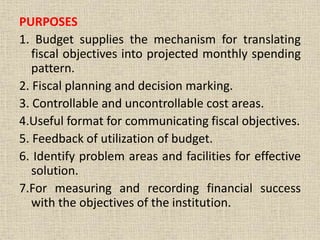

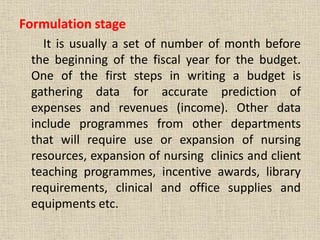

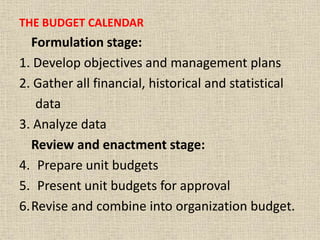

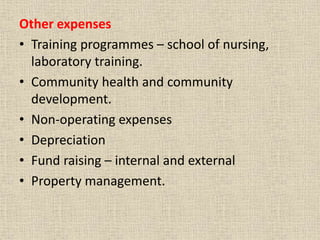

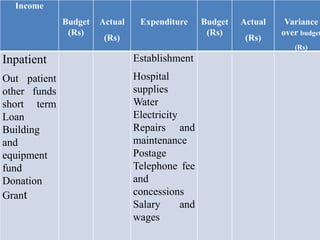

The document discusses the importance of budgeting in nursing practice, defining it as a control device for planning and financial management in healthcare organizations. It outlines various types of budgets, their purposes, principles, processes, and the steps involved in budget preparation, highlighting the need for collaboration across departments. Additionally, it emphasizes how effective budgeting can enhance resource allocation, improve operational efficiency, and support the delivery of nursing services.