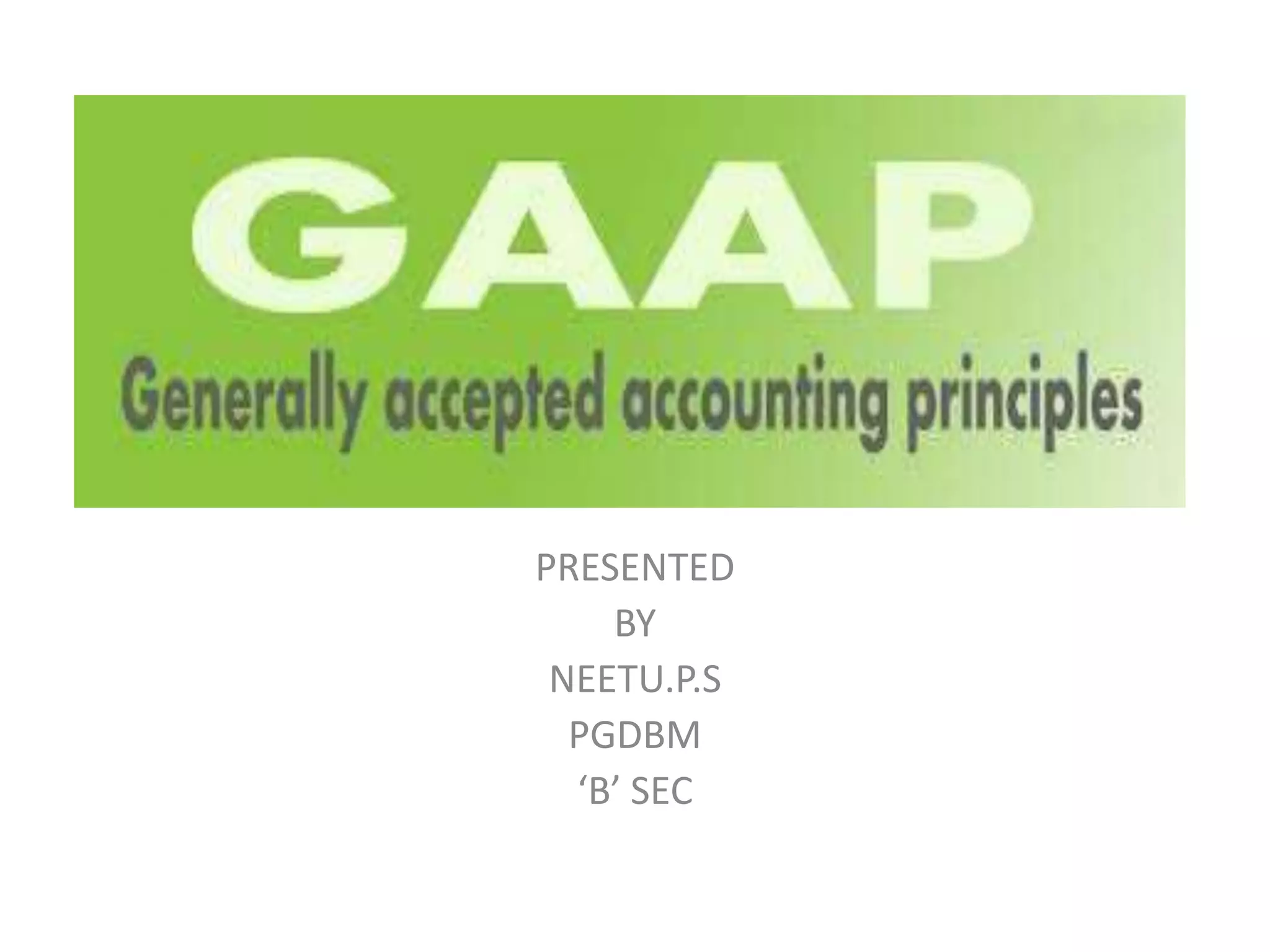

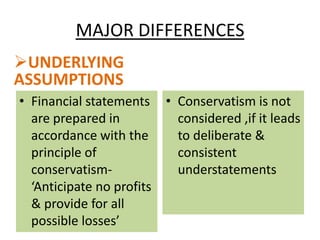

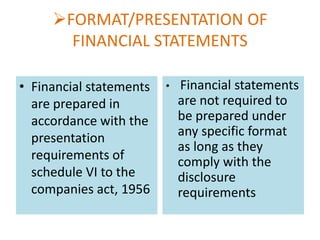

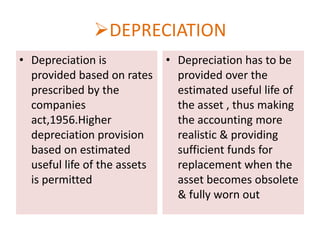

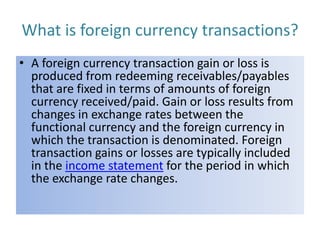

This document provides an overview of key differences between Indian GAAP and US GAAP. It defines GAAP as the common set of accounting principles, standards and procedures used to compile financial statements. Some major differences discussed include underlying assumptions, financial statement presentation formats, treatment of investments, consolidation of subsidiaries, accounting for foreign currency transactions, and accounting for expenses such as depreciation, pre-operating expenses, and employee benefits. The document also explains some accounting concepts and terms referenced in discussing the differences between Indian and US GAAP.

