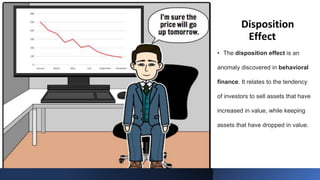

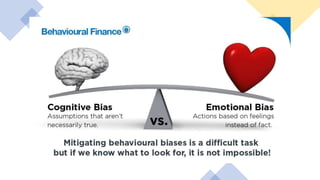

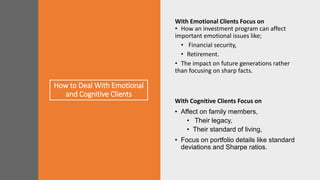

The document presents an overview of behavioral finance, highlighting its significance in understanding irrational investor behavior compared to classical finance. It discusses various investor biases such as overconfidence and herd mentality, and emphasizes the importance of recognizing these biases for better investment decision-making. Additionally, it outlines different types of risks and investors, providing strategies for financial advisors to assist their clients effectively.