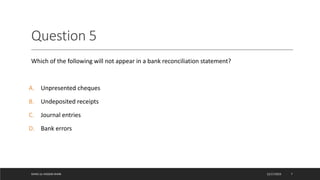

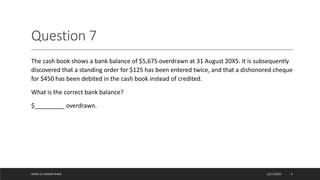

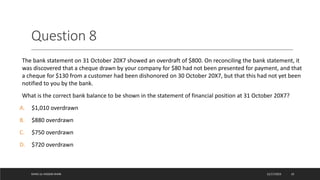

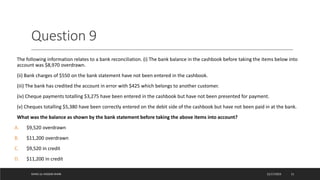

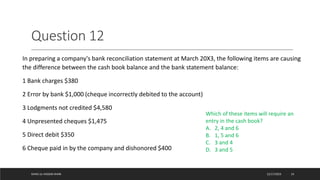

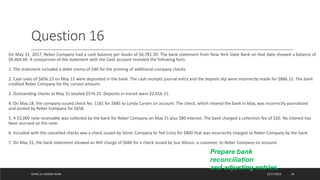

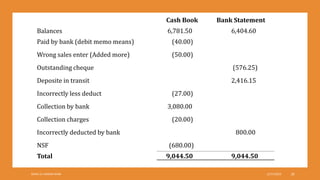

This document contains sample questions and answers about bank reconciliation statements. It begins with 15 multiple choice questions about concepts such as defining a bank statement, calculating balances based on bank and cash book information, and identifying reconciling items. The document then provides two word problems asking to prepare full bank reconciliations based on given financial information.