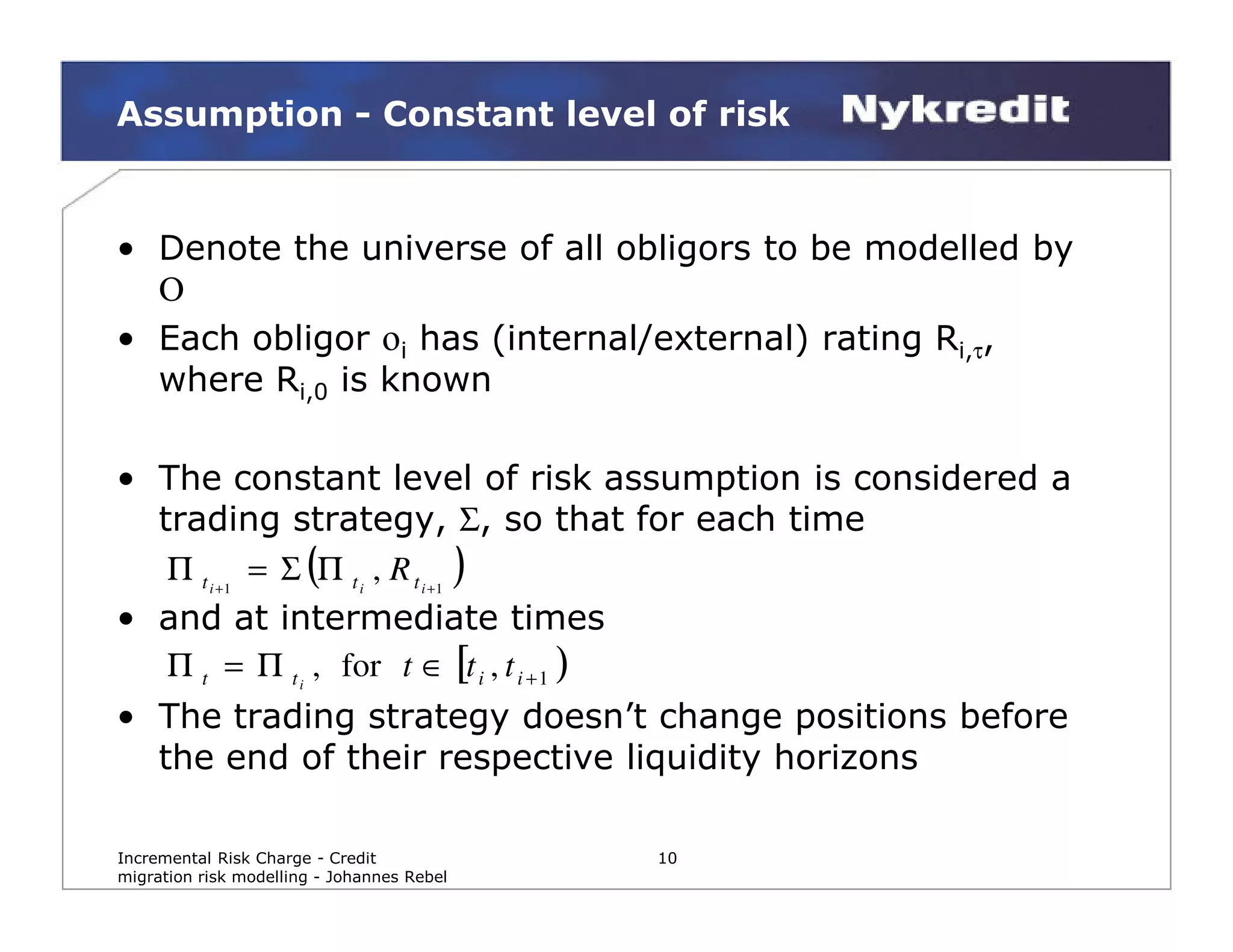

The document discusses credit migration risk modeling for calculating the Incremental Risk Charge (IRC). It outlines the requirements for IRC models, including using a one-year capital horizon at a 99.9% confidence level. It also discusses model assumptions, such as assigning positions to liquidity buckets and using a constant level of risk trading strategy. The document then provides an initial outline for an IRC risk model and discusses considerations such as the need to model credit migration risk under both objective and risk-neutral probability measures.

