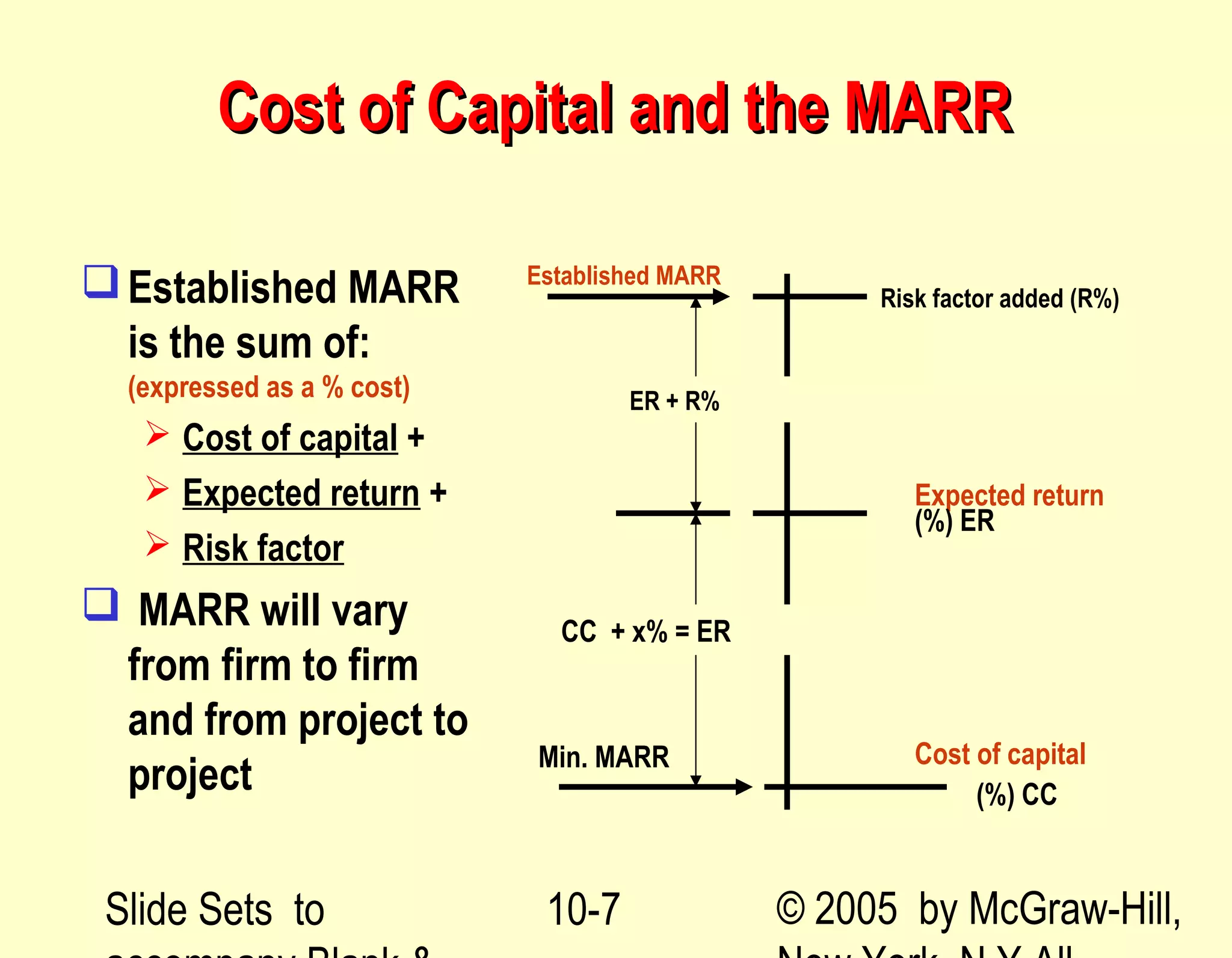

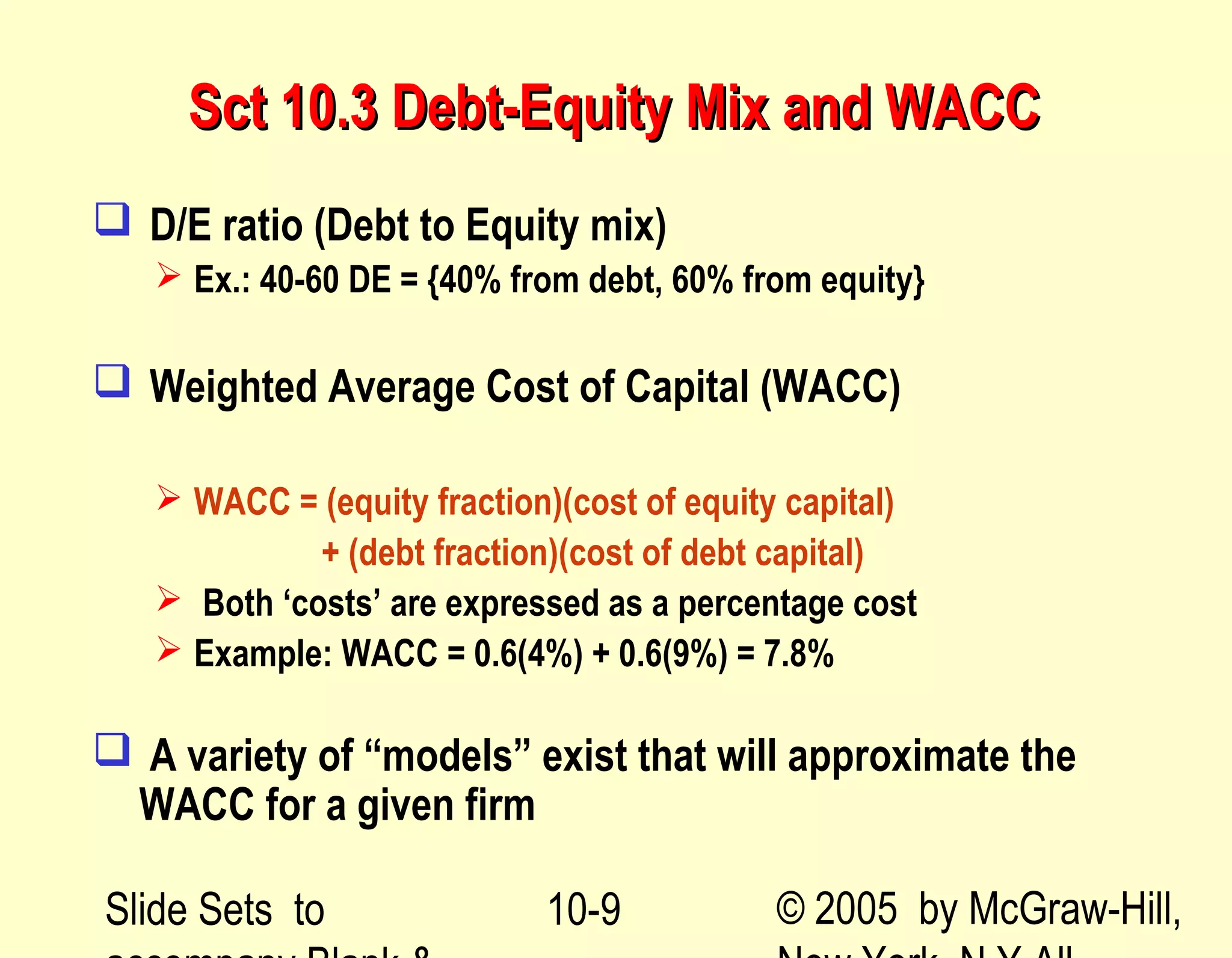

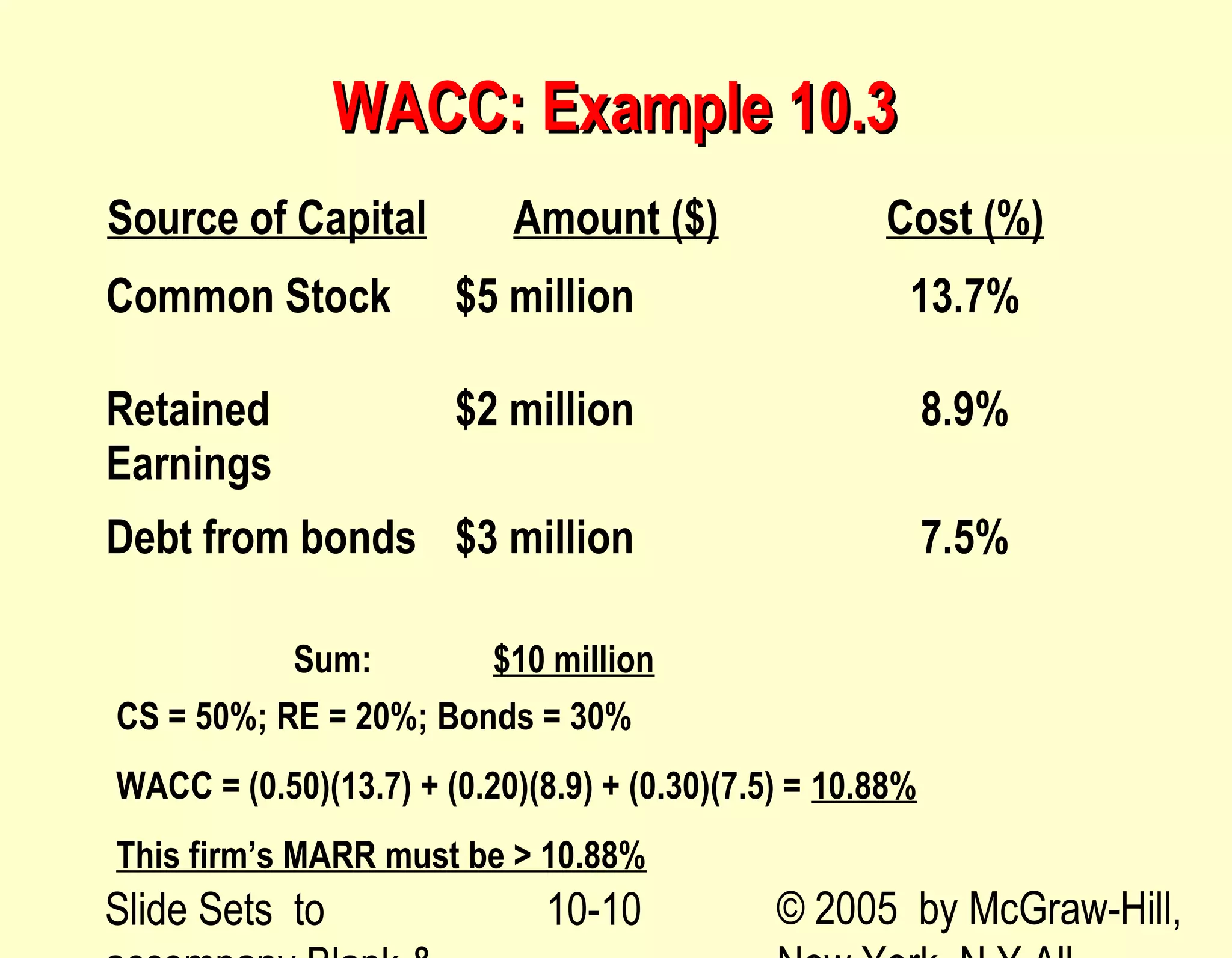

