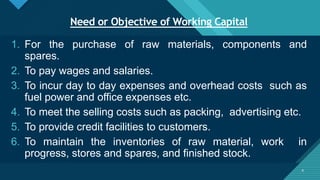

1. Working capital refers to the capital required for short-term obligations of a business, such as paying wages, purchasing inventory, and meeting selling costs. It is the difference between current assets and current liabilities.

2. There are two types of working capital - gross working capital, which is the capital invested in current assets, and net working capital, which is the difference between current assets and current liabilities.

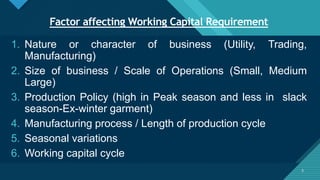

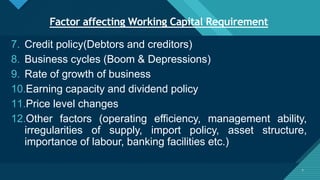

3. Factors that affect a company's working capital requirements include the nature of the business, its size and scale of operations, production processes, seasonality, credit policies, business cycles, growth rate, and various other external factors. Maintaining sufficient working capital is crucial for businesses to meet their