![Transition rates data – rating

modifiers

• Data for rating modifiers (A+, A, A- etc.) are

also available

From/To AAA AA+ AA

AAA 88.53 4.29 2.78

AA+ 2.45 77.90 …

AA 0.54 … …

• Conveys more information about the sample

• But many more rare events – poor estimates of

”true” probabilities*

*see [CL02]

Incremental Risk Charge - Credit 16

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-16-2048.jpg)

![Transition rates data – low default

rates

• Basel minimum probability of default (PD) of 0.03%

• Could use linear regression on a logarithmic scale*

*see [BOW03] sect. 2.7

Incremental Risk Charge - Credit 18

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-18-2048.jpg)

![Transition rates data – Moody’s

database

• The complete transition history has been studied

([CL02]) using a continuous-time procedure

• Significantly improved confidence sets for rare

events

Drawbacks

• Probably not available for commercial purposes!

• Various issues have to be dealt with on a case-by-

case basis

– Special covenants

– Several transitions over a very short time-span e.g. B1

to Caa to D (interpreted as B1 directly to D)

– New debt issued after default

Incremental Risk Charge - Credit 19

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-19-2048.jpg)

![An approach to assigning internal

ratings

• 8 steps to assigning internal ratings to obligors*

• 7 steps to assign an Obligor Default Rating (ODR)

that identifies the probability of default and a final

step to (independent of the ODR) assign a Loss

Given Default Rating (LGDR) that identifies the risk

of loss in the event of default.

• It’s important that the rating categories are not too

broad, so that the obligors do not get clustered in a

few categories.

*[CGM06] chap. 10

Incremental Risk Charge - Credit 21

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-21-2048.jpg)

![The modified transition matrix

The transition data have to be modified a bit to be

useful for modelling purposes:

• The NR probabilities get redistributed to the other

categories(*) assuming that they convey ”no

information”

• A default (D) row is added to make the matrix

square

• Each row gets rescaled to 1 (100%) to iron out minor

inaccuracies

The result is the Modified Transition Matrix

* Redistribution to other rating categories is likely to inflate the default risk

according to Standard and Poor’s ([SP07])

Incremental Risk Charge - Credit 26

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-26-2048.jpg)

![Speed and direction of migrations

[AV08] introduce the concepts of speed and direction

of rating migrations. K −1

The direction is defined as ∑ j <i

∑ pij − ∑ pij

i =1

j >i ∈ [− 1,1]

K −1

and measures the general tendency of ratings to drift

upwards or downward, typically during economic

expansions and contractions respectively

K K

The speed is defined as

∑∑ | i − j | p

i =1 j =1

ij

K −1

∑k

k =1

and measures the speed at which ratings jump –

weighted by jump size

Incremental Risk Charge - Credit 28

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-28-2048.jpg)

![Constructing PIT migration

matrices

• [AV08] model the point-in-time default probabilities

as expectation of the PD conditional upon the state

of the economy, which in turn is modelled by a single

macroeconomic factor – the CFNAI index (*)

• The resulting PIT matrix exhibits over time frequent

changes in both direction and speed compared to its

TTC-counterpart (solid and dashed lines resp.)

* Other indexes or multiple indexes could also be used

Incremental Risk Charge - Credit 29

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-29-2048.jpg)

![The matrix exponential -

Calculation

• The naïve approach to calculating the matrix

exponential is just to calculate the truncated sum

N

Xk

exp( X ) ≈ ∑ for N sufficiently large

k =0 k!

• Unfortunately it is not numerically stable (adding

large quantities with opposite signs), but the

following diagonal adjustment overcomes this

problem*:

• Choose x = max{| xii |: i = 1,..., K}

• and note that (since xIK and X commute)

exp( xI K + X ) = exp( xI K ) exp( X ) ⇒ exp( X ) = exp(− x) exp( xI K + X )

• then the last exponent has all elements positive

*see [Lando04] Appendix C

Incremental Risk Charge - Credit 36

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-36-2048.jpg)

![The matrix logarithm

• But how do we find the generator G itself ? Taking

the logarithm ? Almost …

∞

(P − I )k

G = ∑ (−1) k +1

• [IRW01] suggest k =1 k

• which corresponds to the series expansion of the

logarithm function in the scalar case.

• Unfortunately property 2 could be violated so an

adjustment is necessary

• Best practise is to add back negative values to their

row neighbours in proportion to their absolute values

Incremental Risk Charge - Credit 38

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-38-2048.jpg)

![The generator matrix in action

Survivalces

probabilities (1-default probability) generated for each

rating class over a 30-year horizon. Data and methodology as

in [JLT97].

