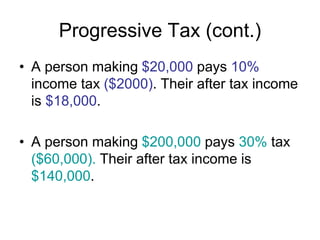

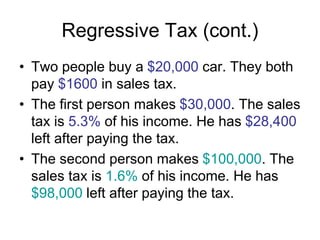

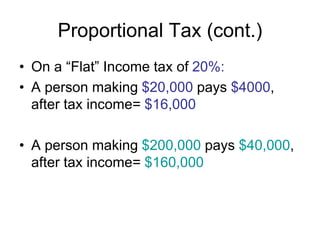

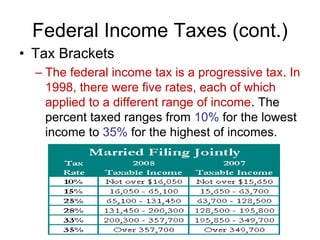

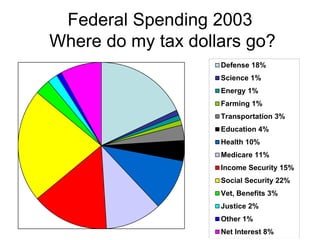

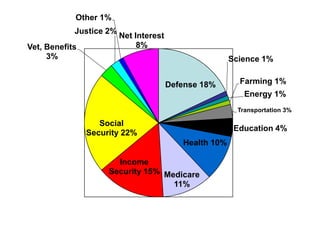

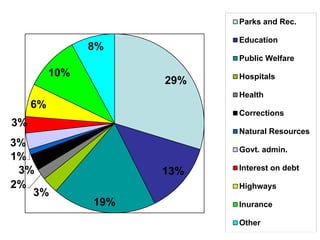

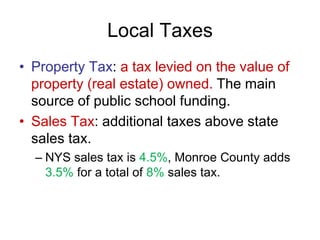

Taxes are payments required by governments to fund services like schools, police, and defense. The US Constitution grants Congress power to tax and levy income taxes. Taxes can be progressive, taking a larger percentage from the wealthy, regressive, taking more from the poor, or proportional, taking the same percentage from all. Federal taxes fund entitlement programs like Social Security and discretionary spending like defense and education. State and local governments also collect taxes to fund services within their jurisdictions like education, transportation, and welfare.