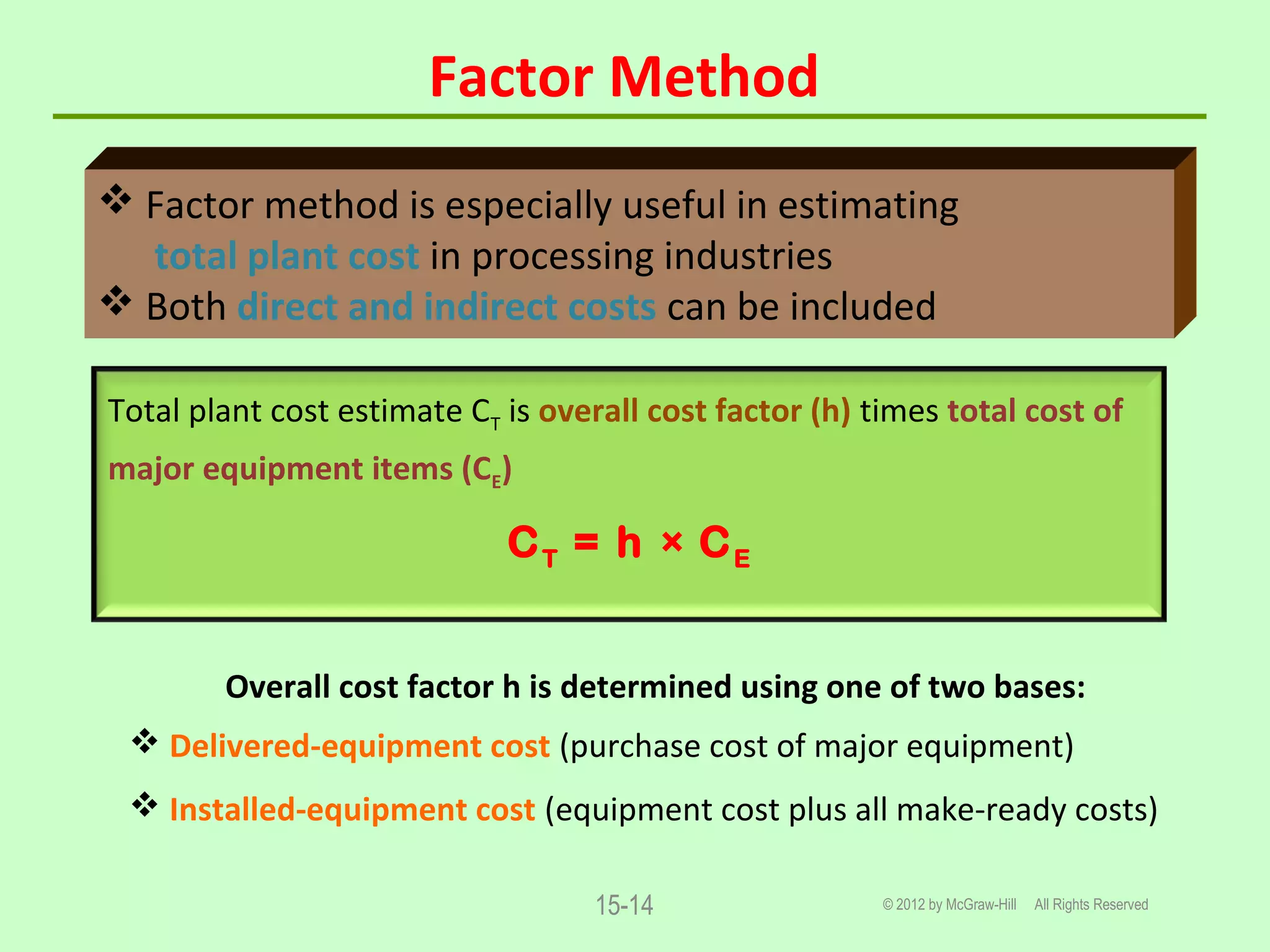

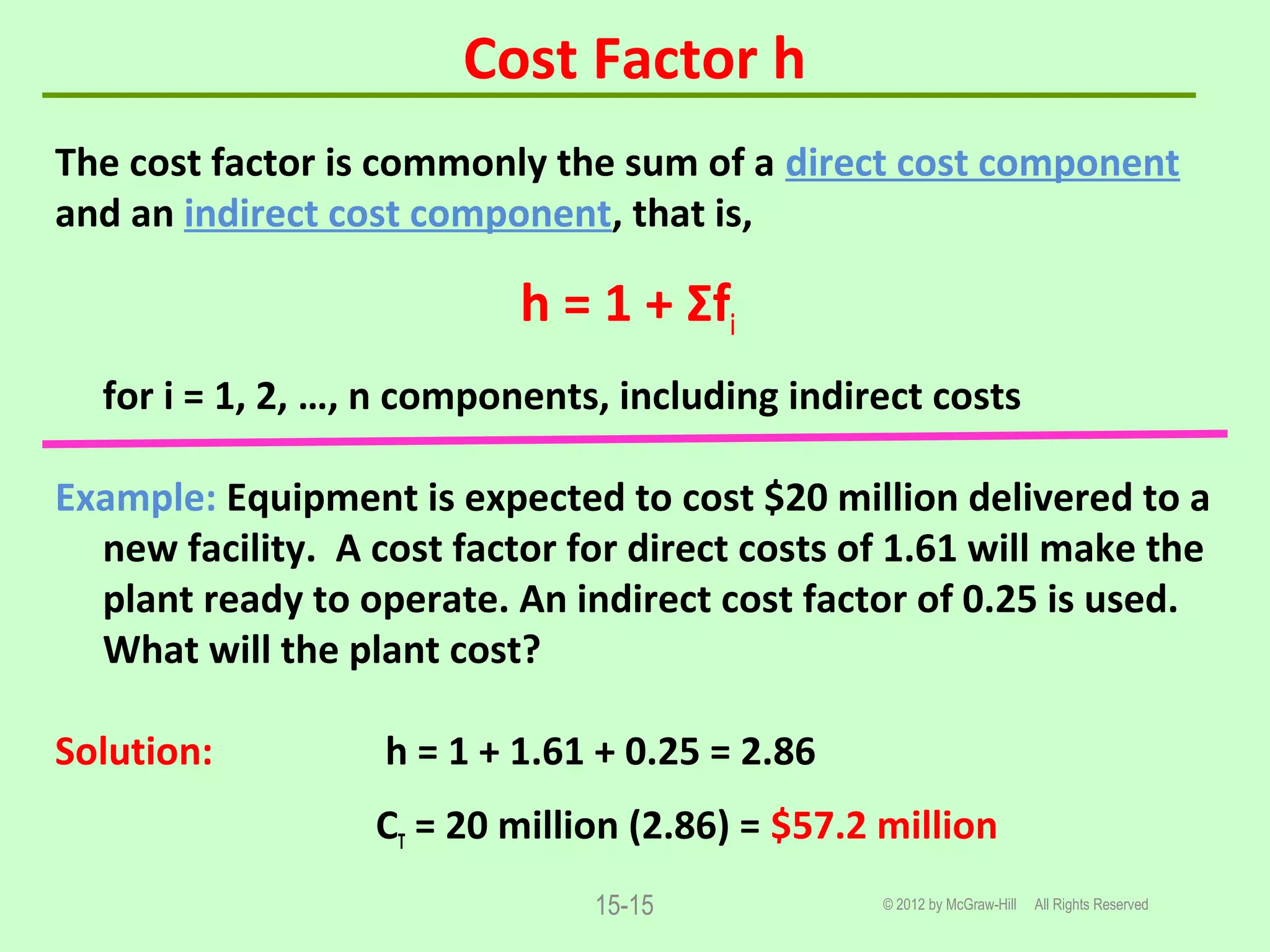

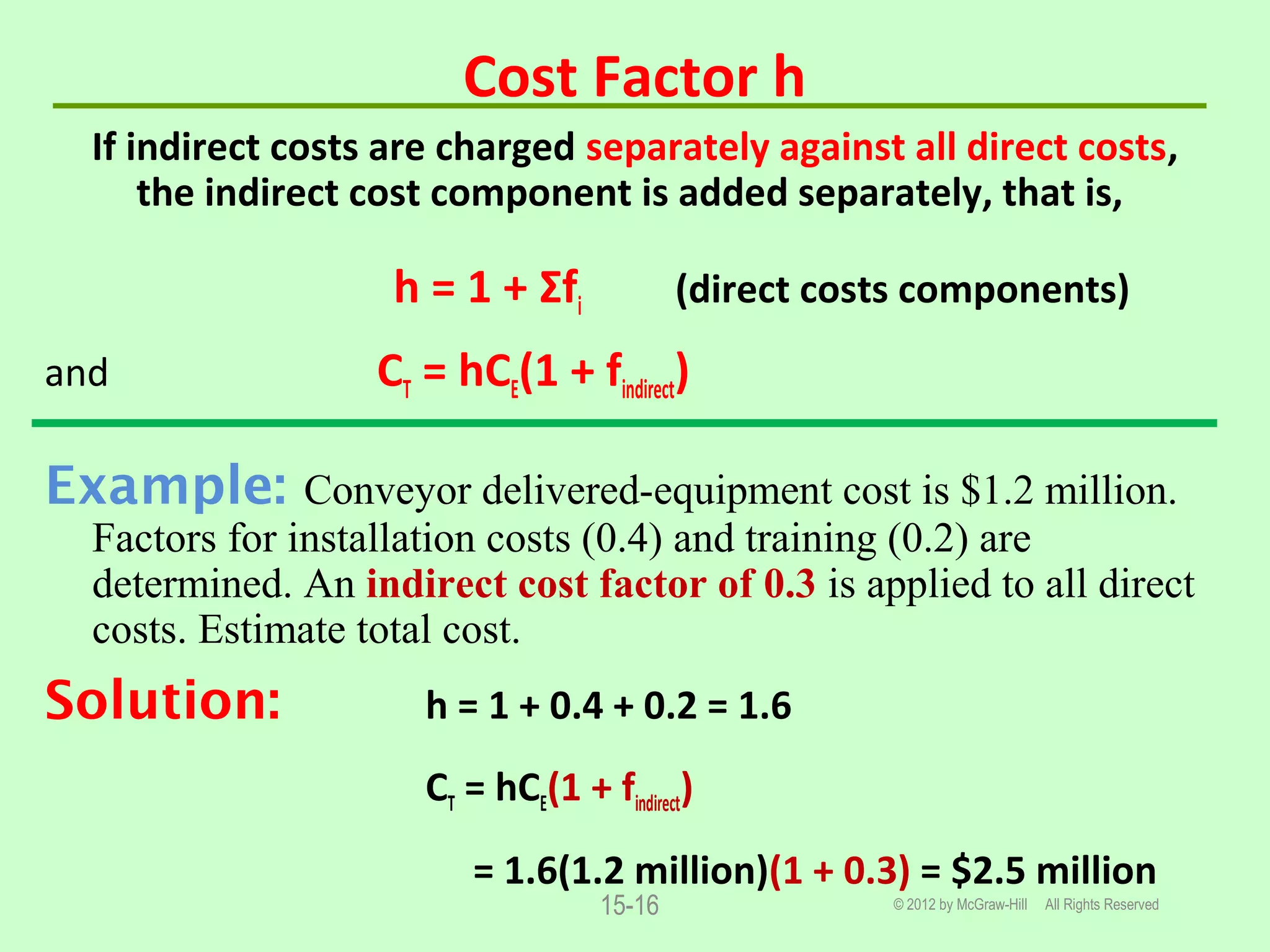

