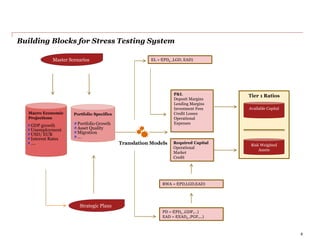

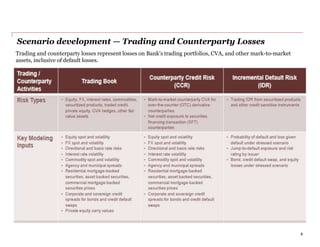

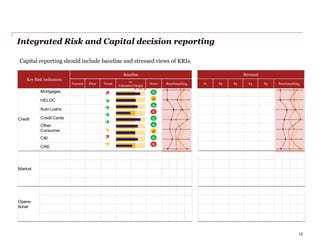

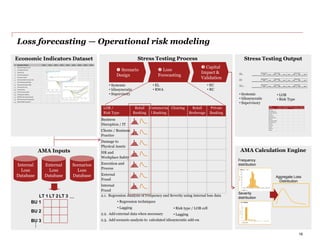

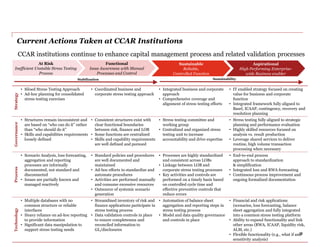

The document discusses capital management and stress testing frameworks. It provides an overview of the CCAR capital planning process, which includes developing multiple stress scenarios and using those scenarios to project losses, revenues, expenses, and capital ratios over nine quarters. It also discusses building blocks for stress testing like modeling credit and trading losses, and frameworks for integrating risk reporting and PPNR forecasting.