![DEFINITION: The common set of accounting principles,

standards and procedures that companies use

to compile their financial statements. GAAP

are a combination of authorities standards

[set by policy boards] and simply the

commonly accepted ways of recording and

reporting accounting information.](https://image.slidesharecdn.com/fa-gaap-140125033656-phpapp01/85/Fa-gaap-3-320.jpg)

![GAAP WAS ESTABLISHED BY Securities

and exchange

commission [SEC]

Financial accounting standards

board [FASB]

Governmental accounting

standards board [GASB]](https://image.slidesharecdn.com/fa-gaap-140125033656-phpapp01/85/Fa-gaap-5-320.jpg)

![CASH FLOW STATEMENT

• Cash flow statement in

financial statements is

mandatory only for

listed companies[AS-3]

• Cash flow statement is

mandatory for 3yearscurrent year & 2

immediate preceding

years irrespective of

whether the company is

listed/not[AS-95]](https://image.slidesharecdn.com/fa-gaap-140125033656-phpapp01/85/Fa-gaap-12-320.jpg)

![ Subsidiary company- A company controlled

by holding company i:e the company holding

more than 51% of shares.

Consolidation- It refers to the

aggregation[collection] of financial statements

of a group company as consolidated financial

statements.](https://image.slidesharecdn.com/fa-gaap-140125033656-phpapp01/85/Fa-gaap-16-320.jpg)

![CONSOLIDATION OF SUBSIDIARY

ACCOUNTS

• Consolidation of

accounts of subsidiary

companies is not

mandatory[AS-21]

• Consolidation of results

of subsidiary companies

is mandatory, hence

eliminating material,

inter company

transactions & giving a

true picture of the

operations &

profitability [AS-94]](https://image.slidesharecdn.com/fa-gaap-140125033656-phpapp01/85/Fa-gaap-17-320.jpg)

![What is prudence?

• It is a good judgement or wisdom gained by

experience & knowledge, expressed in a

realistic & frugal attitude. It is not the same as

grave caution or wariness concerned only with

preserving status quo[existing state of affairs].

If there is no real cause for fear, prudence lies

in avoiding excessive deliberations & in the

readiness to sacrifice today’s gain for

tomorrow’s greater gain.](https://image.slidesharecdn.com/fa-gaap-140125033656-phpapp01/85/Fa-gaap-19-320.jpg)

![FOREIGN CURRENCY TRANSACTIONS

• Exchange

• Capitalization of

fluctuations on

exchange fluctuation

liabilities incurred for

arising from

fixed assets can be

liabilities incurred for

capitalized[AS-11]

acquiring fixed

assets does not

exist[AS-52]](https://image.slidesharecdn.com/fa-gaap-140125033656-phpapp01/85/Fa-gaap-22-320.jpg)

![EXPENDITURE DURING

CONSTRUCTION PERIOD

• All incidental

expenditure on

construction of assets

during project stage are

accumulated &

allocated to the cost of

asset

• Such expenses are

divided into 2 heads

direct & indirect. While

direct expense is

accumulated &

allocated to the cost of

asset, indirect are

charged to revenue[AS7]](https://image.slidesharecdn.com/fa-gaap-140125033656-phpapp01/85/Fa-gaap-23-320.jpg)

![RESEARCH & DEVELOPMENT

EXPENDITURE

• R&D to be charged to

P/L, except equipment

& machinery which are

capitalized &

depreciated[AS-8]

• All R&D costs are

expenses except

intangible assets

purchased from others

& tangible assets that

have alternative future

uses which are

capitalized &

depreciated[AS-2]](https://image.slidesharecdn.com/fa-gaap-140125033656-phpapp01/85/Fa-gaap-24-320.jpg)

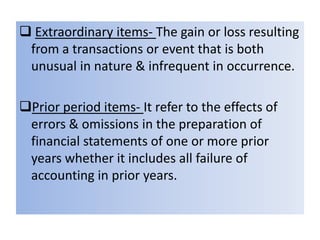

![EXTRAORDINARY ITEMS & PRIOR

PERIOD ITEMS

• Extraordinary &

prior period items

are disclosed

without netting off

for tax effects[AS-5]

• Adjustments for tax

effects are required

to be made while

reporting the prior

period items[AS-16](https://image.slidesharecdn.com/fa-gaap-140125033656-phpapp01/85/Fa-gaap-28-320.jpg)

![GOODWILL

• Goodwill is

capitalized &

charged to earnings

over 5-10yrs period

• Goodwill &

intangible assets are

amortized, but they

are tested at least

annually for

impairment[AS-142]](https://image.slidesharecdn.com/fa-gaap-140125033656-phpapp01/85/Fa-gaap-29-320.jpg)

![INVESTMENTS IN ASSOCIATED

COMPANIES

• Investments in

associate companies is

initially recorded at

cost, identifying

goodwill/capital reserve

arising at the time of

acquisition[AS-23]

• Investments in

associates are

accounted under equity

method in group

accounts but would be

held at cost in the

investor’s own A/c[AS115]](https://image.slidesharecdn.com/fa-gaap-140125033656-phpapp01/85/Fa-gaap-33-320.jpg)

![PREOPERATIVE EXPENSES

• Direct revenue

expenses like

preliminary &

indirect like

incidental, are

allowed to be

capitalized

• Expenses have to be

charged to revenue

& assets are

capitalized as a

normal

organization[AS-7]](https://image.slidesharecdn.com/fa-gaap-140125033656-phpapp01/85/Fa-gaap-34-320.jpg)