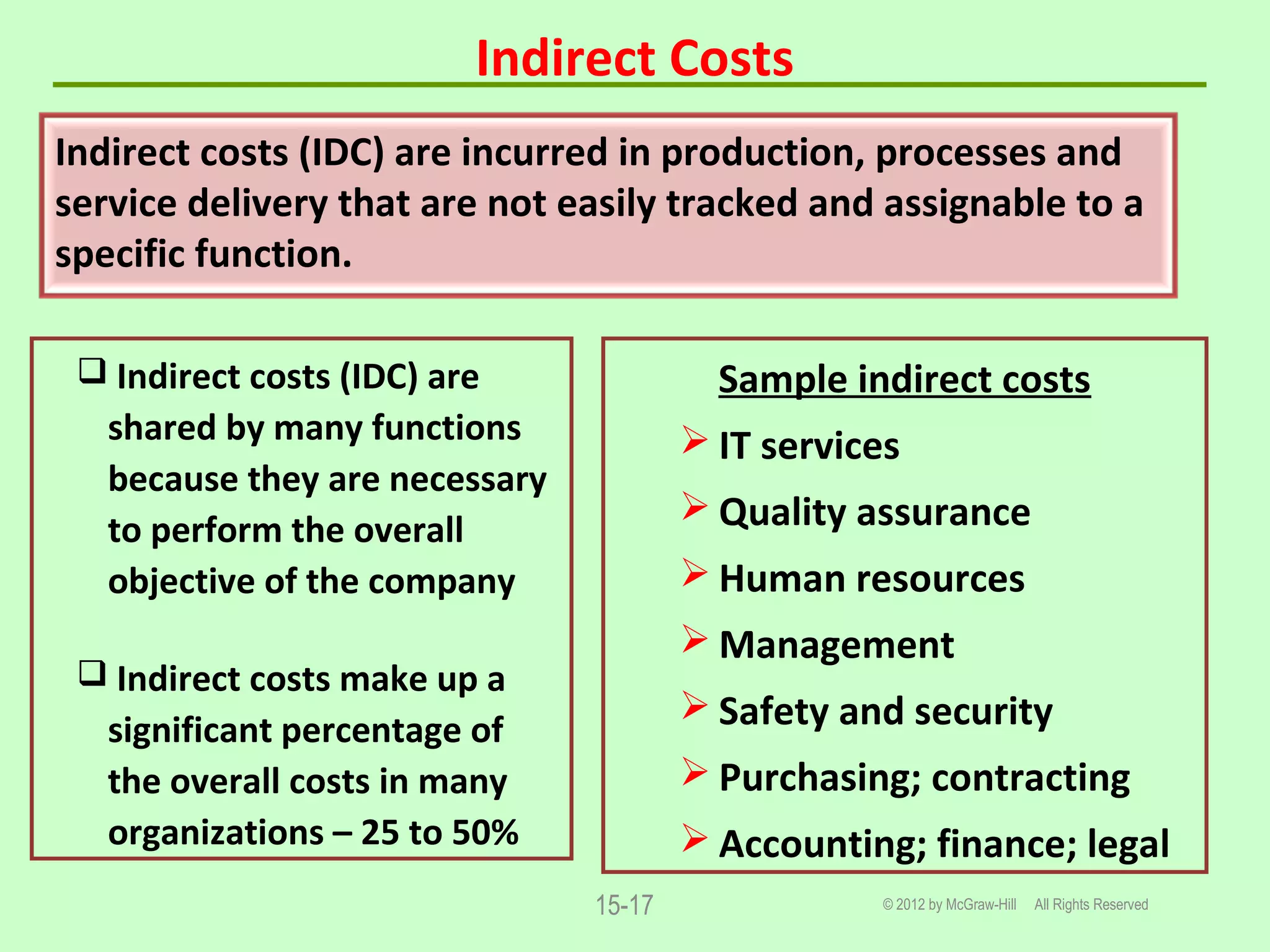

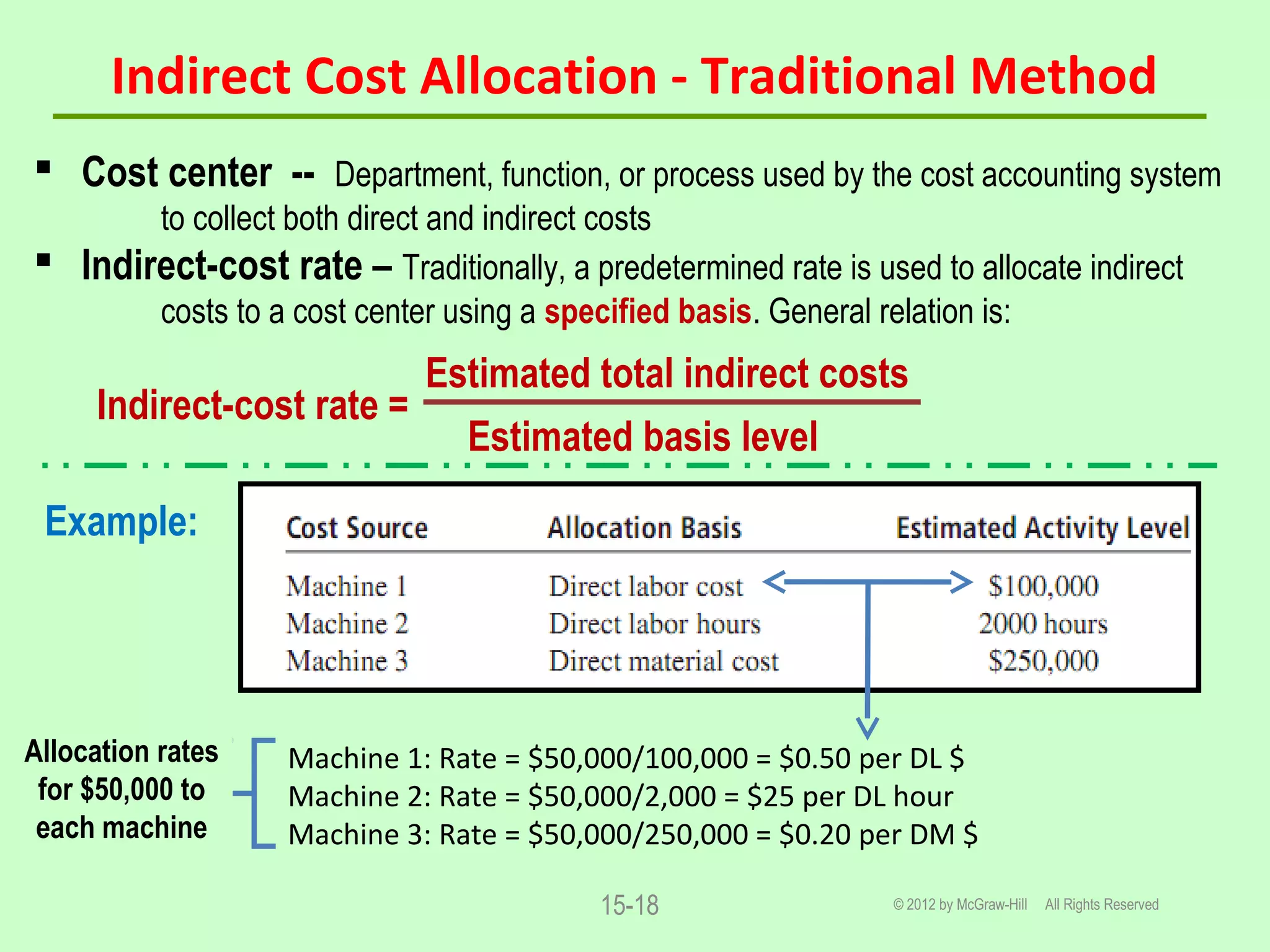

