The document provides information about various types of budgets including union budget, zero-based budgeting, capital budget, revenue budget, and performance budgeting. It also discusses the budgetary process and roles of key stakeholders. The main points are:

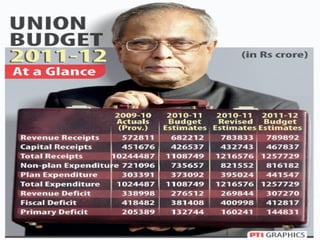

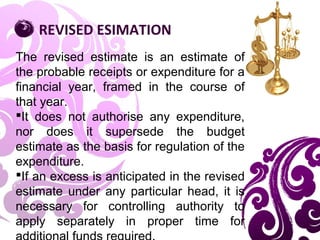

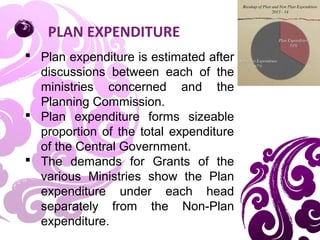

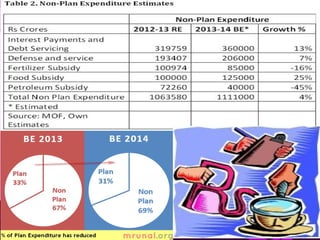

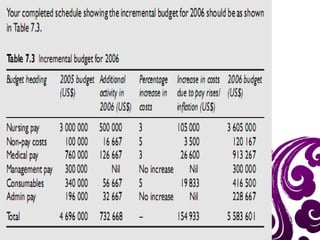

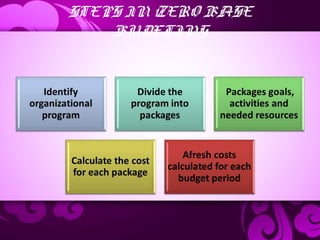

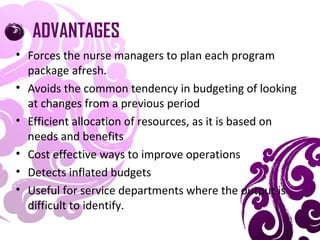

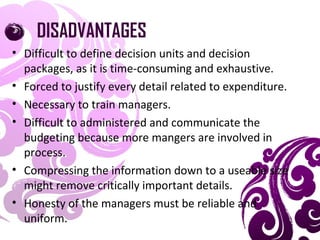

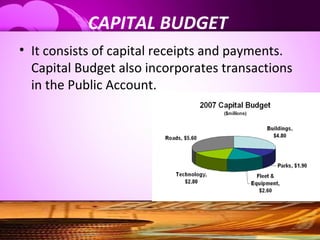

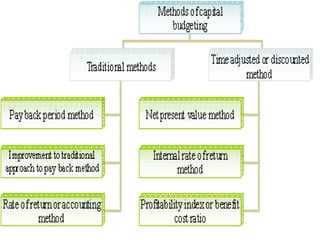

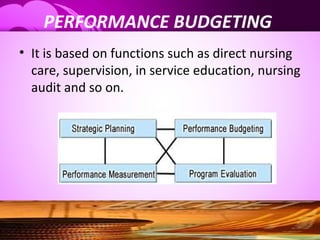

1) It defines key terms like union budget, zero-based budgeting, capital budget, and revenue budget and describes their main features and purposes.

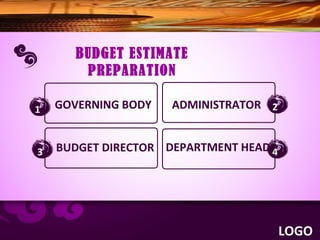

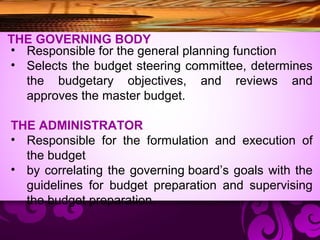

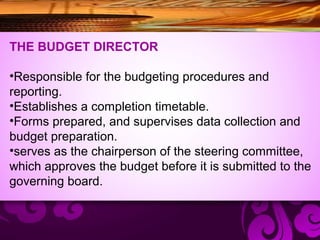

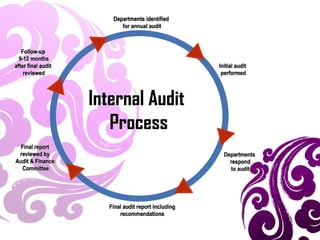

2) It explains the steps involved in budget preparation from estimation to approval and the roles of administrator, governing body, budget director, and department heads.

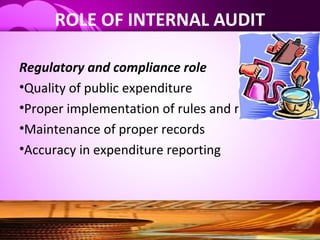

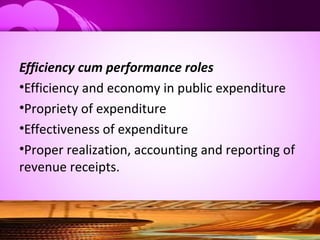

3) It discusses the purposes and types of audits including external, internal, financial, operational, and compliance audits and their roles in budget oversight.