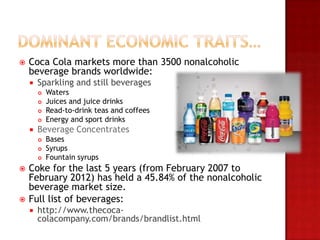

Coca-Cola is the world's largest manufacturer and distributor of non-alcoholic beverages, holding a 45.84% market share over recent years with over 3500 products. The competitive landscape includes major players such as Pepsi and Nestlé, with ongoing innovations and joint ventures like Tata Water Plus showing market adaptability. Despite its strong position, Coca-Cola faces pressures from rivals, market demands for healthier options, and environmental sustainability initiatives.