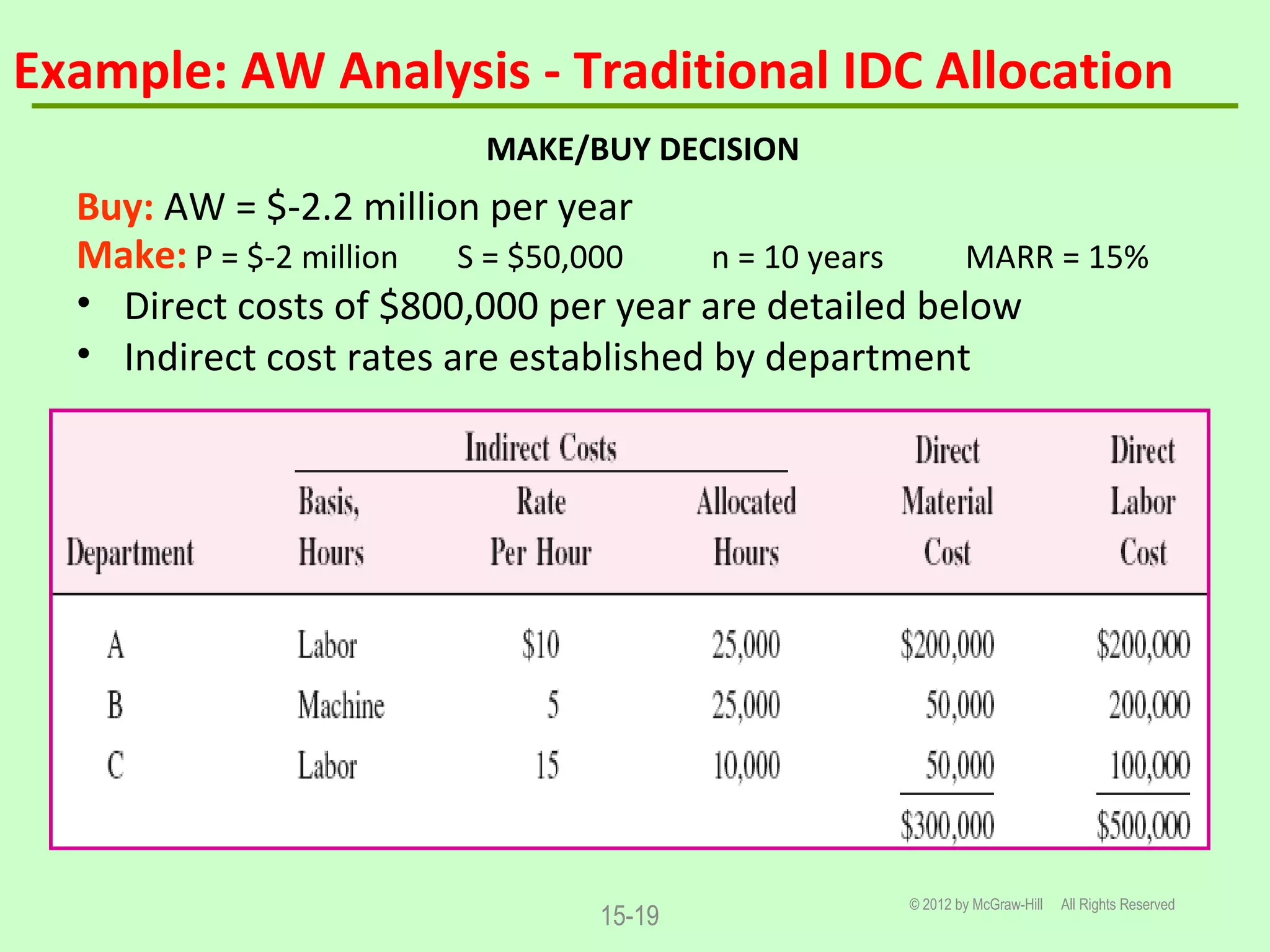

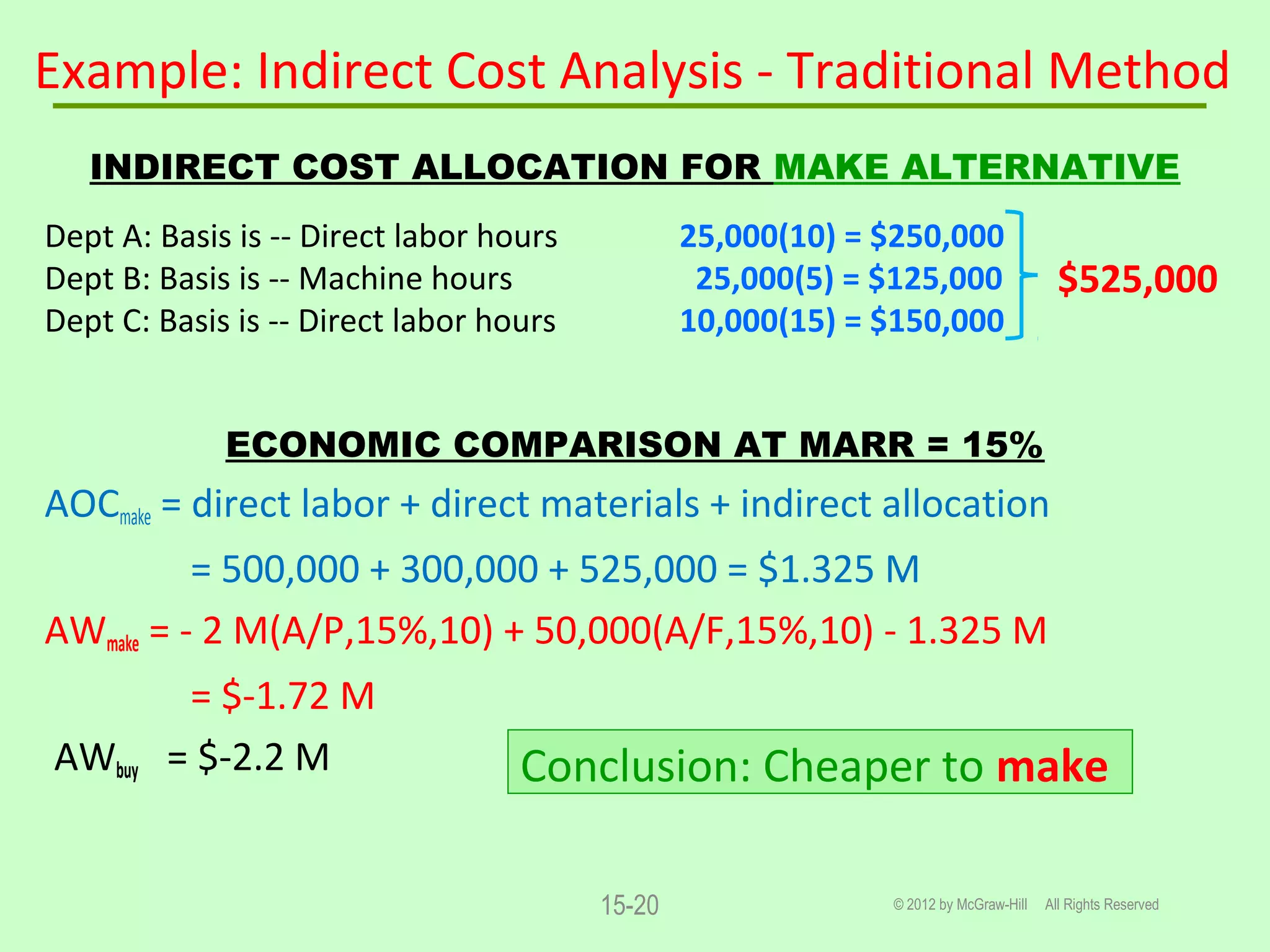

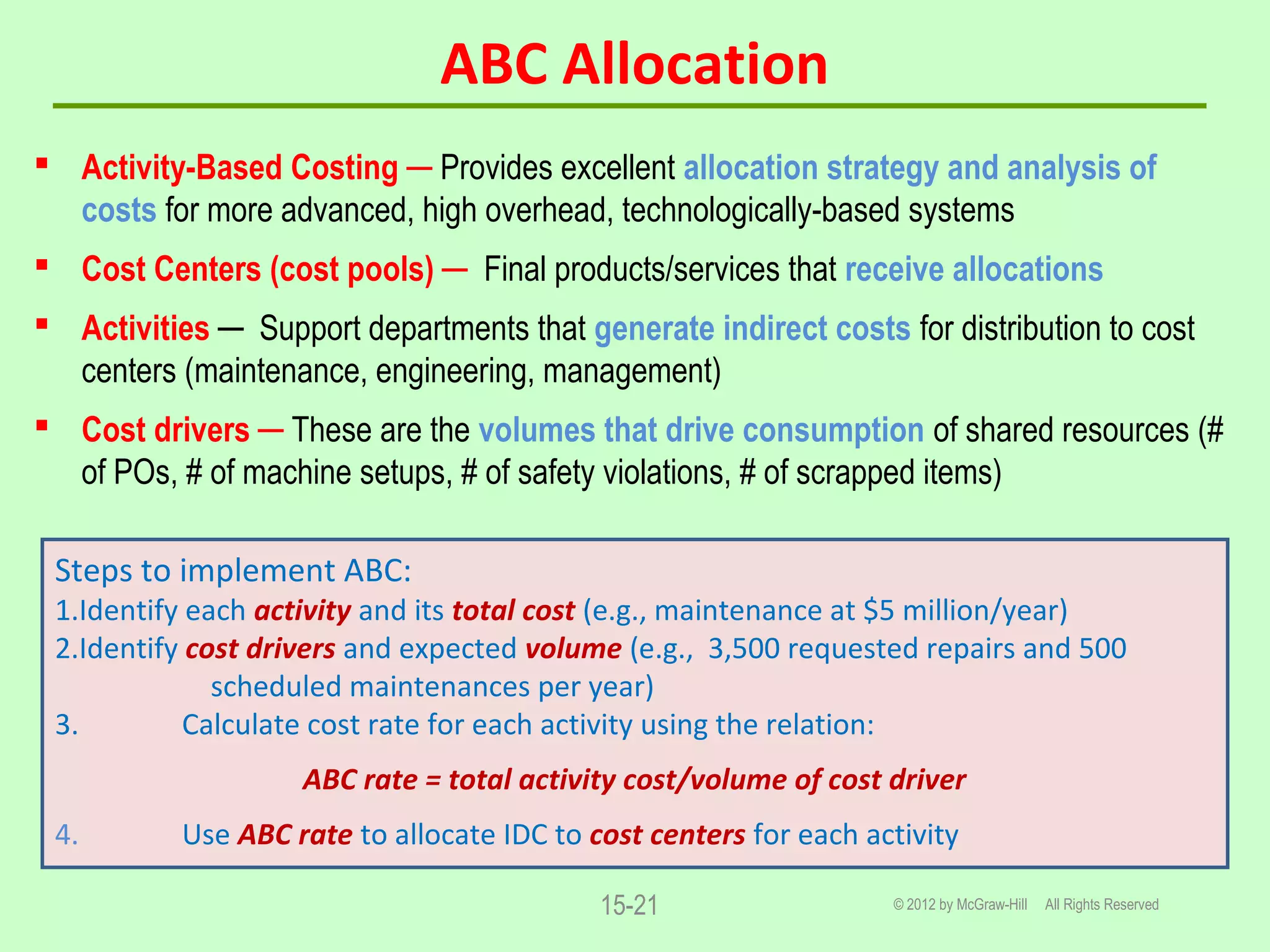

