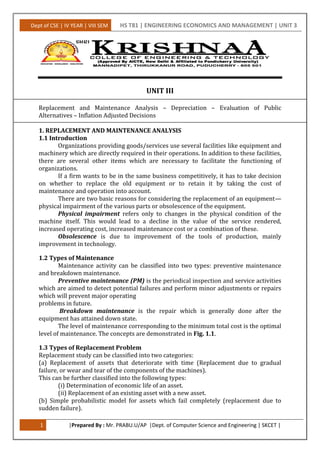

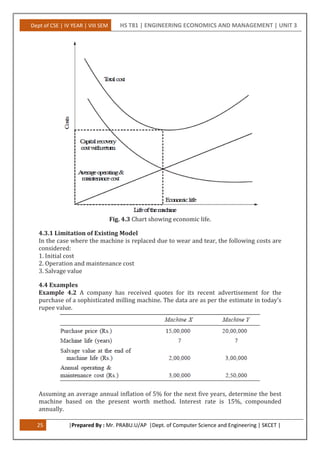

This document discusses replacement and maintenance analysis, including determining the economic life of assets. It provides examples of calculating the economic life of equipment using total cost when interest is 0% and 12%. It also discusses replacement of existing assets, types of maintenance, and a simple probabilistic model for items that fail completely. Optimal replacement policies are determined by comparing individual and group replacement costs. The document also covers several methods of depreciation, including straight-line depreciation calculation examples.