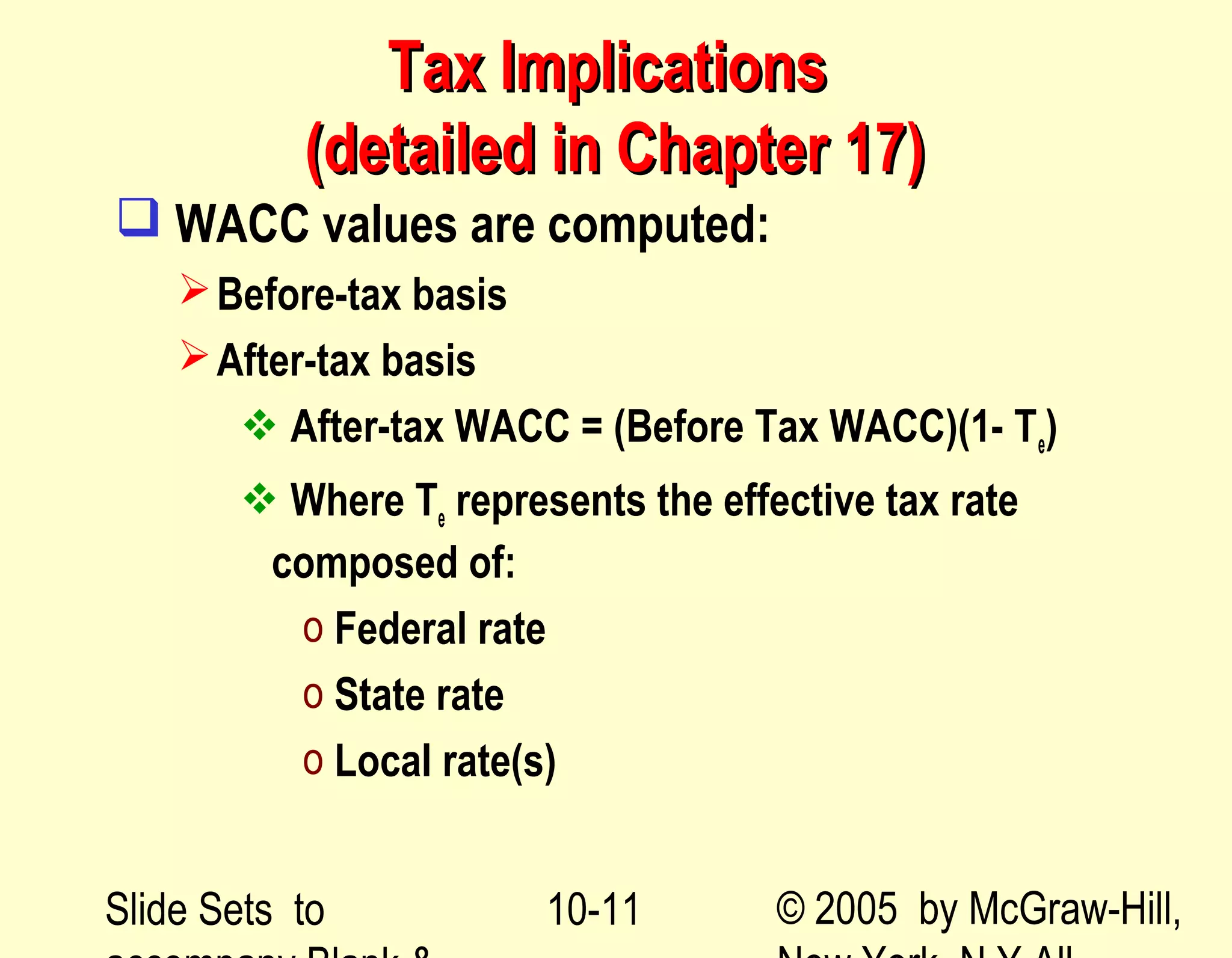

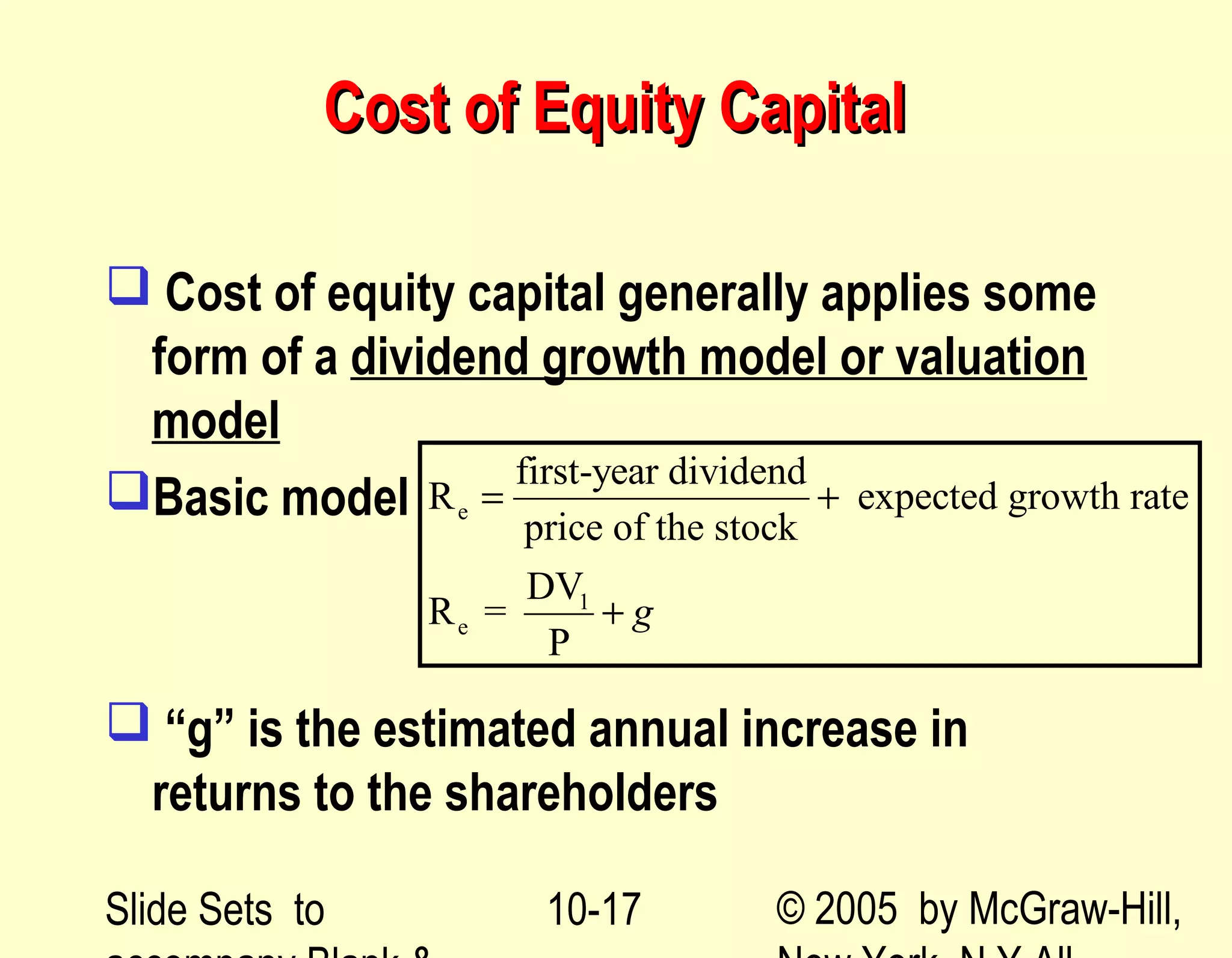

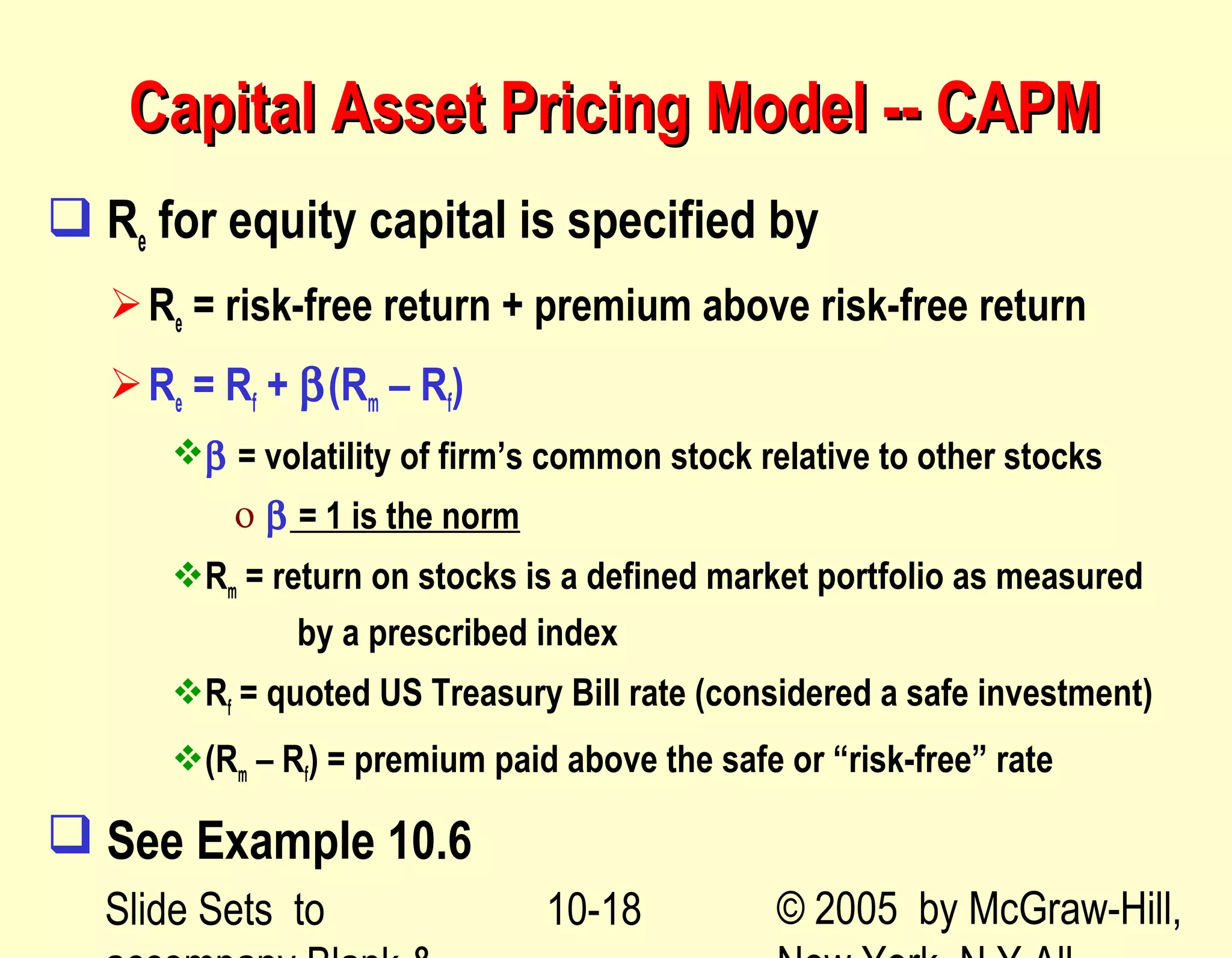