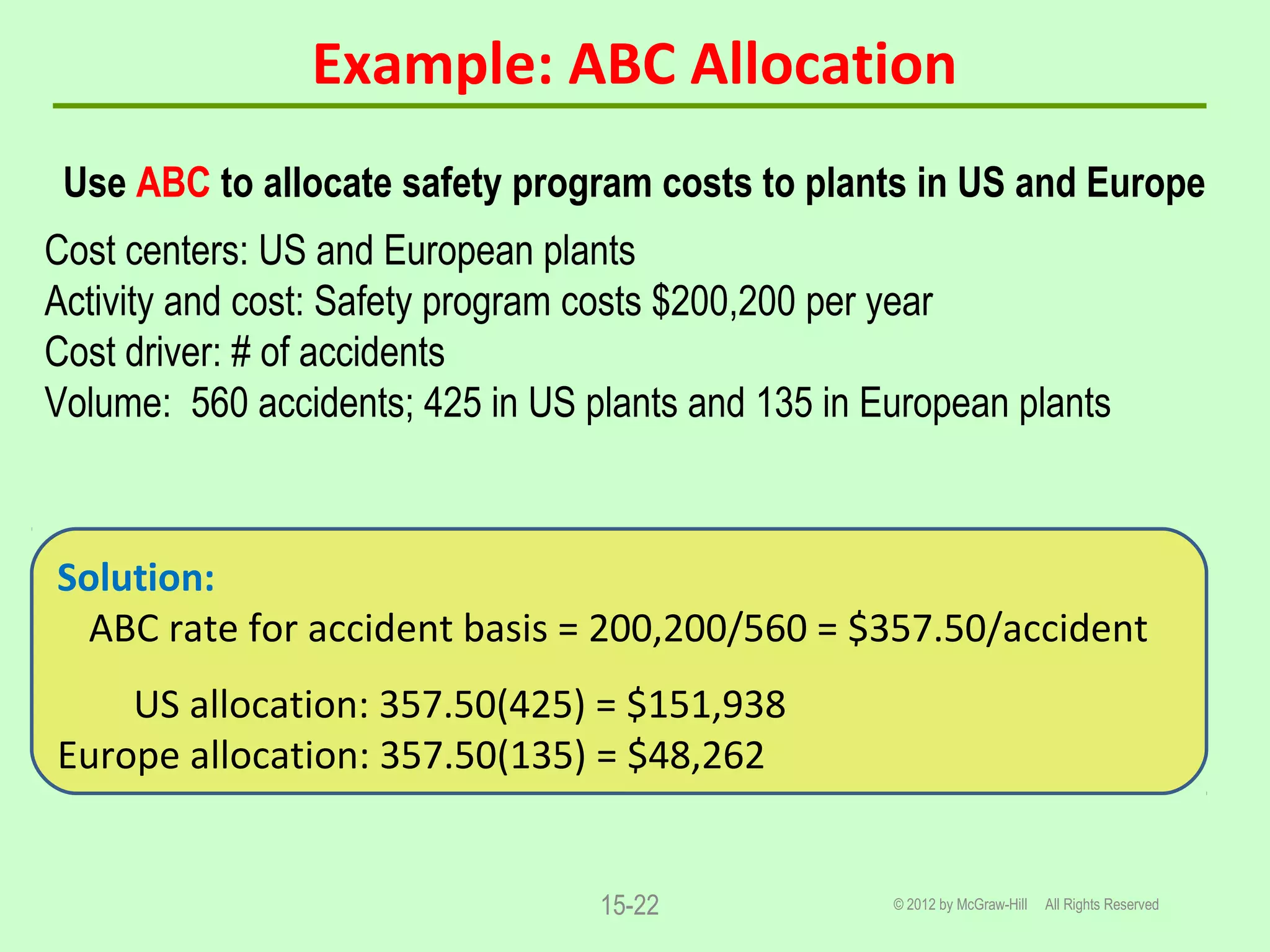

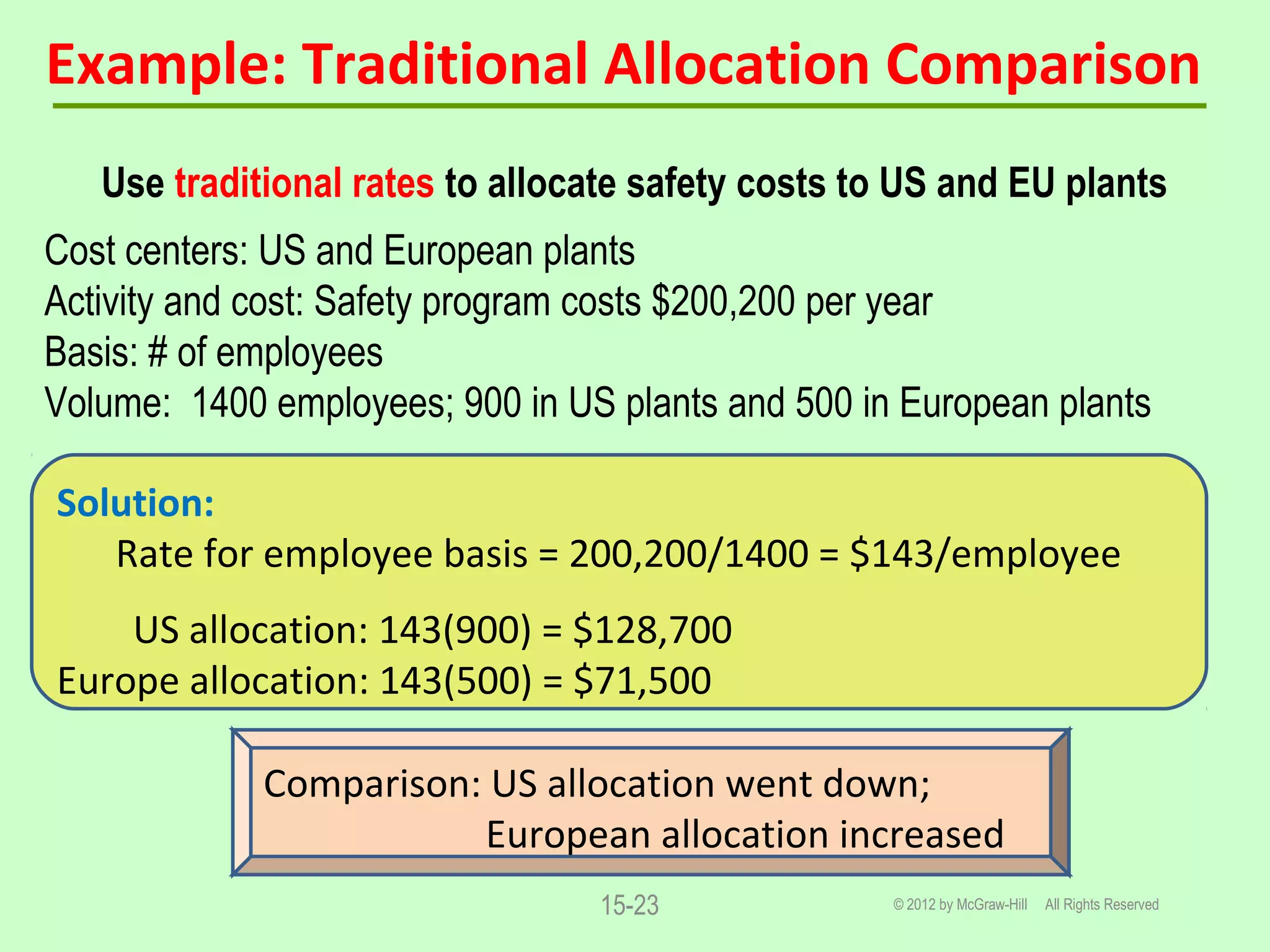

Direct and indirect costs must be estimated for engineering projects. Common direct cost estimation techniques include the unit method, cost indexes, and cost-estimating relationships. Indirect costs can comprise 25-50% of total costs and are traditionally allocated using predetermined rates. Activity-based costing is a more accurate allocation method that uses cost drivers. Ethical practices like avoiding deception are important for quality cost estimation.