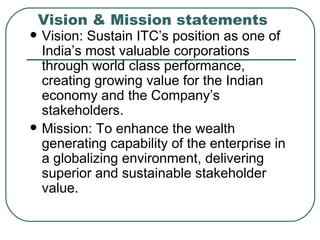

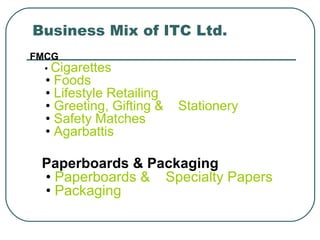

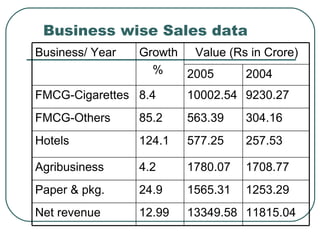

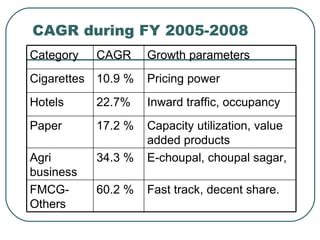

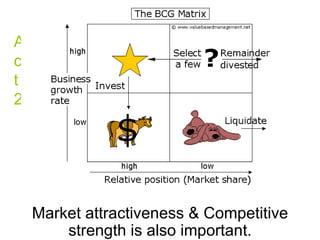

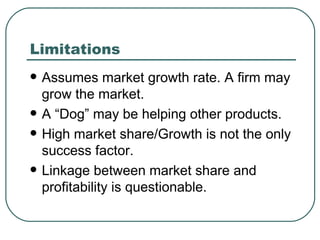

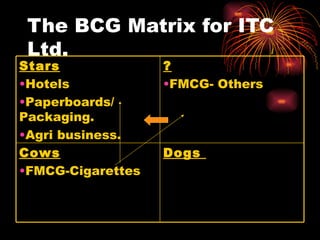

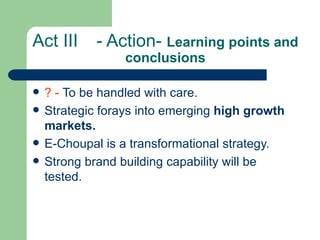

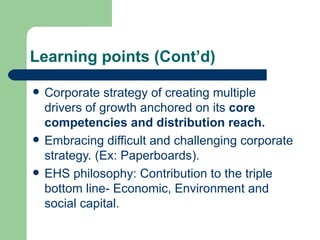

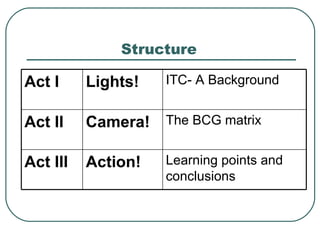

The document discusses ITC Ltd.'s business strategy and performance using the BCG matrix, highlighting its diverse portfolio which includes FMCG, hotels, and agribusiness. ITC aims to sustain its position as a leading corporation through a focus on governance, innovation, and stakeholder value. Key learning points emphasize the need for strategic growth, strong brand presence, and the importance of adapting to emerging markets.

![Act –I [Lights!] Governance structure Strategic supervision Strategic management Executive management Core values Nation Orientation; Trusteeship; Excellence; Customer focus; respect for people; Innovation](https://image.slidesharecdn.com/bcg-matrix-for-itc-ltd-3536/85/BCG-Matrix-for-ITC-Ltd-3-320.jpg)