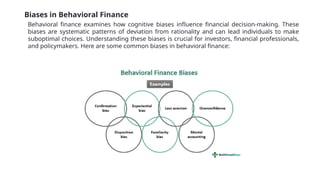

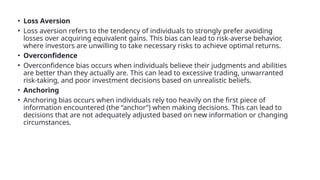

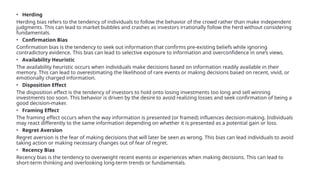

Behavioral finance is an interdisciplinary field that combines psychology and economics to analyze how cognitive biases, emotions, and heuristics shape financial decision-making. Key concepts include loss aversion, overconfidence, and herding, which challenge traditional economic theories that assume rational behavior. Understanding these biases is crucial for improving financial outcomes for investors, financial professionals, and policymakers.