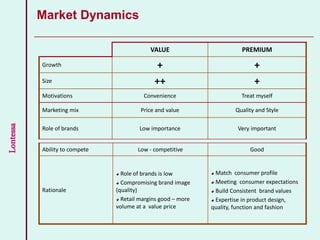

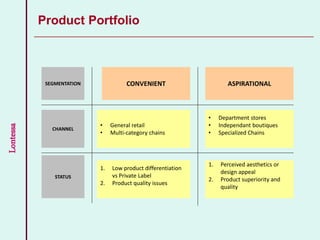

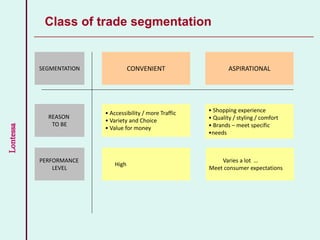

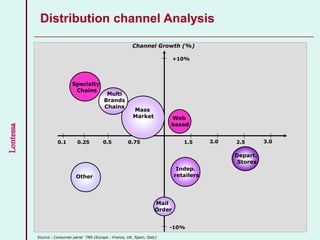

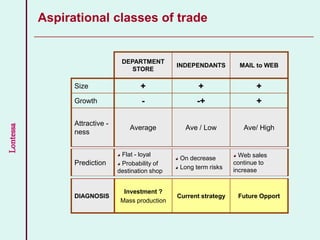

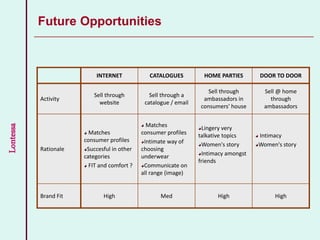

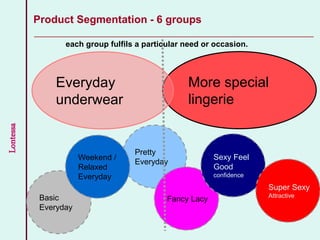

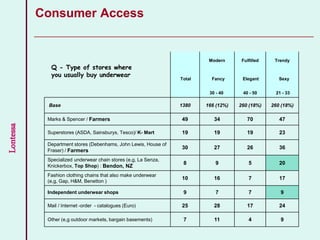

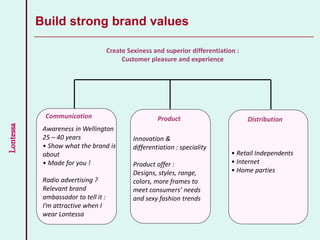

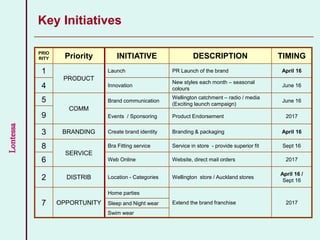

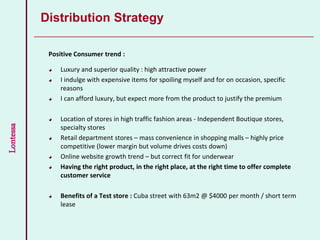

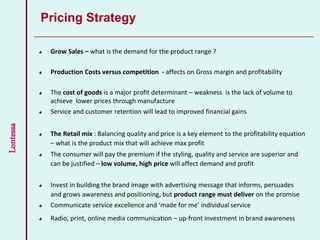

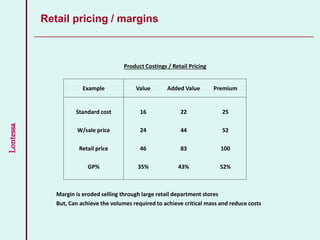

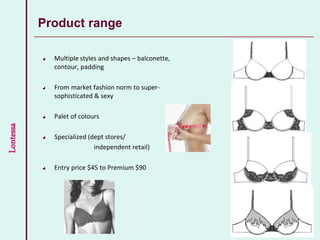

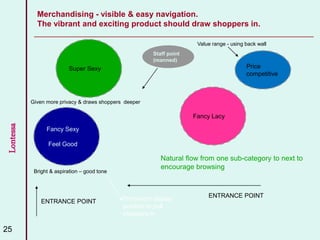

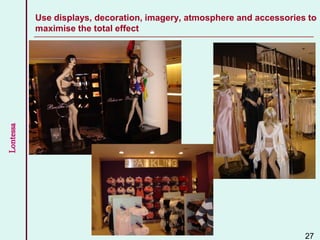

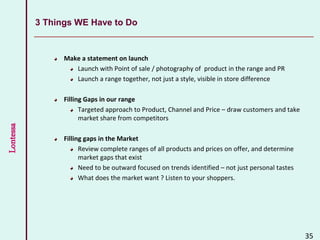

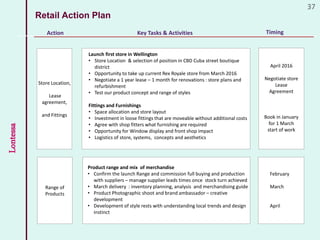

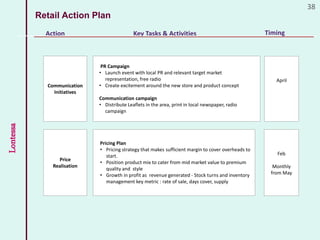

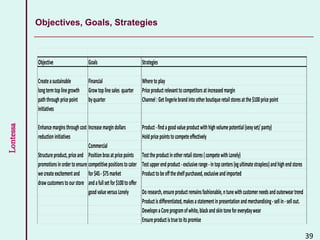

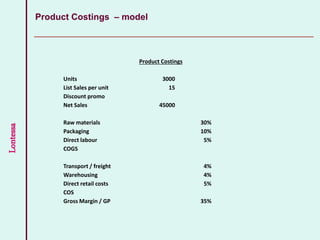

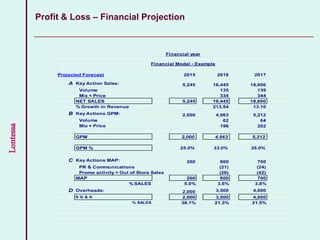

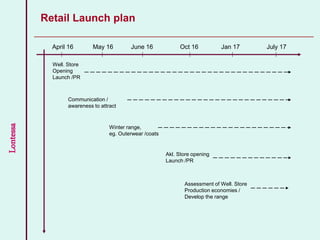

This document outlines a retail business plan for Lontessa, a proposed women's fashion boutique. It discusses objectives like sales, profitability, and target market. Key aspects of the plan include selecting the right location, developing a product mix of stylish and fashionable designs, determining pricing, identifying competitors, and ensuring a positive customer experience. The executive summary proposes positioning the brand as offering distinct Maori-inspired female fashion that makes women feel attractive. The retail strategy focuses on location, products, customer service, pricing, and promotion.