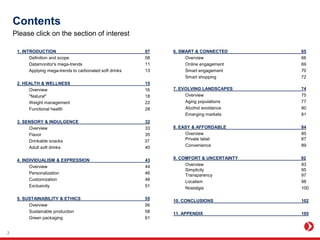

This document discusses trends in the carbonated soft drinks category. It covers 9 key trends: health and wellness, sensory and indulgence, individualism and expression, sustainability and ethics, smart and connected, evolving landscapes, easy and affordable, comfort and uncertainty, and conclusions. For the health and wellness trend, it notes consumers are increasingly seeking out "natural" products and avoiding artificial ingredients, representing an opportunity for more natural soft drinks.

![Sensory & Indulgence

Experiment with the sensory properties of carbonates to create "drinkable snacks"

Interest in drinkable snacks presents opportunities for carbonates

The concept of a product that comes in the form of a drinkable snack

appeals to 45% of consumers globally, with younger consumers the

most interested in the idea. PepsiCo has pinpointed this as a key area

of growth for its business going forward. Carbonated drinks could be

positioned as a snack, by using more filling and substantial ingredients:

creating a novel sensory experience and better catering to consumers

who favor on-the-go meal solutions. Carbonates should look to other

categories, such juices, for inspiration as to ways to "snackify" drinks.

Ingredients such as protein, oats, chia seeds, aloe vera pulp or fruit

pieces can add substance and texture, as well as potential functional

health benefits.

Source: Datamonitor's Consumer Survey 2013; Datamonitor's Product Launch Analytics

4

"[PepsiCo has a] whole range of products […] in

the pipeline that are value-added products that can

be snacks made into beverages […] A way to grow

the beverage business is to take foods and

drinkify them."

Indra Nooyi, CEO of PepsiCo, at Beverage Digest's

Future Smarts conference in New York, December

2012

Global: consumers who consider the concept of a product that

comes as a "drinkable snack" appealing, segmented by age and

country, 2013

China 74%

US 46%

UK 38 %

Italy 52%

Brazil 44%

Global average 45%

Mamma Chia – Chia

Squeeze

US

Chia seeds become gel-

like when mixed with

juice, creating a filling

snack.

Sapporo red grape juice

drink with aloe chunks

Japan

This carbonated drink

contains aloe pulp chunks

and red grape juice

flavoring.

Overview Flavor Drinkable snacks Adult soft drinks](https://image.slidesharecdn.com/carbonated-sfot-drinks-140426074230-phpapp02/85/Consumer-and-Innovation-Trends-in-Carbonated-Soft-Drinks-4-320.jpg)