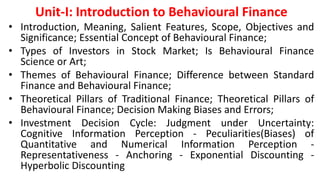

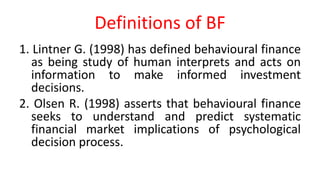

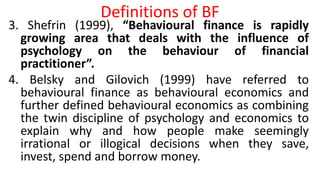

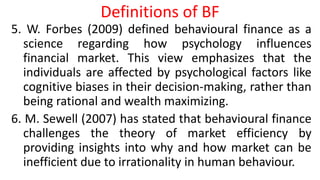

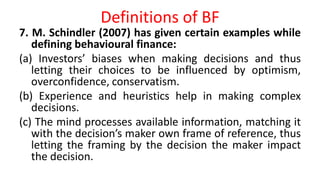

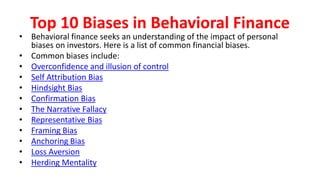

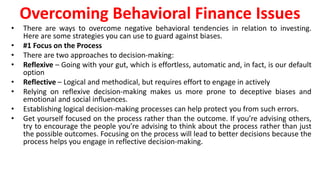

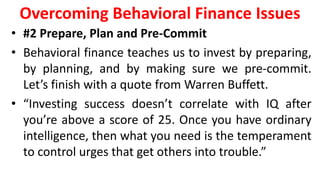

This document provides an introduction to behavioral finance. It defines behavioral finance as the study of how psychology impacts investors' financial decision making and markets. Key topics covered include common biases that influence investors like overconfidence, loss aversion, and herding behavior. Strategies for overcoming behavioral biases in decision making are also discussed, such as focusing on the decision making process rather than outcomes and pre-committing to investment plans.