This document discusses replacement analysis and factors to consider when determining whether to replace existing assets. It provides information on:

- Reasons for conducting replacement analysis, including physical impairment, changes in economic requirements, and technological obsolescence shortening an asset's life.

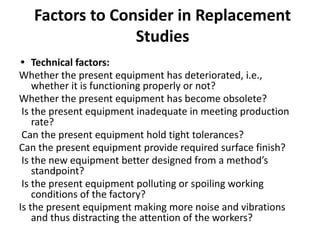

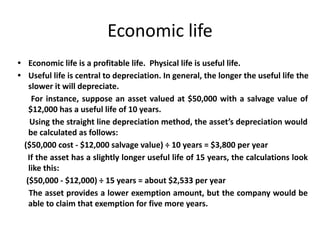

- Factors to consider in replacement studies, including technical factors like deterioration and obsolescence, as well as financial factors like operating expenses, salvage value, and expected economic life.

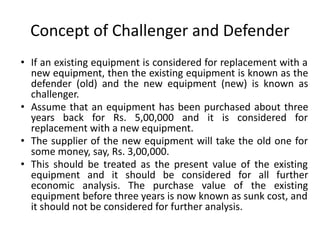

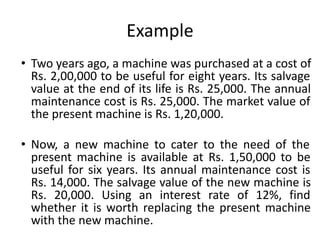

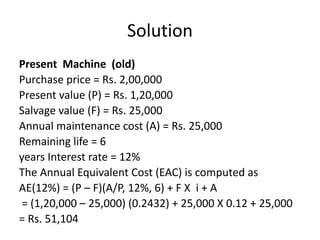

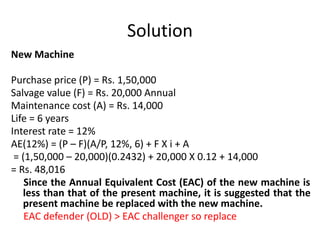

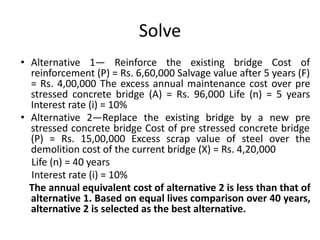

- The concept of the "defender" (existing asset) and "challenger" (potential replacement asset) and how their annual equivalent costs are compared to determine the best alternative.