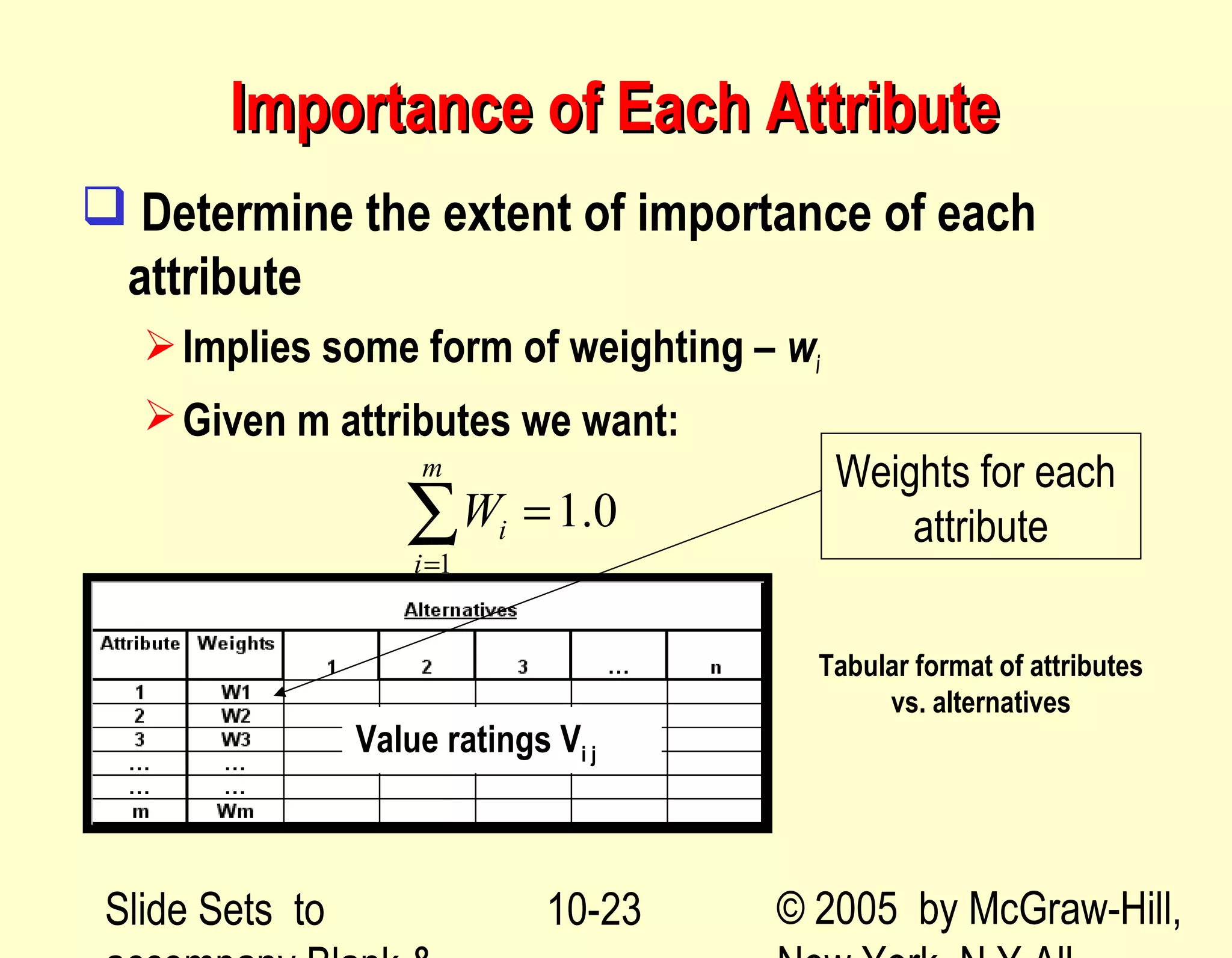

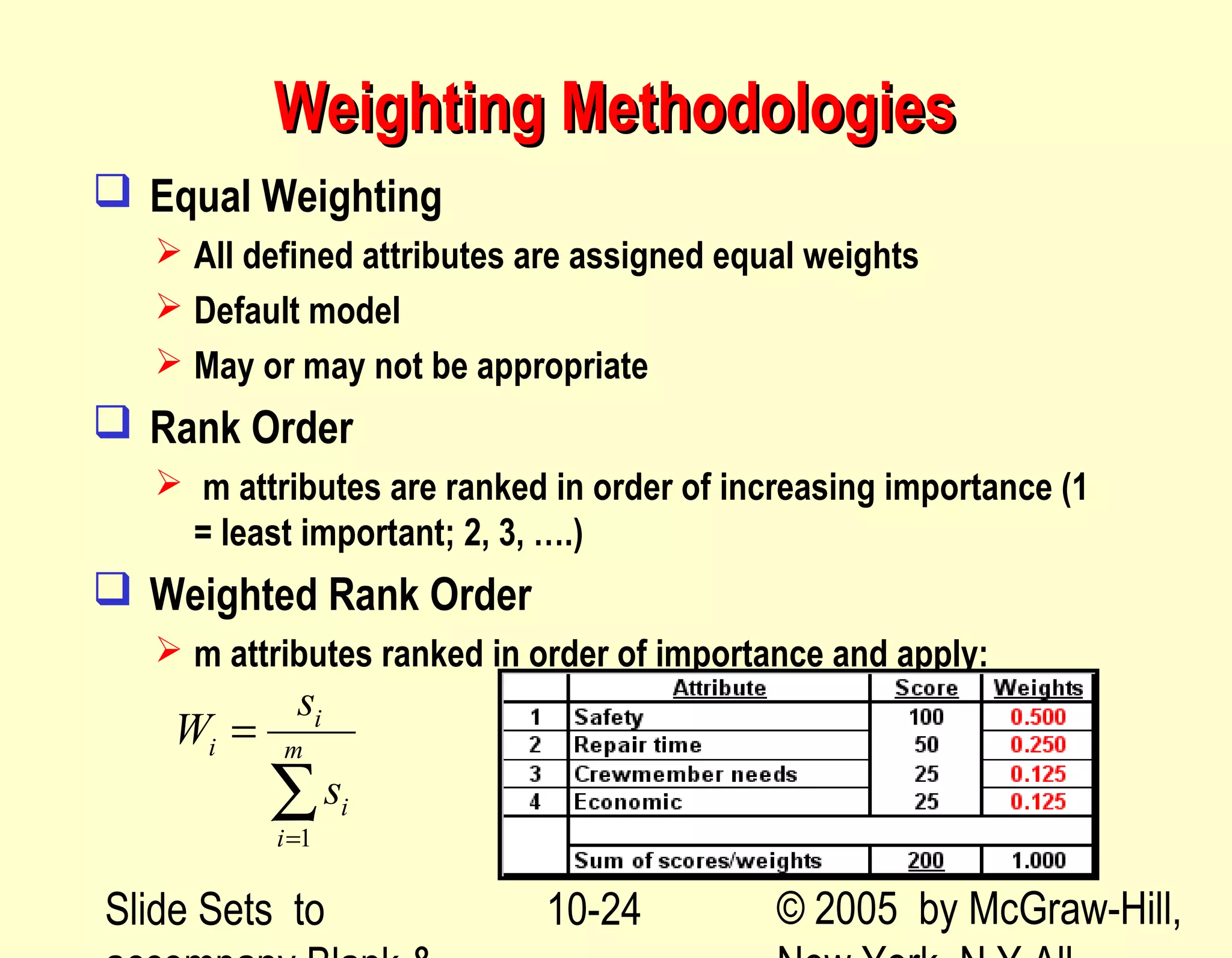

The document provides an executive summary of Chapter 10 from a textbook on engineering economy. It covers several key topics from the chapter, including different evaluation methods for comparing alternatives, determining the minimum attractive rate of return (MARR), accounting for debt and equity in the weighted average cost of capital (WACC), and methods for multi-attribute decision analysis. The summary highlights the importance of selecting the appropriate evaluation method based on problem characteristics, and calculating the MARR and WACC to evaluate investment opportunities.