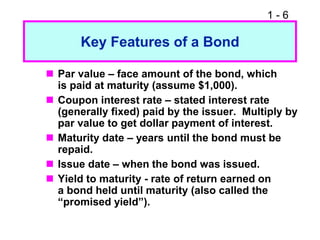

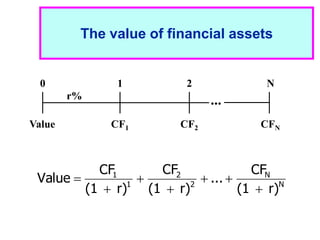

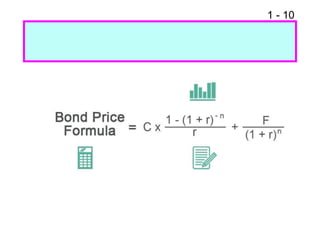

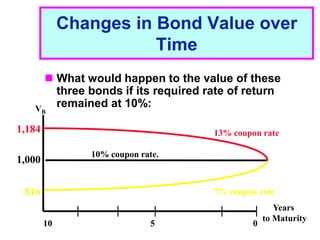

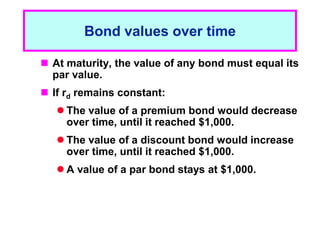

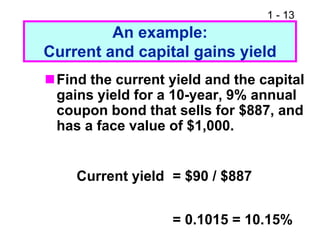

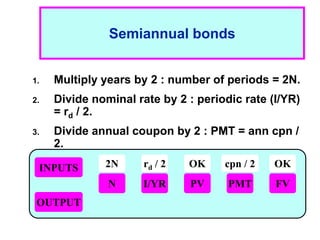

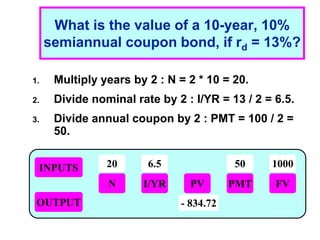

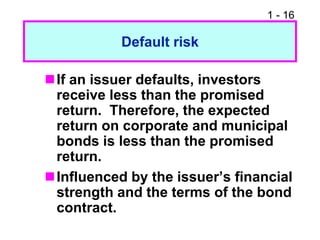

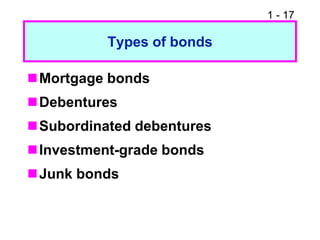

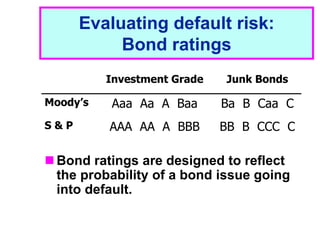

This document defines key terms related to bonds, including par value, coupon rate, coupon payments, maturity date, call price, required return, yield to maturity, and yield to call. It also discusses how the value of a bond changes over time based on its coupon rate and the required rate of return. Finally, it briefly covers default risk, bond ratings, and different types of bonds.