Incremental Risk Charge - Credit 39

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-39-2048.jpg)

![Calibration to market data

• Determine U from e.g. credit spreads or CDS

spreads

• In their seminal paper [JLT97] use time and state-

dependent factors

U(t) = diag µ1(t),K, µK−1(t),1)

(

• where each row in the generator matrix is scaled up

by a risk premium – increases the transition

intensities so that the drift towards default is

accelerated

• Due to mean reversion lower rated debt could get

lower credit spreads!

Incremental Risk Charge - Credit 44

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-44-2048.jpg)

![Generator – Probabilistic

interpretation

Interpretation of generator matrix elements

• off-diagonal (g(i,j), where i<>j) elements are

intensities of independent Poisson processes of

transition from state i to state j.

• Diagonal elements (g(i,i)) are the negatives of

arrival intensities to any state other than i

This interpretation suggests how to simulate the rating

process ([Jones03]):

Incremental Risk Charge - Credit 45

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-45-2048.jpg)

![Generator – Simulation I

• Start from state i at t = 0

• Draw a uniform [0, 1] random variable u.

• Time to (first) transition from state i is computed as

t = LN (u / g ij )

• This is an exponentially distributed random variable

with mean −1/g(i,j).

• and it is the time between arrivals in a Poisson

distribution with intensity g(i,j).

Incremental Risk Charge - Credit 46

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-46-2048.jpg)

![Alternative approach - Translated

asset value process

• [ML00] translate the true distribution (normal) of

asset returns by a risk premium

ρθ

• where ρ is the correlation with the market (CAPM).

• Denoting the risk-neutral probabilities by qij we get

pij = P{b j < R < b j +1} = Q{b j < R + ρθ < b j +1}, where qij = Q{b j < R < b j +1}

• where − ∞ = b1 < K < bK +1 = ∞

• define interval boundaries (thresholds)

Incremental Risk Charge - Credit 49

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-49-2048.jpg)

![Modelling rating transitions – jump

diffusion model

• [ML00] introduce a mean-reverting jump-

diffusion process for the 1-year default probability

• The parameters

– diffusion volatility

– mean-reversion level and speed

– Jump intensity, size and standard deviation

– rating thresholds (7)

– market risk premium

• The parameters get calibrated to both historical

transition data, multi-year cumulative default

probabilities and credit spreads

Incremental Risk Charge - Credit 51

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-51-2048.jpg)

![Generator - Estimation

• [CL02] use Maximum-Likelihood estimators to

estimate the generator directly (from Moody’s

database)

• Then they use simulation to arrive at confidence sets

for default probabilities

Incremental Risk Charge - Credit 52

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-52-2048.jpg)

![Time-heterogeneity

• [BO07] use a time-dependent generator to fit to

multi-year default probabilities

• The time-homogeneity property is sacrificed to

obtain a better fit to the whole term structure of

default probabilities

Incremental Risk Charge - Credit 53

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-53-2048.jpg)

![Pricing correlation products

• Correlations under the risk-neutral measure

• Have to use fairly simple factor models - not much

information in the market*

• Or use copulas - an abundance of literature exists on

copula approaches**

*see [ILS09]

**see [CLV04] chap. 7

Incremental Risk Charge - Credit 54

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-54-2048.jpg)

![The Merton model

• The asset value process is assumed to follow a geometric

Brownian motion

dVt = µV Vt dt + σ V Vt dWt , 0 ≤ t ≤ T

• The value of the firm’s equity is equivalent to a call option

on the assets with the strike rate set to the face value of

the debt at Τ

[

S t = Ε Q e − r (T − t ) (VT − B ) | Ft

+

]

• Classic extensions of the model include

– Stochastic interest rates

– Jumps

– Default barrier

– Less simplistic capital structure incl. coupons

Incremental Risk Charge - Credit 56

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-56-2048.jpg)

![Credit contagion - I

• Conditional independence framework usually leads to

default correlations between obligors that are too

low to explain large portfolios losses*

• Should deal with asymmetrical dependencies –

counterparty relations

• Intrinsic risk that cannot be diversified away!

• Could maybe be ignored for large retail credit

portfolios, but what about the trading book ?

