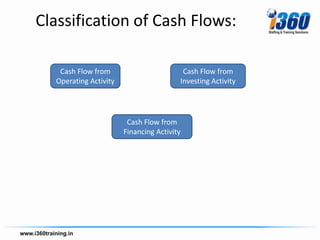

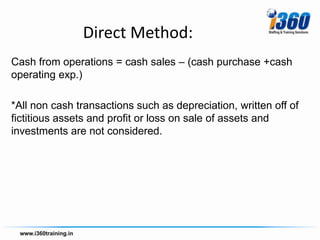

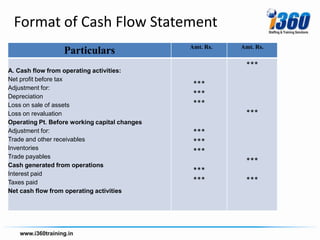

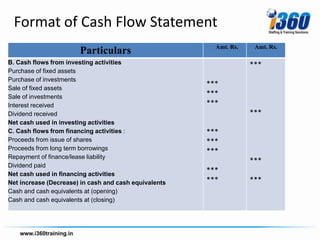

The document discusses the key components and classification of cash flows in a cash flow statement. It defines operating, investing, and financing cash flows and provides examples of cash inflows and outflows for each classification. The direct and indirect methods for determining cash flows from operations are also described. Additional information required from the income statement, balance sheet, and other sources is outlined. The uses and limitations of the cash flow statement are listed. Finally, the document includes a sample format for the cash flow statement.