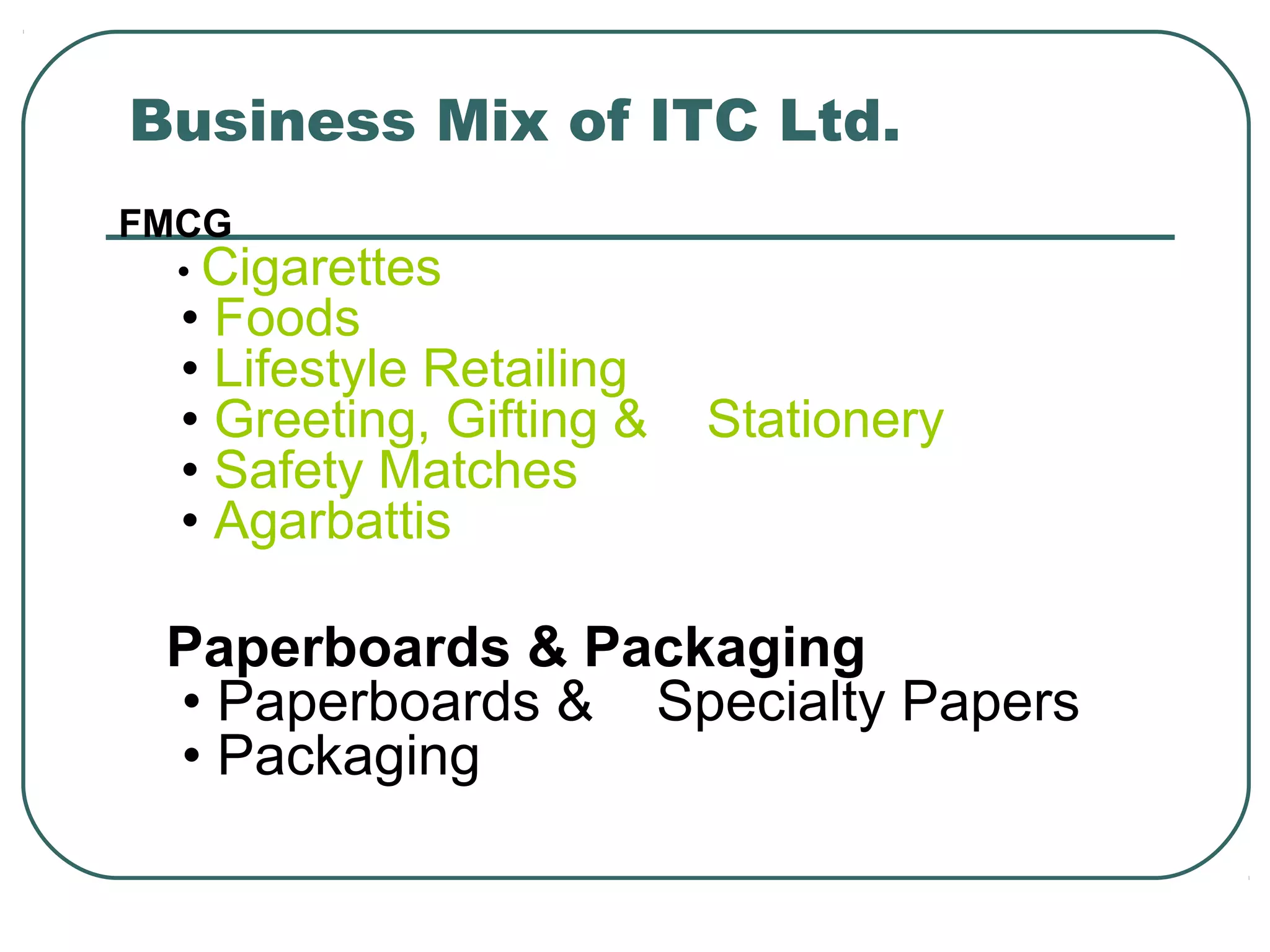

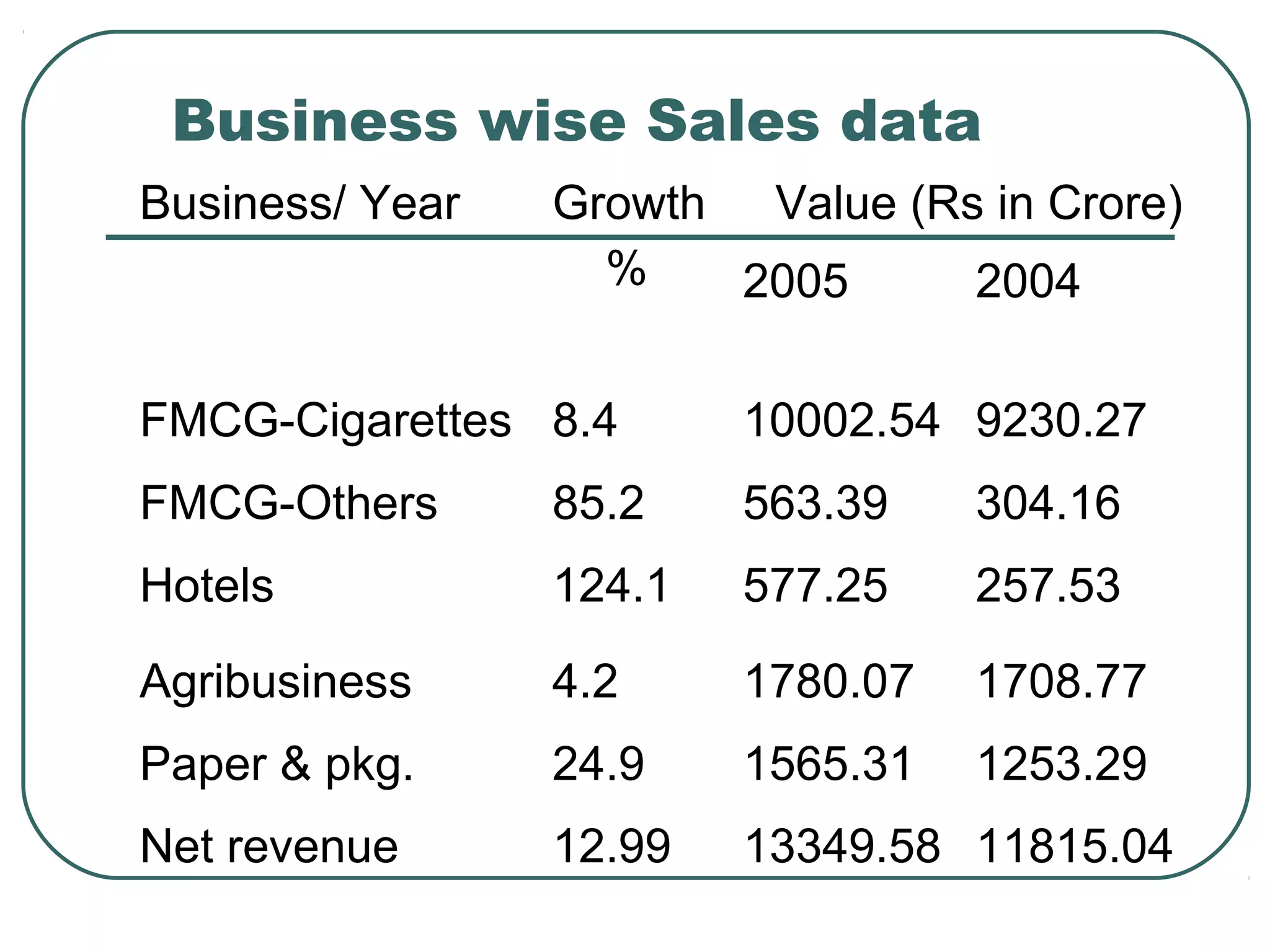

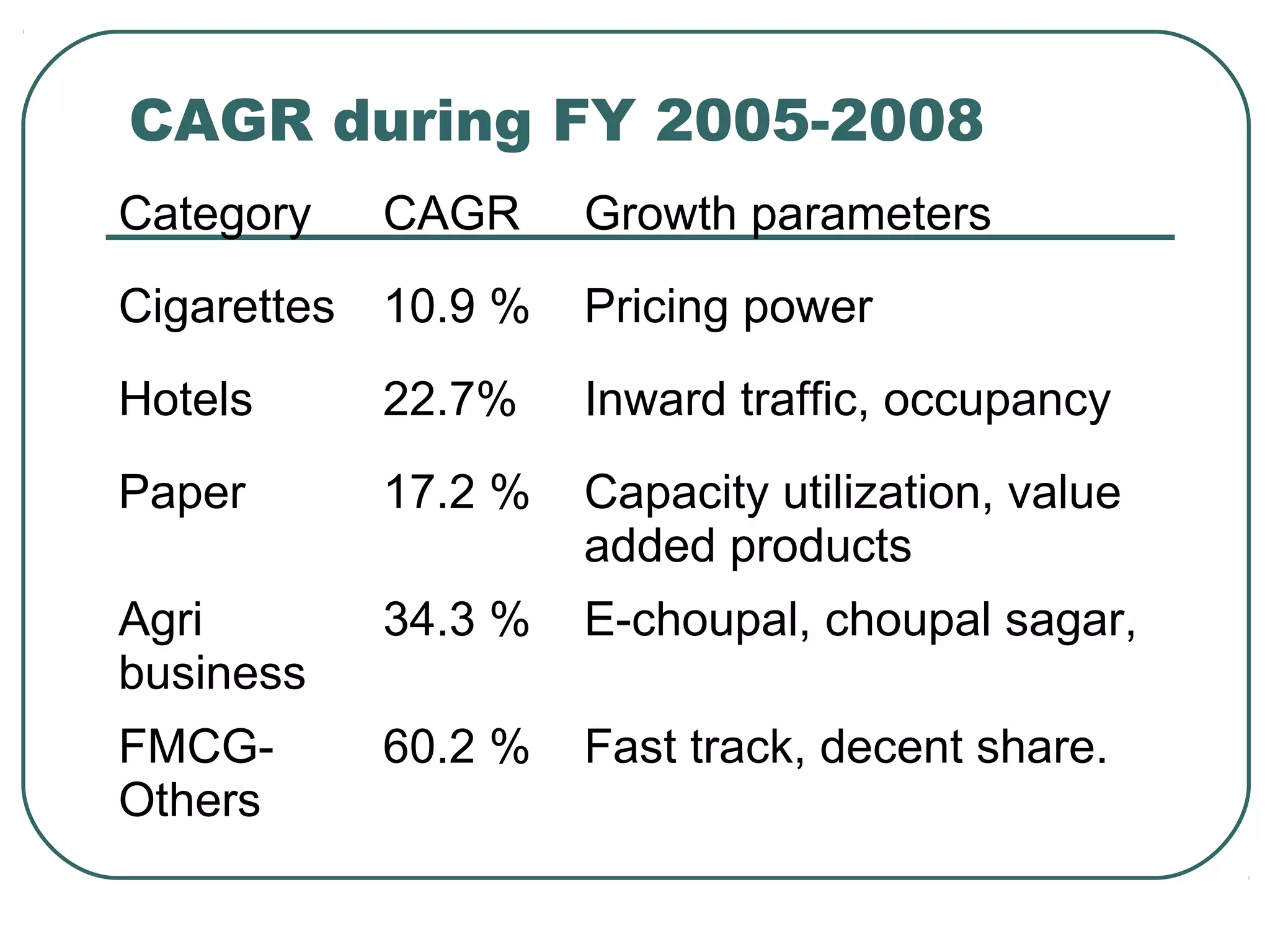

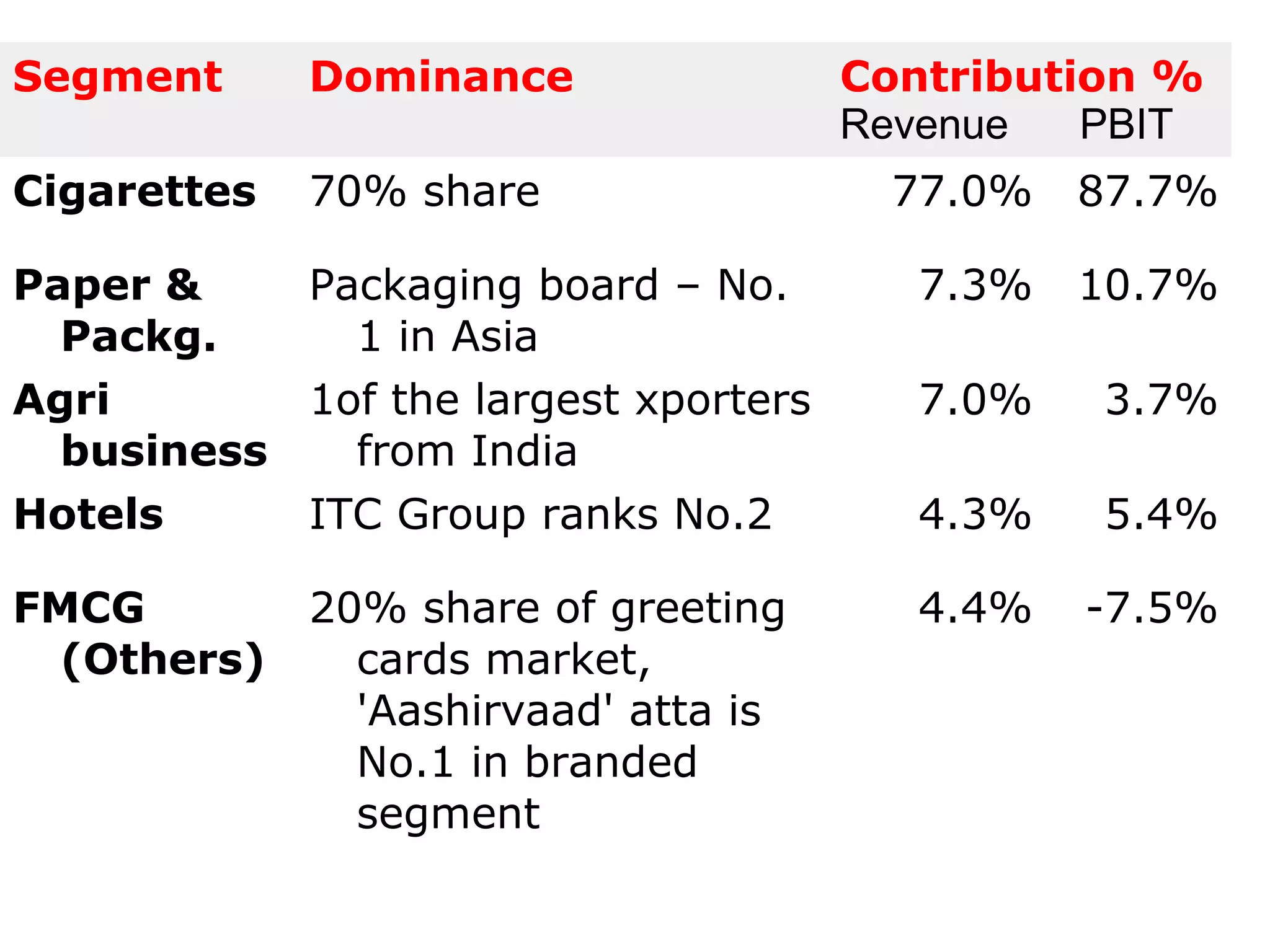

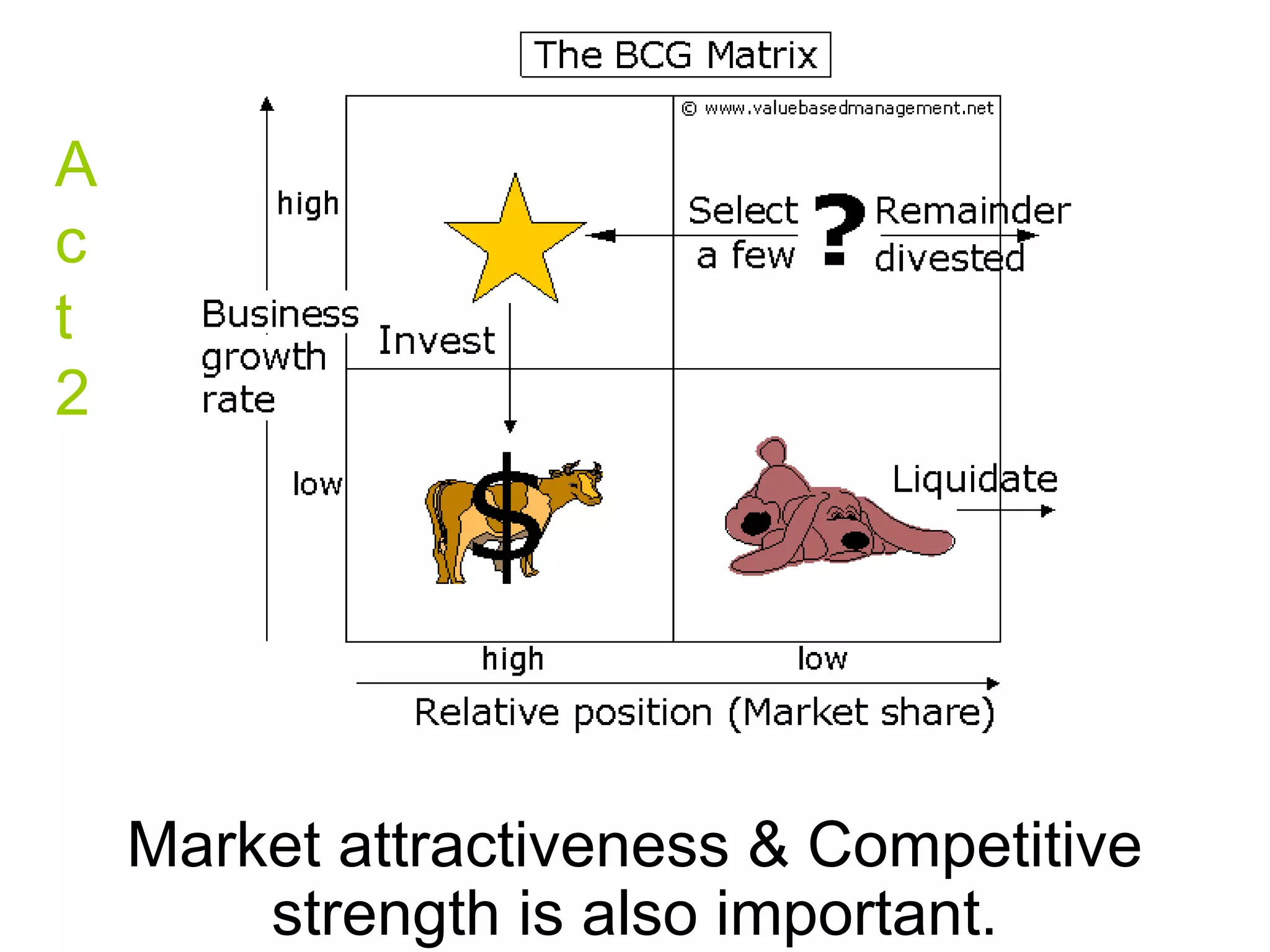

