Embed presentation

Downloaded 33 times

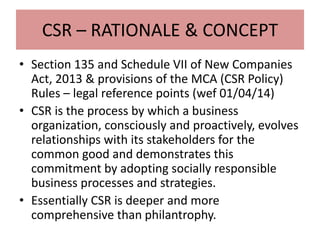

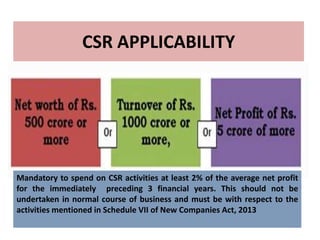

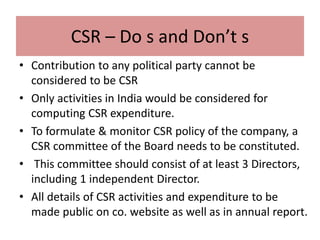

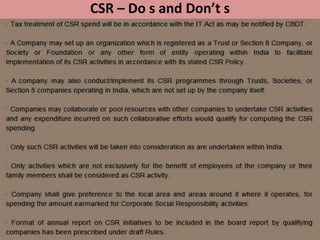

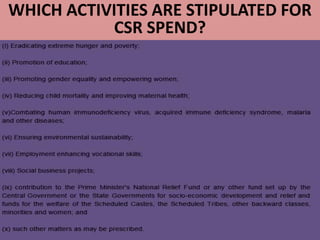

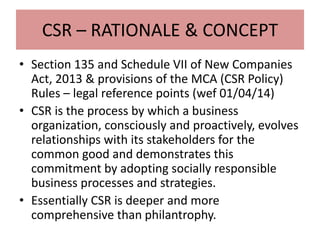

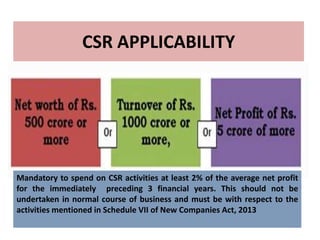

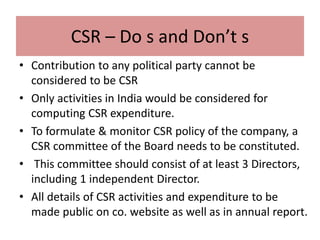

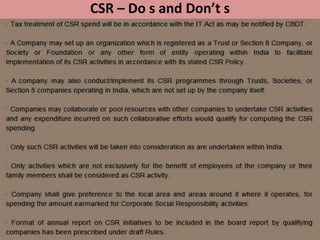

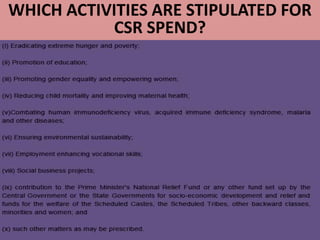

The document outlines the key points of corporate social responsibility (CSR) in India based on the new Companies Act of 2013. It mandates that companies spend at least 2% of their average net profits from the past three years on CSR activities focused on areas like poverty alleviation, education, and rural development. CSR goes beyond mere philanthropy to involve proactive stakeholder engagement. Companies must form a CSR committee, publicly disclose CSR activities and spending, and ensure contributions do not support political parties or activities outside of India.