* see [Lüt09] chap. 12

Incremental Risk Charge - Credit 60

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-60-2048.jpg)

![Credit contagion - II

• [RW08] present a model that divides obligors into

infecting and infected firms (e.g. a large corporation

and its suppliers)

• Defaults in the infecting group feed into the

creditworthiness of infected firms by increasing the

default probability

• Contagion channels within business sectors

• Finding: most infecting firms are investment grade

and most infected firms speculative grade

Incremental Risk Charge - Credit 61

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-61-2048.jpg)

![Existing models

• Many IRB models based on the Merton model have

been implemented

• Several commercial products available (Moody’s

KMV, CreditMetrics™ etc.)

• Focus is on default risk but ratings can usually be

handled

• A lot of time and effort has gone into modelling joint

annual default probabilities

• Most are based on one-year horizons and not all are

easily adaptable to a multi-period setting*

*see [Straumann09]

Incremental Risk Charge - Credit 62

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-62-2048.jpg)

![Brownian bridge – I

• The Brownian bridge is a method to construct a path

of a Brownian motion between known end points*

• Bridging market and credit risk ? Use a Brownian

bridge!

*see [Jäckel02] sect. 10.8.3

Incremental Risk Charge - Credit 63

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-63-2048.jpg)

![References - I

• [JLT97] - ”A Markov Model for the Term Structure of Credit Risk Spreads”, Robert

A. Jarrow, David Lando, Stuart M. Turnbull, The Review of Financial Studies

summer 1997 Vol. 10, No. 2, pp. 481-523

• [CGM06] – ”The essentials of risk management”, Michel Crouhy, Dan Galai, Robert

Mark, McGraw-Hill Companies, Inc.

• [AV08] – ”Credit Migration Risk Modelling”, Andreas Andersson, Paolo Vanini,

2008

• [SP07] – ”2007 Annual Global Corporate Default Study And Rating Transitions”,

Standard and Poor’s, February 5, 2008

• [CL02] – ”Confidence sets for continuous-time rating transition probabilities”, Jens

Christensen, David Lando, 2002

• [BOW03] – ”An introduction to Credit Risk Modelling”, Christian Bluhm, Ludger

Overbeck, Christoph Wagner, Chapman & Hall/CRC 2003

• [Lando04] – ”Credit Risk Modelling”, David Lando, Princeton University Press,

2004

• [IRW01] – ”Finding Generators for Markov Chains via Empirical Transition

Matrices, with Application to Credit Ratings”, Robert B. Israel, Jeffrey Rosenthal,

Jason Z. Wei, Mathematical Finance, 11 (April 2001)

• [BO07] – ”Calibration of PD term structures: to be Markov or not to be”, Christian

Bluhm, Ludger Overbeck, RISK magazine, November 2007

Incremental Risk Charge - Credit 67

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-67-2048.jpg)

![References - II

• [Jones03] – ”Simulating Continuous Time Rating Transitions”, Robert A. Jones,

2003

• [Merton74] – ”On the Pricing of Corporate Debt: The Risk Structure of Interest

rates”, Robert C. Merton, Journal of Finance, 2, 449, 470

• [ML00] – ”Modeling Credit Migration“, Cynthia McNulty, Ron Levin, RISK

magazine, February 2000.

• [RW08] – ”Estimating credit contagion in a standard factor model“, Daniel Rösch,

Birker Winterfeldt, RISK magazine, August 2008.

• [ILS09] – ”Factor models for credit correlation”, Stewart Inglis, Alex Lipton, Artur

Sepp, RISK magazine, April 2009

• [Lüt09] – ”Concentration Risk in Credit Portfolios”, Eva Lütkebohmert, Springer-

Verlag, 2009

• [Jäckel02] – ”Monte Carlo methods in finance”, Peter Jäckel, John Wiley & Sons

Ltd. 2002

• [Straumann09] - “What happened to my correlation?”, On the white board,

Daniel Straumann, 2009

• [CLV04] - “Copula methods in finance” , Umberto Cherubini, Elisa Luciano, Walter

Vecchiato, John Wiley & Sons Ltd. 2004

Incremental Risk Charge - Credit 68

migration risk modelling - Johannes Rebel](https://image.slidesharecdn.com/irccreditmigrationriskjohannesrebel-124517642939-phpapp02/75/Incremental-Risk-Charge-Credit-Migration-Risk-68-2048.jpg)