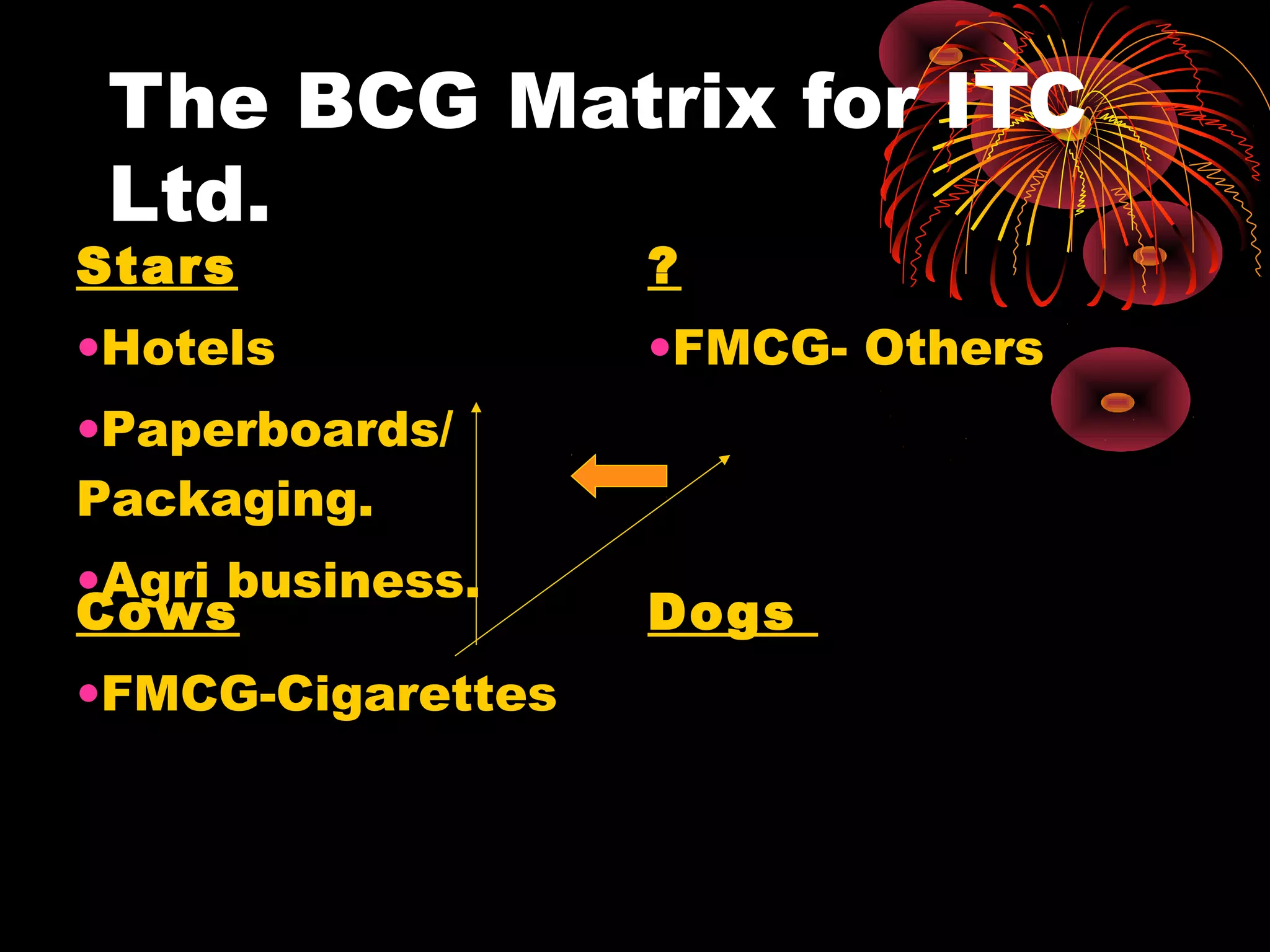

ITC Ltd operates in several business segments including FMCG, hotels, paperboards & packaging, and agriculture. When applying the BCG matrix:

- Hotels, paperboards/packaging, and agriculture are classified as stars due to their high market share and growth rates.

- FMCG-cigarettes are considered cows with high market share but low growth.

- FMCG-others may be dogs or question marks depending on their ability to gain market share.

Overall, ITC pursues a strategic of diversifying into emerging high growth markets while leveraging its core competencies and distribution network across businesses.

![Act –I [Lights!]

Governance structure

Strategic supervision

Strategic management

Executive management

Core values

Nation Orientation; Trusteeship; Excellence;

Customer focus; respect for people; Innovation](https://image.slidesharecdn.com/bcg-matrix-for-itc-ltd-3536-130515053024-phpapp02/75/Bcg-matrix-for-itc-ltd-3536-3-2048.jpg)