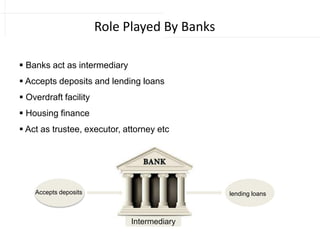

The document discusses financial intermediaries and their role in facilitating transactions between lenders and borrowers. It defines a financial intermediary as an entity that acts as a middleman in financial transactions. Banks are a key type of financial intermediary, as they accept deposits and provide loans. Other financial intermediaries mentioned include non-banking financial companies, mutual funds, insurance companies, and development financial institutions. The document outlines the various risks that financial intermediaries must manage, such as credit risk, liquidity risk, and systemic risk.