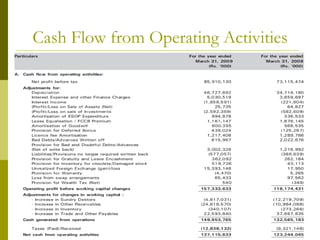

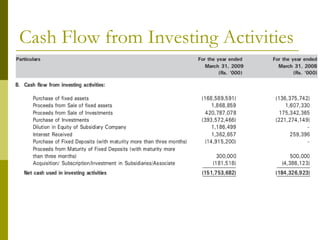

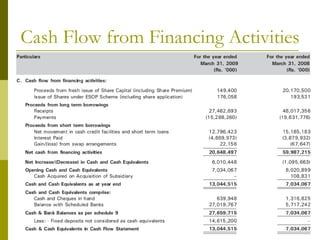

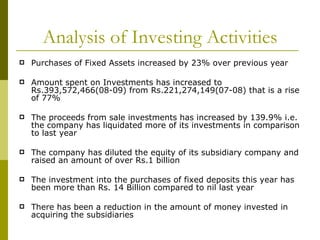

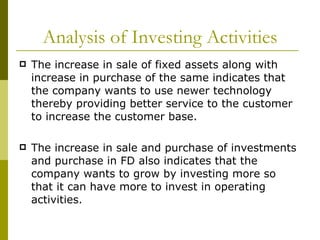

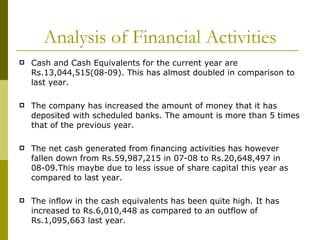

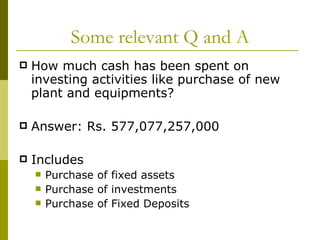

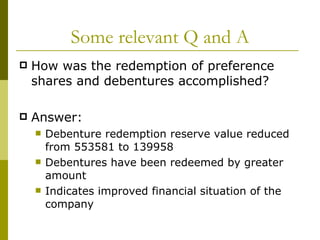

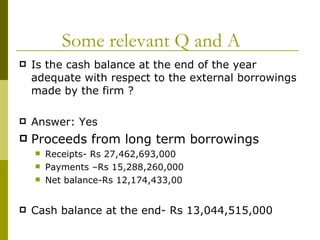

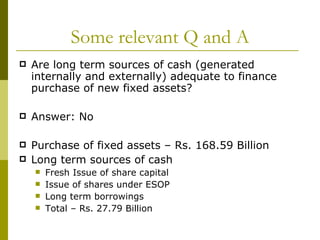

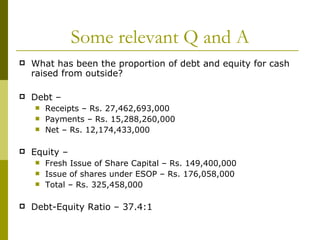

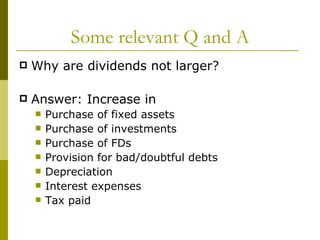

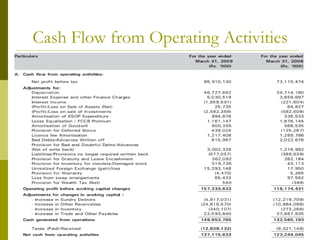

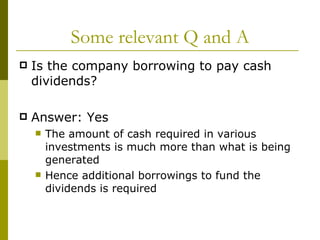

This document provides an analysis of the cash flow statement of Bharti Airtel Limited for the fiscal year 2008-2009. It begins with an overview of what a cash flow statement is and how it is divided into operating, investing, and financing activities. The document then examines Airtel's cash flow statement in detail, analyzing sources and uses of cash across the different activity categories and answering relevant questions about the company's liquidity, debt versus equity, and ability to fund purchases.