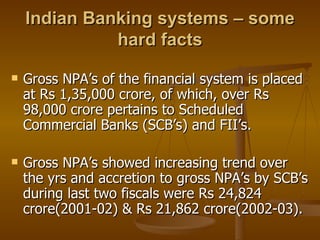

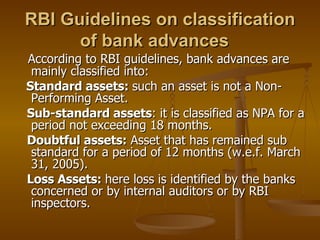

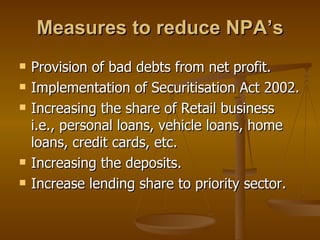

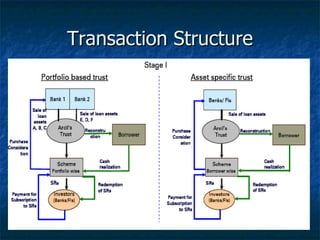

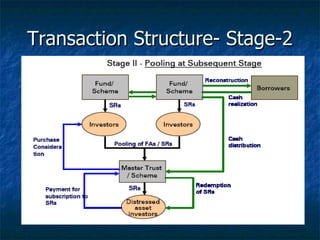

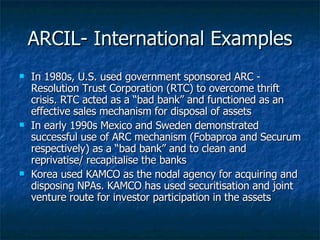

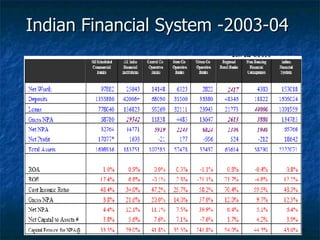

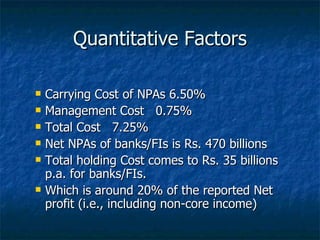

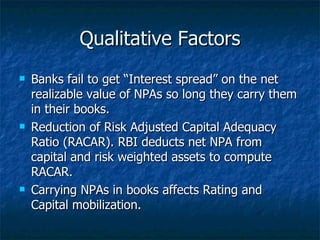

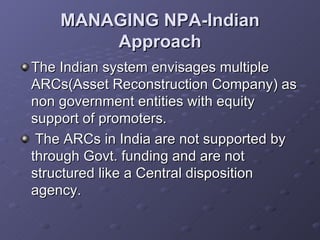

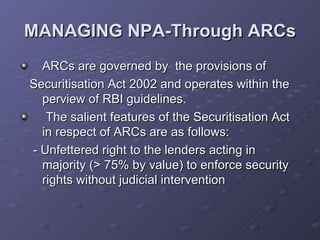

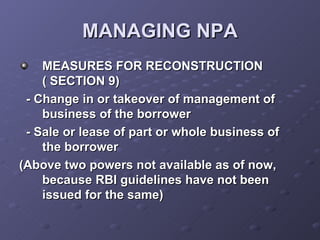

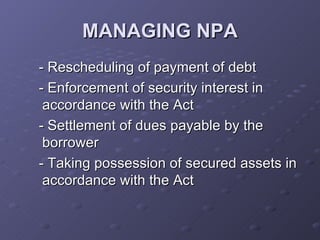

Non-performing assets (NPAs) refer to loans that are in default or close to being in default. NPAs have become a major issue for Indian banks and financial institutions, totaling over Rs. 1.1 trillion. The origin of rising NPAs lies in poor credit risk management practices in banks. To resolve NPAs, the government established asset reconstruction companies (ARCs) to purchase NPAs from banks and resolve them to enable banks to focus on core operations and lending. ARCs operate under the legal framework of the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act of 2002.