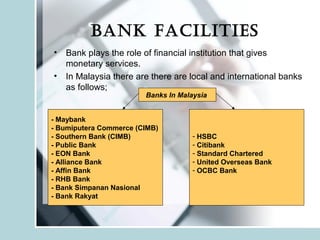

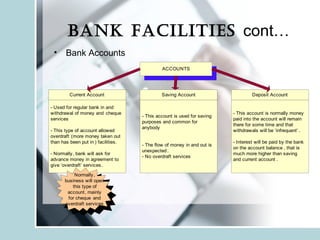

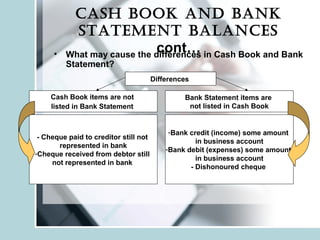

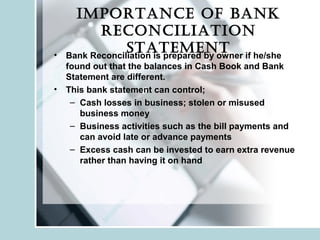

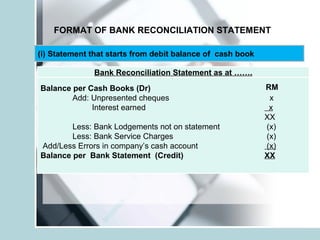

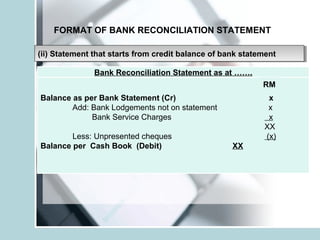

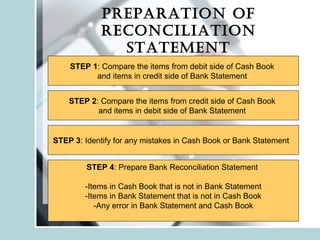

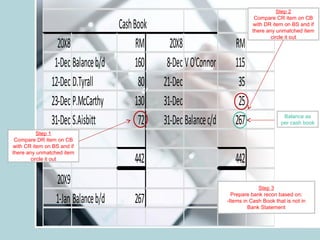

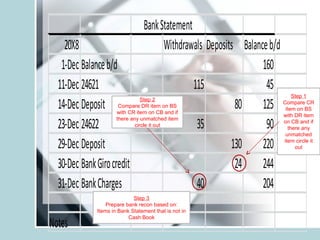

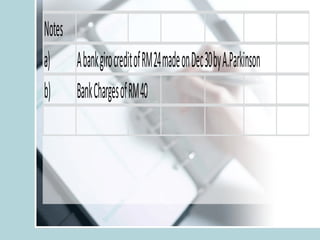

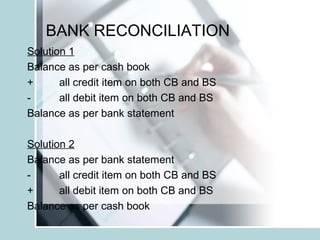

The document discusses bank reconciliation. It begins by explaining key bank facilities like savings, current, and deposit accounts. It then distinguishes between the cash book balance recorded by a business and the bank statement balance provided by the bank. Differences can arise due to uncleared deposits or withdrawals. The document emphasizes the importance of preparing a bank reconciliation statement to identify differences and errors. It provides the format for the reconciliation statement and walks through the steps to prepare it, including identifying unmatched items in the cash book and bank statement and adjusting for any errors.