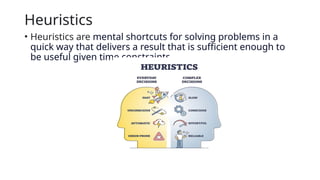

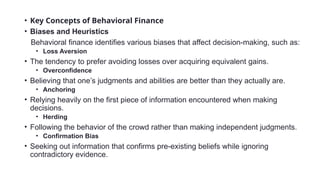

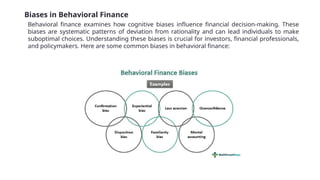

Behavioral finance integrates psychology and economics to understand financial decision-making, highlighting the influence of cognitive biases and emotions, which often deviate from traditional rationality assumptions. Key concepts include loss aversion, overconfidence, and prospect theory, which explain how individuals assess risk and create investment strategies influenced by psychological factors. By recognizing these biases, investors and policymakers can make more informed decisions and address market inefficiencies.