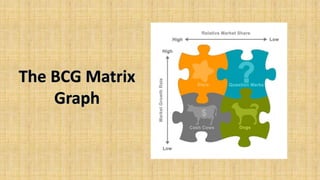

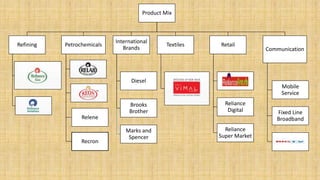

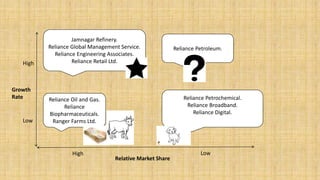

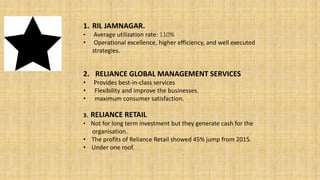

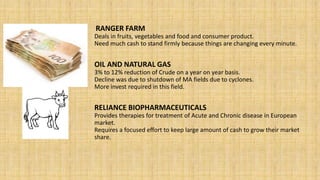

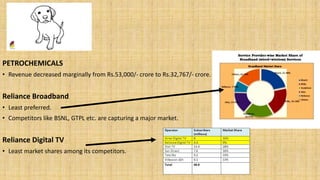

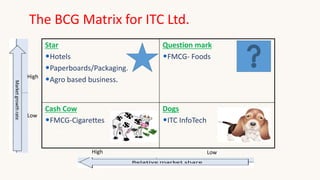

The document discusses the BCG Matrix, a strategic tool created by Bruce D. Henderson for analyzing business units and product lines, utilizing market growth rate and relative market share to classify products into categories: stars, cash cows, question marks, and dogs. It also provides examples of companies such as Reliance Industries and ITC Limited, illustrating how they fit into the matrix and their respective market positions. Moreover, the document outlines the advantages and limitations of the BCG Matrix, emphasizing its simplicity and applicability alongside the potential pitfalls of relying solely on market share and growth rates.