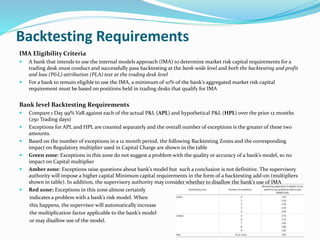

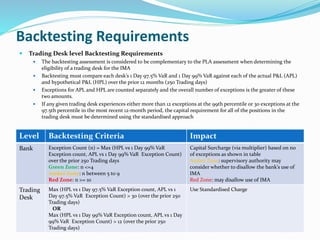

1) Banks must pass backtesting at the bank-wide level and desk-level to use internal models to determine market risk capital requirements. Backtesting compares Value at Risk (VaR) to actual and hypothetical profit and loss.

2) At the bank level, more than 10 exceptions results in increased capital charges. At the desk level, more than 12 exceptions at 99% VaR or 30 at 97.5% VaR requires standard capital charges.

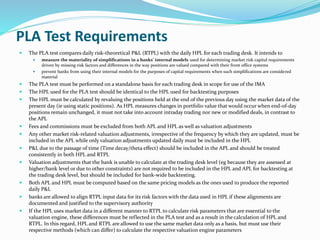

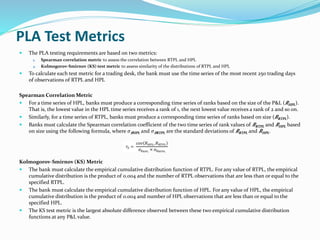

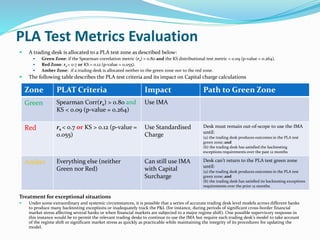

3) Profit and loss attribution (PLA) testing compares risk-theoretical profit and loss to hypothetical profit and loss. Strong correlation and similar distributions are required to use internal models, otherwise standard capital charges apply.