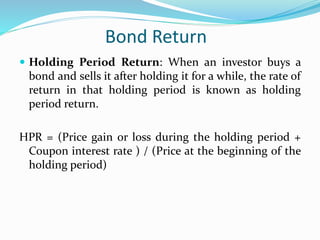

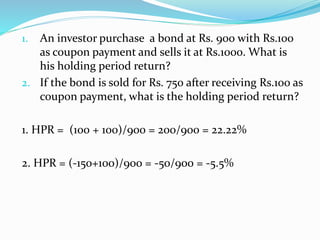

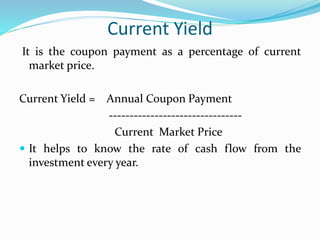

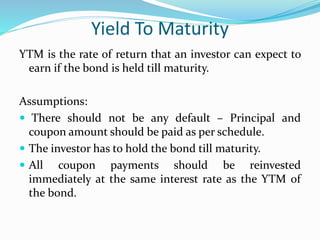

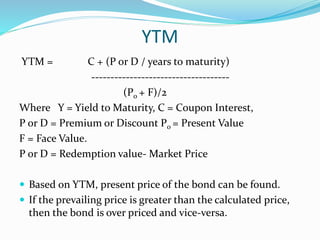

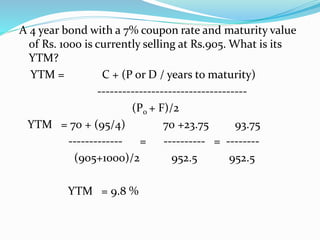

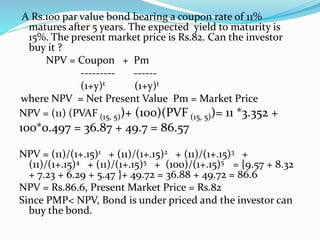

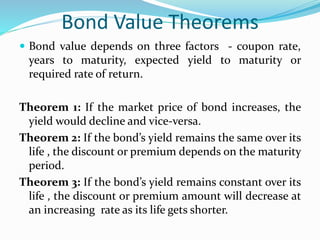

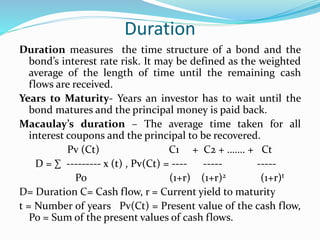

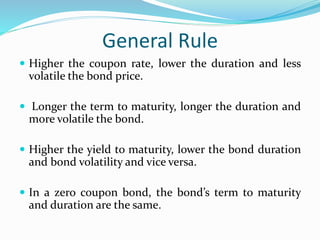

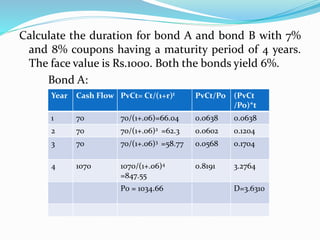

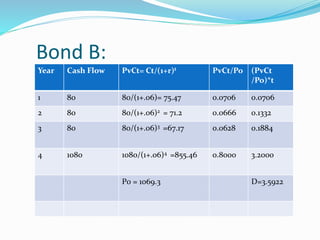

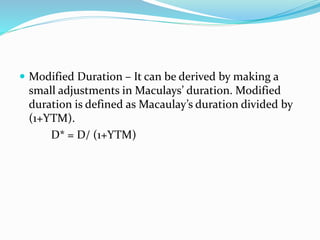

A bond is a contract where the borrower pays interest to the lender. Bonds have risks like interest rate risk, default risk, marketability risk, and callability risk. The time value of money concept states that money received today is worth more than money received in the future. Key metrics for bonds include holding period return, current yield, yield to maturity, and duration. Duration measures a bond's interest rate sensitivity - the higher the duration, the more sensitive the bond is to interest rate changes.