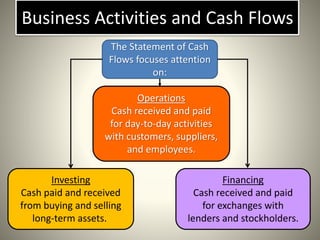

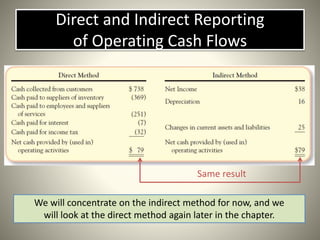

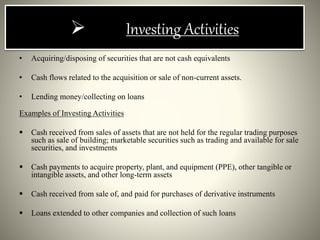

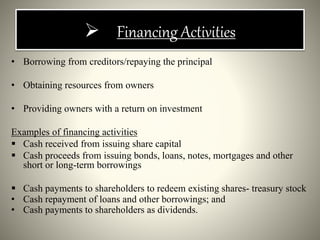

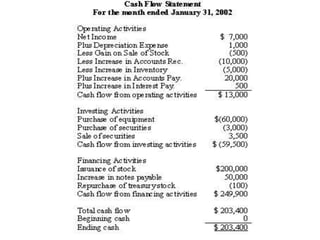

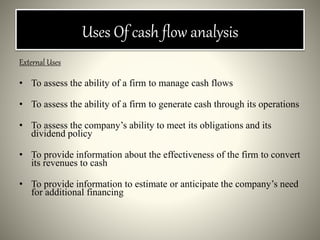

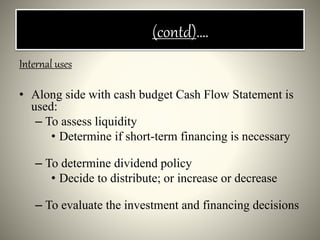

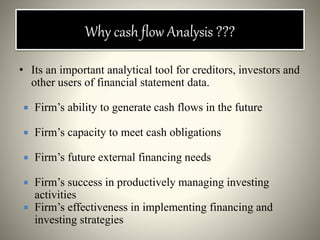

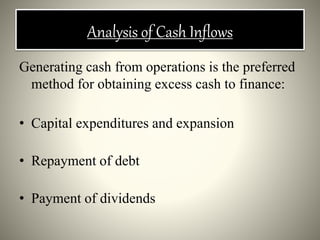

The cash flow statement provides information about cash inflows and outflows during an accounting period. It is developed from balance sheet and income statement data and is an important analytical tool. The cash flow statement focuses on operating, investing, and financing activities. Operating activities relate to core business operations like sales and expenses. Investing activities involve the purchase and sale of long-term assets. Financing activities include borrowing, repaying debt, and providing returns to owners. Cash flow analysis is used both internally and externally to evaluate a firm's liquidity, investment decisions, ability to meet obligations, and future financing needs.