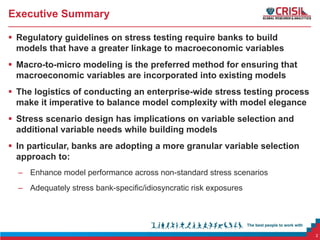

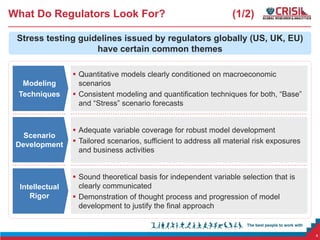

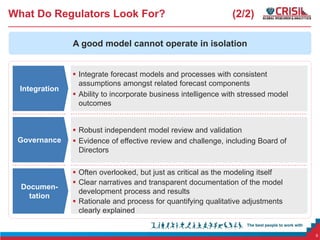

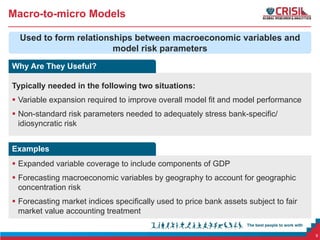

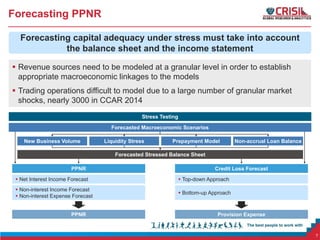

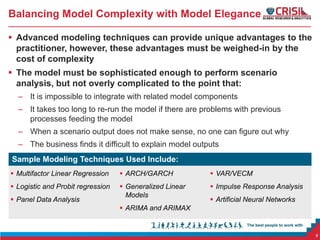

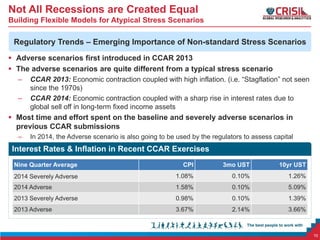

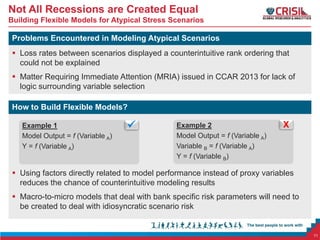

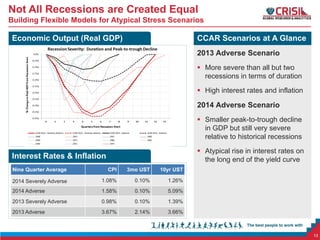

The document discusses the challenges in building effective stress testing models that meet regulatory guidelines. It outlines key things regulators look for, such as models being clearly linked to macroeconomic variables and scenario design covering all material risks. It also discusses techniques for incorporating macroeconomic factors into models through macro-to-micro modeling. The document emphasizes balancing model complexity with usability and explains how to build flexible models to address atypical stress scenarios.