This document defines and discusses bay' al-dayn (sale of debt), including:

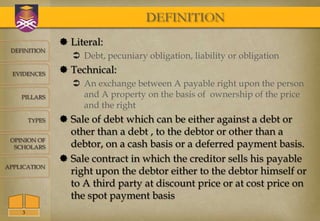

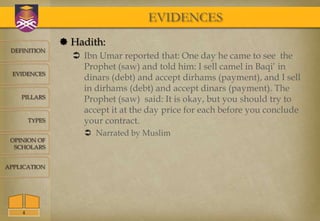

1) Its definition in Islamic law and evidence from hadith.

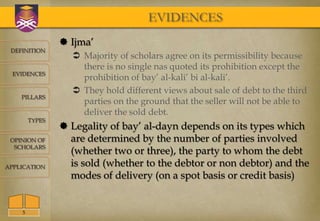

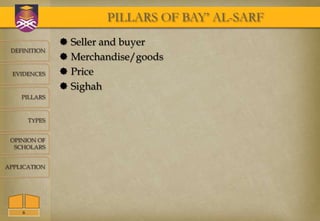

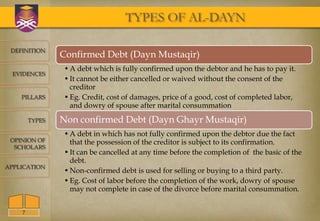

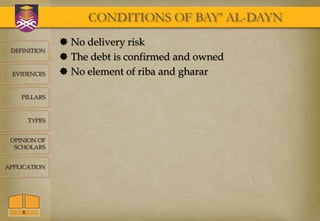

2) The different types of debts and pillars required for a valid bay' al-dayn contract.

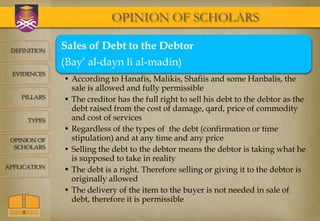

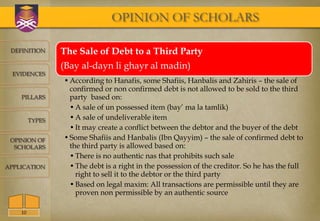

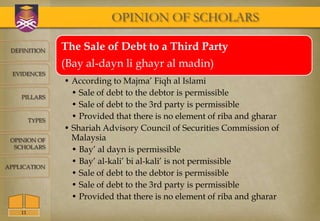

3) Scholars' opinions on the permissibility of selling debt to the debtor or third parties.

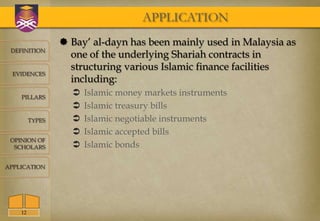

4) Modern applications of bay' al-dayn in Islamic finance instruments.